Why take EPF money to dabble? It's a safety net.

There is always PRS, suppose to be EPF back-up plan. From my experience, if not for the savings on income tax, I would stay far away from PRS.

Money in EPF vs Unit Trusts

Money in EPF vs Unit Trusts

|

|

May 15 2020, 08:57 PM May 15 2020, 08:57 PM

|

Junior Member

157 posts Joined: Sep 2007 |

Why take EPF money to dabble? It's a safety net. There is always PRS, suppose to be EPF back-up plan. From my experience, if not for the savings on income tax, I would stay far away from PRS. LOvebugs liked this post

|

|

|

|

|

|

May 15 2020, 09:11 PM May 15 2020, 09:11 PM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(saintmikal @ May 15 2020, 08:57 PM) Why take EPF money to dabble? It's a safety net. i do agree with you. there are so many good funds to choose from asides those from PRS.There is always PRS, suppose to be EPF back-up plan. From my experience, if not for the savings on income tax, I would stay far away from PRS. |

|

|

May 15 2020, 09:32 PM May 15 2020, 09:32 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(Enemy @ May 15 2020, 12:50 PM) Let me first start by admitting that I am almost clueless about Unit Trusts. However a few years back I decided to support a friend who is a Public Mutual agent, and ever since funds have been withdrawn from my EPF to go into unit trusts that he manages. But it seems like his unit trusts have been underperforming (versus EPF's return) for the past few years since we started. You are clueless, and his unit trusts have been underperforming.Now he's asking to withdraw even more from my EPF. Should I stop all of this and just keep the funds in EPF? Or let him continue with the unit trusts? Perfect reasons to keep in EPF. (and give him a kick in the butt, but that's optional). Thaxuphus3593 liked this post

|

|

|

May 15 2020, 09:56 PM May 15 2020, 09:56 PM

|

Junior Member

132 posts Joined: Jun 2017 |

Been invested in public unit trust for 5 years with monthly top up, even bought the newly launched fund with extra 1% unit. But sadly since day 1 losing money. The launch price is RM0.25 and continue dropping till RM0.1x.after 5 years. In the end I gave up and withdraw with net loss few k not counting the interest if put into bank. Most money paid as mgmt fee only Thaxuphus3593 and patricktoh liked this post

|

|

|

May 15 2020, 10:12 PM May 15 2020, 10:12 PM

|

Junior Member

119 posts Joined: Dec 2007 From: Selangor |

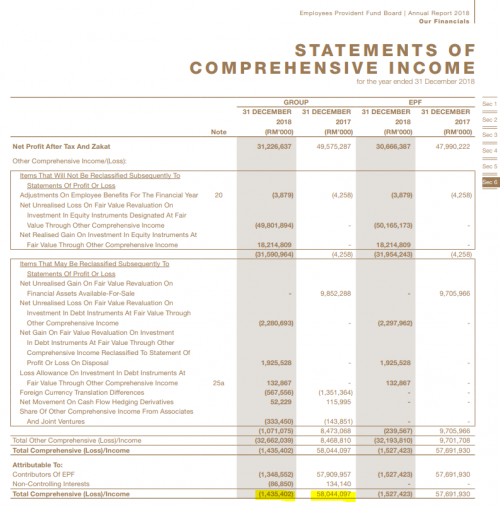

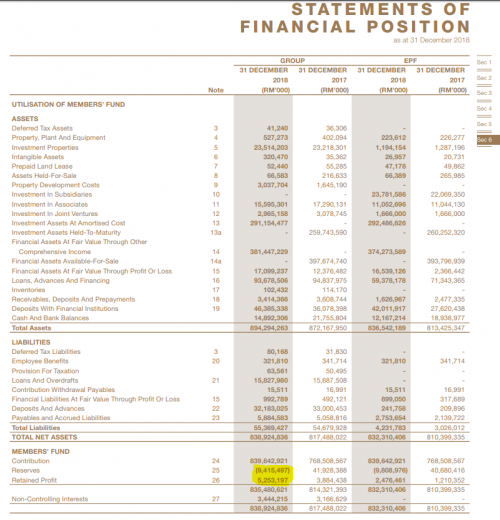

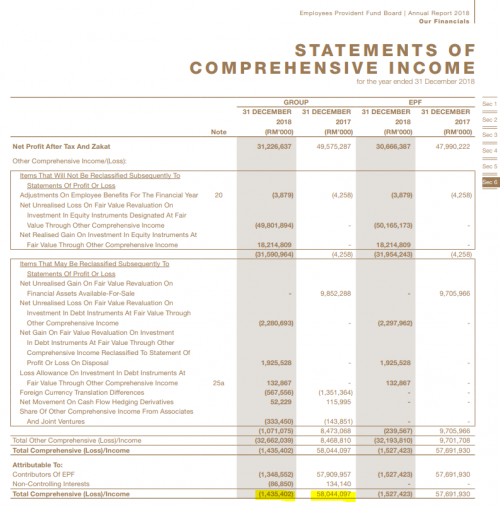

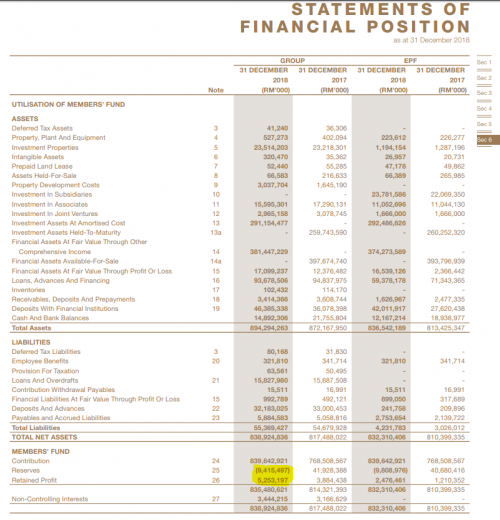

Check out EPF making unrealised loss of 1.4bil in 2018, also negative reserve of 9bil in 2018. Donno why EPF yet to publish their 2019 report, I bet the loss and reverse might be even greater.

https://www.kwsp.gov.my/documents/20126/974...t=1564377639847 EPF declares stable dividends every year. When they perform well, they will keep the remaining profits so that future years can still declare. This time around market has only performed well in 1 out of the past 5 years, until the reserve also become negative. Why EPF can declare 5% dividend in 2019 while Tabung Haji cannot? Not to worry as EPF has guaranteed dividend 2.5%, but donno where they will get the money. EPF recently (commenced this month) lowered fee to transfer to Unit Trust via i invest at 0% fee (before was 0.5%) and through agent to 1.5% (before was 3%). Not sure why EPF giving such an incentive right now? Making profit or loss depend on when you transferred (if you had transferred 15 years ago, UT might have outperformed EPF. if 5 years ago, most likely it is loss) There are few cases where transfer from EPF to unit trust might work: -If you can predict future market performance (if you think market will gain higher than epf 5% can also able to cover fee of 0%-1.5%) -To reallocate between equity and bond (EPF is roughly 50% equity 50% bond, switching to unit trust can let you allocate higher portion to either which one you want more) -To reallocate diversify to specific country market This post has been edited by cxjiek: May 15 2020, 10:24 PM |

|

|

May 15 2020, 10:16 PM May 15 2020, 10:16 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cxjiek @ May 15 2020, 10:12 PM) Check out EPF making unrealised loss of 1.4bil in 2018, also negative reserve of 9bil in 2018. Donno why EPF yet to publish their 2019 report, I bet the loss and reverse might be even greater. that was ending Dec 2018....1 year later they can still gives 5.45% dividend rate for year 2019... ....... |

|

|

|

|

|

May 16 2020, 09:10 AM May 16 2020, 09:10 AM

Show posts by this member only | IPv6 | Post

#27

|

Junior Member

169 posts Joined: Oct 2008 |

QUOTE(Enemy @ May 15 2020, 12:50 PM) Let me first start by admitting that I am almost clueless about Unit Trusts. However a few years back I decided to support a friend who is a Public Mutual agent, and ever since funds have been withdrawn from my EPF to go into unit trusts that he manages. But it seems like his unit trusts have been underperforming (versus EPF's return) for the past few years since we started. No not worth it, the benefits you gain from EPF are way more than what you risk in mutual funds. I am not against investing in unit trust, in fact I made quite a handsome returns from them. However, EPF is your retirement fund hence, preserving and protecting your funds is the priority. It is your golden nest eggsNow he's asking to withdraw even more from my EPF. Should I stop all of this and just keep the funds in EPF? Or let him continue with the unit trusts? |

|

|

May 16 2020, 09:17 AM May 16 2020, 09:17 AM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(hioniq @ May 15 2020, 09:56 PM) Been invested in public unit trust for 5 years with monthly top up, even bought the newly launched fund with extra 1% unit. But sadly since day 1 losing money. The launch price is RM0.25 and continue dropping till RM0.1x.after 5 years. In the end I gave up and withdraw with net loss few k not counting the interest if put into bank. Most money paid as mgmt fee only most people get to know of unit trust through Public Mutual. PM doesn't have a lot of good funds to choose from. you can open an account and waive agent commission through eUnitTrust or FSM. im from Phillip eUnitTrust btw. if you still wanna have a portion of your portfolio in UT and will like choose from more than 30 fund houses, you can deposit investment fund yourself. eUnitTrust/FSM is suitable for you then.QUOTE(potatoes @ May 16 2020, 09:10 AM) No not worth it, the benefits you gain from EPF are way more than what you risk in mutual funds. I am not against investing in unit trust, in fact I made quite a handsome returns from them. However, EPF is your retirement fund hence, preserving and protecting your funds is the priority. It is your golden nest eggs yes agree with you. some agents advise clients to invest from EPF is because clients will mostly agree since they do not need to fork out money from their pocket. really sad to see this, i have a client whom has less than 10 years to retire, invest into a bad performing china equity fund from PM... regretted his decision. |

|

|

May 20 2020, 01:30 PM May 20 2020, 01:30 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(cxjiek @ May 15 2020, 10:12 PM) Check out EPF making unrealised loss of 1.4bil in 2018, also negative reserve of 9bil in 2018. Donno why EPF yet to publish their 2019 report, I bet the loss and reverse might be even greater. Now I'm no accountant. But I believe those numbers you are seeing are the effects of EPF switching to MFRS9 accounting standard in 2018. You can see that the main reason why the reserves and the total comprehensive income became negative is due to a revaluation of their equity assets from using AFS to FVOCI. MFRS9 includes some kind of impairment provision into the revaluation if I'm not mistaken, hence dragging down the revaluation.  https://www.kwsp.gov.my/documents/20126/974...t=1564377639847 EPF declares stable dividends every year. When they perform well, they will keep the remaining profits so that future years can still declare. This time around market has only performed well in 1 out of the past 5 years, until the reserve also become negative. Why EPF can declare 5% dividend in 2019 while Tabung Haji cannot? Not to worry as EPF has guaranteed dividend 2.5%, but donno where they will get the money. EPF recently (commenced this month) lowered fee to transfer to Unit Trust via i invest at 0% fee (before was 0.5%) and through agent to 1.5% (before was 3%). Not sure why EPF giving such an incentive right now? Making profit or loss depend on when you transferred (if you had transferred 15 years ago, UT might have outperformed EPF. if 5 years ago, most likely it is loss) There are few cases where transfer from EPF to unit trust might work: -If you can predict future market performance (if you think market will gain higher than epf 5% can also able to cover fee of 0%-1.5%) -To reallocate between equity and bond (EPF is roughly 50% equity 50% bond, switching to unit trust can let you allocate higher portion to either which one you want more) -To reallocate diversify to specific country market If you look at their statement of P&L, it is still healthy. Retained Profits increased from RM 3.8 bil to RM 5.2 bil. Meaning their investment activities are still sound.  As to why so long 2019 not out, I don't know. But EPF is not alone. Pretty much all the government bodies have yet to release their 2019 annual report. This post has been edited by Eurobeater: May 20 2020, 01:33 PM |

|

|

May 20 2020, 02:25 PM May 20 2020, 02:25 PM

|

Senior Member

2,220 posts Joined: Oct 2010 |

Don't withdraw EPF funds to buy UTs.

Keep it in EPF. |

|

|

May 20 2020, 02:29 PM May 20 2020, 02:29 PM

|

Senior Member

1,590 posts Joined: Sep 2011 |

QUOTE(saintmikal @ May 15 2020, 08:57 PM) Why take EPF money to dabble? It's a safety net. Yes, but the real purpose of PRS is not make sure you contribute diligently for a period of time, force investing.There is always PRS, suppose to be EPF back-up plan. From my experience, if not for the savings on income tax, I would stay far away from PRS. |

|

|

May 20 2020, 02:36 PM May 20 2020, 02:36 PM

|

Senior Member

1,590 posts Joined: Sep 2011 |

Don't do it if you don't know what you are doing. LOvebugs liked this post

|

|

|

May 20 2020, 03:09 PM May 20 2020, 03:09 PM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

74 posts Joined: Mar 2020 |

My personal opinion is that taking EPF (which almost guarantee you minimum 5-6% return) and putting it into Unit Trust is totally not a best move.

Like earlier someone mentioned, a lot of those friends as agent will tell you take your EPF out and invest into those Equity funds, it can generate 18% - 40% return from what you see in the past. Then you don't need to take out your own money (Cash) so you wont feel you are losing out. In fact, when you withdraw EPF and invest into UT, last time usually invest using EPF will have 3% sales charge for those growth fund, which means before your investment start to make money for you, you got penalised to pay commission to the company and your friend by paying 3%. To earn back this 3% is not like this year up 3% then you gain back, you need it to up at least 3.5% just to breakeven. Dont forget about your EPF return that give u 5-6% returns. I am not saying Unit Trust is not a good investment tools, but just now using your EPF. Invest your cash or savings and understand the type of Uint Trust. A lot of agents out there introduce you Unit Trust which is growth fund (high risk) and comes with high sales charge and management fee. It is suitable to you? Not necessary, but is suitable to your friend because he can earn commission. I am not blaming the agents, they are finding a living too, but you must understand your own risk appetite and investment horizon (short term, long term) and the liquidity of your cash. Hope it helps explain your concern. |

|

|

|

|

|

May 20 2020, 05:09 PM May 20 2020, 05:09 PM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

2,139 posts Joined: Nov 2007 |

It depends, if u are familiar with investimg through the stock market or unit trust, i believe you are also familiar with the risk.

I actually started to invest in unit trust via epf i-invest around 2 month ago. I also invest in the stock market and unit trust directly and aware of the risk. I also control my exposure by allowing only a certain percentage in the unit trust. I also have managed to earn roughly 3x of the 2019 dividend ( percentage wise for the amount invested) for this short period. Please do not follow the advise of unit trust agent, learn about investing yourself and get familiar with all the charges involved. By the way all sales charge for EPF MIS through i-invest is 0%. The one who tell you otherwise is just not updated and the previous sales charge coupled with listening to their agent without any understanding of investment caused a lot of people to get burned. This post has been edited by backspace66: May 20 2020, 05:13 PM |

|

|

May 20 2020, 10:47 PM May 20 2020, 10:47 PM

|

Junior Member

532 posts Joined: Jan 2019 |

The only person making money here is your ‘friend’

|

|

|

May 20 2020, 10:52 PM May 20 2020, 10:52 PM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

171 posts Joined: Sep 2019 |

It is about averaging monthly..If u not consistent..better dont..

|

|

|

Dec 2 2020, 05:19 PM Dec 2 2020, 05:19 PM

|

Junior Member

438 posts Joined: Apr 2007 |

QUOTE(backspace66 @ May 20 2020, 05:09 PM) It depends, if u are familiar with investimg through the stock market or unit trust, i believe you are also familiar with the risk. I initially invested some elf money into mutual fund through investment agent. This year, I asked whether got any difference if I invest directly through I-invest, he said cannot, EPF withdrawal can only be done through thumb print using agent's help... is he BS me? do I need to do thumb print withdrawal with I-invest website?I actually started to invest in unit trust via epf i-invest around 2 month ago. I also invest in the stock market and unit trust directly and aware of the risk. I also control my exposure by allowing only a certain percentage in the unit trust. I also have managed to earn roughly 3x of the 2019 dividend ( percentage wise for the amount invested) for this short period. Please do not follow the advise of unit trust agent, learn about investing yourself and get familiar with all the charges involved. By the way all sales charge for EPF MIS through i-invest is 0%. The one who tell you otherwise is just not updated and the previous sales charge coupled with listening to their agent without any understanding of investment caused a lot of people to get burned. |

|

|

Dec 2 2020, 05:23 PM Dec 2 2020, 05:23 PM

Show posts by this member only | IPv6 | Post

#38

|

All Stars

12,387 posts Joined: Feb 2020 |

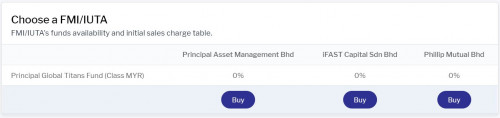

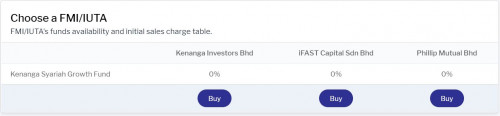

QUOTE(klangboy83 @ Dec 2 2020, 05:19 PM) I initially invested some elf money into mutual fund through investment agent. This year, I asked whether got any difference if I invest directly through I-invest, he said cannot, EPF withdrawal can only be done through thumb print using agent's help... is he BS me? do I need to do thumb print withdrawal with I-invest website? iInvest needs to have existing account from supporting platforms: FSM, eUT, PM, Principal, etcOtherwise, you have to it the manual way. Example 1: If you select a fund from Principal  Example 2: If you select a fund from Kenanga  Best way is to have/open an account with FSM (iFast) or eUT (Philip Mutual) This post has been edited by GrumpyNooby: Dec 2 2020, 05:29 PM |

|

|

Dec 2 2020, 05:46 PM Dec 2 2020, 05:46 PM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

1,056 posts Joined: Apr 2016 |

Ive always wanted to withdraw my epf and putting it into UT But after reading this thread, am glad i didnt patricktoh liked this post

|

|

|

Dec 2 2020, 05:48 PM Dec 2 2020, 05:48 PM

Show posts by this member only | IPv6 | Post

#40

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.0255sec 0.0255sec

1.00 1.00

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 08:44 AM |