QUOTE(ajin999 @ May 16 2020, 06:42 PM)

Hi, i never take any insurance before.

Been quote this from AIA(life link). Is it ok?

Pampasan kematian - 500k

Pampsan TPD - 500k

Pampasan penyakit kritikal accelerated 250k

Age limit 70

Cash value at 70 : 16k

Waiver and save : inclusive

Monthly : 300

Like others mentioned, first step to insurance is better to be a medical card/hospitalisation. i.e. coverage for room & board and annual limit/lifetime limit for hospitalisation bills.

On this AIA plan, the critical illness accelerated means that once you claim critical illness 250k, the life will be deducted 250k as well.

Cash value is the money you can get in the investment part (not guaranteed).

QUOTE(darkueki @ May 17 2020, 12:49 AM)

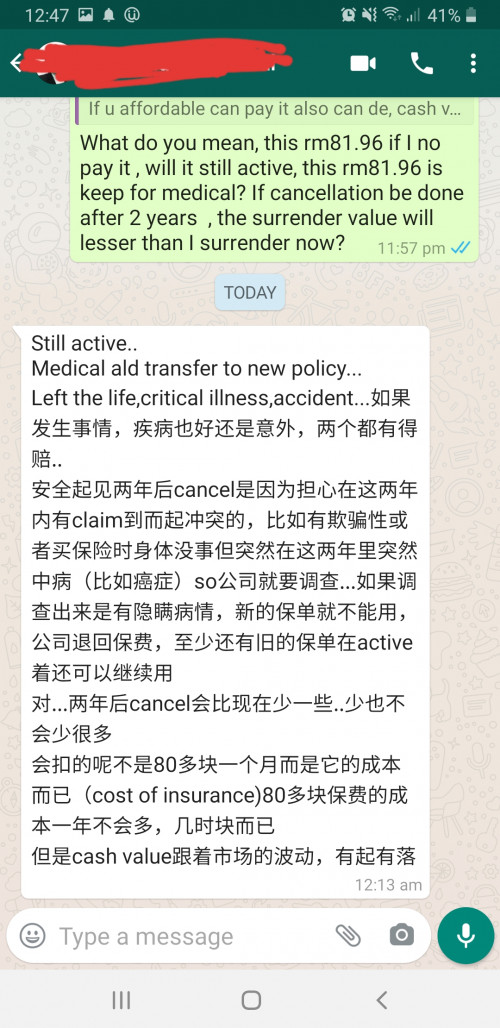

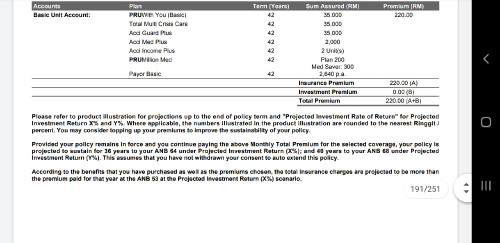

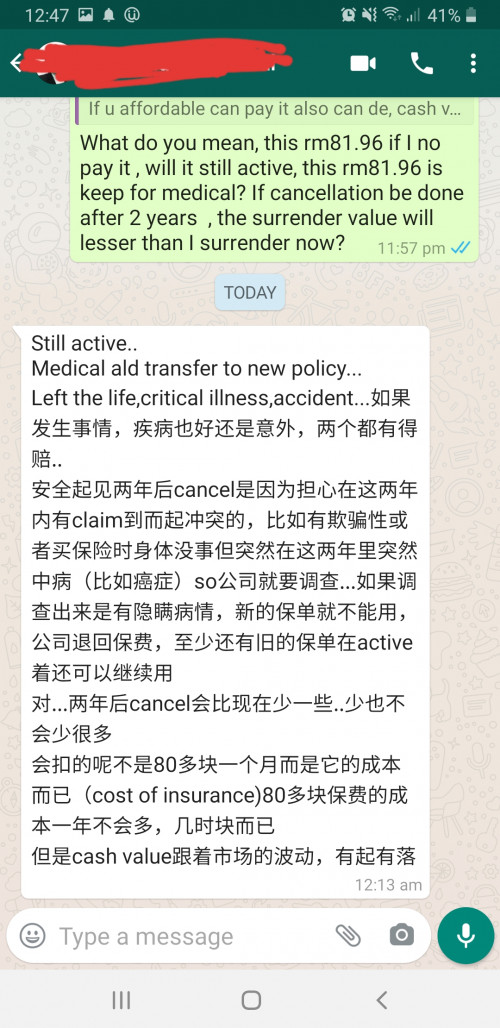

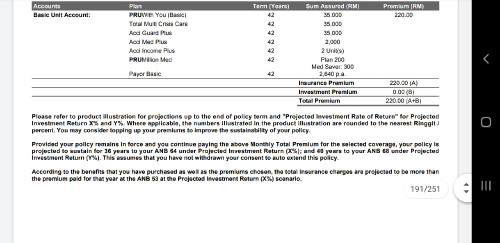

Hi , I would like to seek answer what my agent said is true or not.About one week ago, my agent contacted me and said the insurance company doing offer by let me change the current policy from prulife ready to pruwithyou with medical no waiting period.As my existing policy was only 1 million for life time, then I agreed to shift to new policy.

Currently there are 2 policy , one old and one new, the old policy premium revised to lower.

Then I asked my agent , do I still need to pay for old policy, she said no need but I afforable , I can pay it and the cash value will be more.

I felt weird why to keep the old policy as she mentioned my medical benefit transfer to new .

She answered me it is better to keep and the surrender value will just reduce a bit when I surrender 2 years later.

Can I have advise if I dont pay the old policy premium , will it really be like what my agent said, the surrender value will just reduce a little as only cost of insurance charges.

I attached screenshot but as she replied in Chinese so hope got people can help.

I do agree with Adele123 that it's better to upgrade existing policy first, however there might be a limit on how much you can upgrade the existing policy. The waiting period for specified illness (including cancer) is 60 days or 2 months. However, insurance companies still can initiate early claim investigation for policies inforce within 2 years depends on the case, hence your agent asked you only to surrender after 2 years.

I would advise you to terminate the old policy once your new policy is already inforce for 2 months instead of 2 years because early claim investigation is rather unlikely.

QUOTE(rebornyama @ May 17 2020, 07:18 AM)

Hey guys,

I got laid off a while back and my extended medical coverage benefit will soon expires. Looking at the options available online, it seems like most medical card only covers hospital visits?

Are there takaful/insurance plan that covers GP/private clinic visit? Not really concerned about hospital visit tbh since worse case scenario still got govt hospital, but visiting govt clinic for the occasional flu/ailments is too much of a hassle.

tldr: need coverage for GP/clinic visits

Group insurance can cover for clinical visits if the company signed up outpatient clinical rider. Even if visiting government clinic for flu/ailments, personal medical card won't be able to cover.

Personal medical card only covers for:

1) Accidents

2) Hospitalisation

3) Surgery

QUOTE(darkueki @ May 17 2020, 01:57 PM)

Hi Ckdenion, thanks for your advice, yes there is life insurance /critical illness payout but only 35k each.

I would like to know can you quote me with below details:

Budget rm250

AnB: 28

Non smoker

Medical : annual at least 1m and lifetime unlimited

Occupation : class 2 even thought I think I class 1 but my agent said in system she can found is production site leader, my job is like planner ,work in supply chain management.

Thank you.

Class 1 and class 2 are treated with the same insurance charge (for Great Eastern). 1 million annual and lifetime limited can be easily done with your budget. Remember to add in waiver rider when your agent prepare the quotation for you.

This post has been edited by GE-DavidK: May 17 2020, 06:47 PM

Apr 25 2020, 05:14 PM

Apr 25 2020, 05:14 PM

Quote

Quote

0.1354sec

0.1354sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled