QUOTE(encikbuta @ Jun 18 2020, 12:10 PM)

so i've reading up a lot of US-based personal finance books and there seems to be a common theme on insurance, i.e. "insurance is for protection only, not investment".

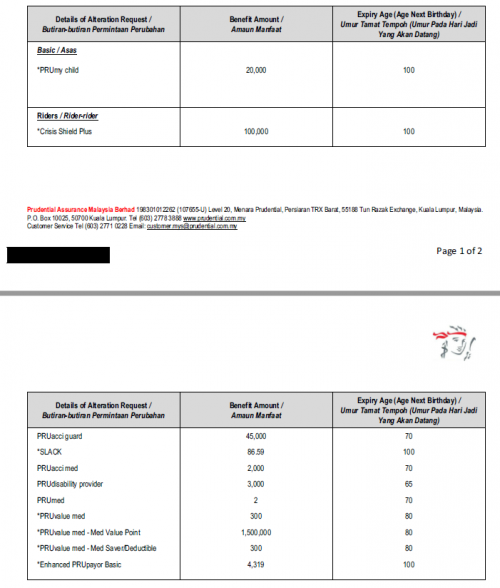

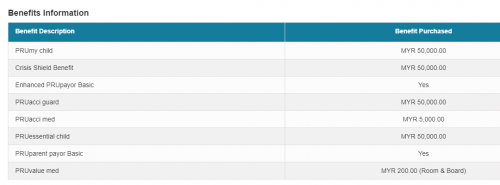

This got me thinking about my insurance choices. I'm 35 yrs old and i have the following 2x GE plans with the listed riders for about 10 yrs running now. They are all investment-linked which I understand is a mistake?

SmartProtect Essential Insurance 2 (RM270/month)

- SmartProtect Essential Insurance 2

- Critical Illness Benefit Rider

- Smart Early Payout CriticalCare

- IL Comprehensive Accident Benefits Xtra Rider

- IL Waiver of Premium Plus

- Smart Medic (SM150)

Great Early Triple Care Special (RM100/month)

I have quite a bit net worth with me that I'm pretty sure I can do without life insurance. My EPF & cash investments are 4x more than my life insurance sum assured. However, I do believe I still need medical and disability insurance. My question is, do you think it's worth for me to restructure my plan so I can:

- Remove the life insurance and investment portion

- Retain (& even upgrade) the medical & disability insurance portion

And what is the best way to go about doing it?

I didn't bother asking my insurance agent because he'll just tell me to retain everything and buy more policies

As you mentioned, insurance is for protection, not investment. Life insurance is a form of protection as well, so there is no need to reduce the life insurance portion.This got me thinking about my insurance choices. I'm 35 yrs old and i have the following 2x GE plans with the listed riders for about 10 yrs running now. They are all investment-linked which I understand is a mistake?

SmartProtect Essential Insurance 2 (RM270/month)

- SmartProtect Essential Insurance 2

- Critical Illness Benefit Rider

- Smart Early Payout CriticalCare

- IL Comprehensive Accident Benefits Xtra Rider

- IL Waiver of Premium Plus

- Smart Medic (SM150)

Great Early Triple Care Special (RM100/month)

I have quite a bit net worth with me that I'm pretty sure I can do without life insurance. My EPF & cash investments are 4x more than my life insurance sum assured. However, I do believe I still need medical and disability insurance. My question is, do you think it's worth for me to restructure my plan so I can:

- Remove the life insurance and investment portion

- Retain (& even upgrade) the medical & disability insurance portion

And what is the best way to go about doing it?

I didn't bother asking my insurance agent because he'll just tell me to retain everything and buy more policies

There are some benefits to have some form of life insurance:

1. Life insurance money will not be frozen and will be passed to your beneficiaries for use immediately.

2. Using small periodical payments to exchange for large payout.

3. Considering you are just age 35, life insurance is to make sure that your family can maintain the same standard of living (daily expenses, children's education fund, parents' expenses, etc) if you were to pass away tomorrow.

3. Rule of thumb is to have life insurance coverage 10 times your annual income.

Looking at your policies in medical card as well as GETC (without looking at the sum assured), it looks like you are covered quite well in terms of medical insurance as well as critical illness.

Jun 18 2020, 02:08 PM

Jun 18 2020, 02:08 PM

Quote

Quote

0.1312sec

0.1312sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled