Premium (or to be exact, cost of insurance) increase, will be every 3-4 years one cycle in the foreseeable future.

Previously, 10-20 years back, the premium/coi pricing strategy was to price in as many future inflation as possible, however this pricing strategy makes the insurers hard to compete in the competitive local market.

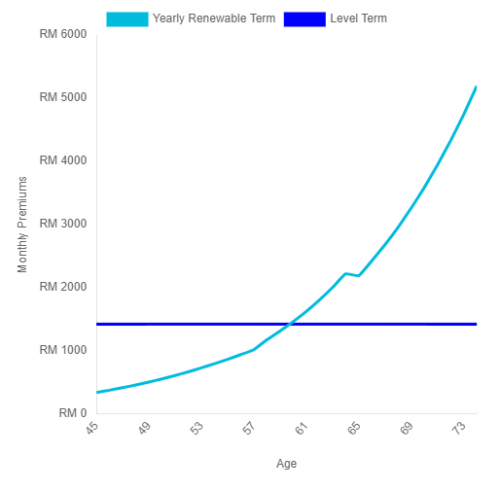

Then in ~2010, most companies changed the pricing strategy, to have a repricing cycle of 3-4 years instead. So we can see a smaller increase in premium, but with higher frequency.

In general, the increase in premium will tend to have a lower magnitude in the future, as the first 1-2 rounds increase in the recent years mainly just recoup back the losses previously, and bring back premium/coi to a more sustainable rates. (Many insurers medical business operated at a loss in early 2010, especially for old block of business)

In principle, the frequent increase in premium/coi, is actually better for most customers, to avoid them paying too much commission in early year, then drop the policy later and purchase a new one.

This year due to covid situation, many insurers actually seeing better medical claims experience, and some insurers delayed their repricing for a few months.

Source : I am an actuary, used to work on this repricing

**some general tips

1. Buy medical insurance with deductible if you perceive yourself to be healthier than average

2. Don't buy medical insurance up to age 100. Ask your agent, usually even if you select age 70 expiry age, the medical rider coverage will continue pass age 70 until the unit funds exhausted. COI is the same for age 70 or age 100 expiry. The only diff is you will have to pay higher premium (and thus higher comm) right now for your age 71-100 coverage.

Oct 30 2020, 01:36 PM

Oct 30 2020, 01:36 PM

Quote

Quote

0.1403sec

0.1403sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled