QUOTE(moiskyrie @ Jun 8 2020, 03:26 PM)

Wow.... That's the worse way to buy insurance without knowing whether it serves the purpose. It will be better for you to talk to a financial advisor to find out how to get proper financial planning done

Insurance Talk V6!, Everything about Insurance

|

|

Jun 8 2020, 03:29 PM Jun 8 2020, 03:29 PM

Return to original view | Post

#101

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

|

|

|

Jun 8 2020, 03:31 PM Jun 8 2020, 03:31 PM

Return to original view | Post

#102

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(rocketm @ Jun 8 2020, 03:30 PM) That is the note from the Premium statement at the bottom. The insurance type is Critical illness. The annual statement will auto summarise for you how much went for medical and life separately for the year. Then key in that amount entitled under your exemption.[attachmentid=10511377] |

|

|

Jun 8 2020, 09:42 PM Jun 8 2020, 09:42 PM

Return to original view | Post

#103

|

All Stars

10,162 posts Joined: Nov 2014 |

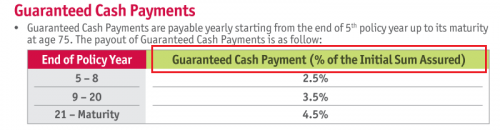

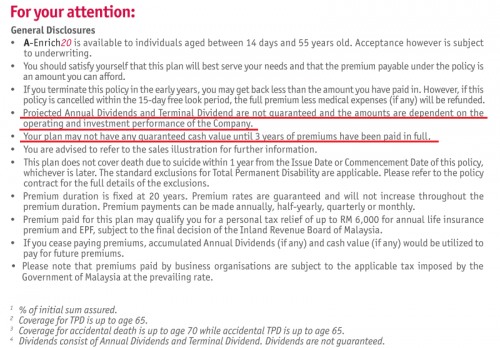

QUOTE(Cyclopes @ Jun 8 2020, 09:01 PM) It's a endowment policy where you pay only for 20 years. It pays a guaranteed cash payment of 2.5% to 4.5% annually. I do hope you would explain to the forummers more in detail that the guaranteed cash payment is based on your sum assured and no based on the overall account value as normal consumer do not understand this terminology used by the insurance company. They would assume 2.5% - 4.5% compounded based on the money that they have in the policy.___ Yes, there is medical card for persons aged 64. There are no payout for medical card, but if it's a critical illness plan, then there will be some cash value, provided the policy is enforced before age 60. Your policy document will provide guidance on definition of critical illness.   https://www.aia.com.my/content/dam/my/en/do...20-brochure.pdf *Correction on the wrong brochure reference earlier* This post has been edited by lifebalance: Jun 8 2020, 09:51 PM |

|

|

Jun 8 2020, 10:12 PM Jun 8 2020, 10:12 PM

Return to original view | Post

#104

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(moiskyrie @ Jun 8 2020, 10:02 PM) My insure sum is 23k, 2.5% based on RM23,000 = RM575 So for year 5~8, the 2.5% is from 23k or sum that have been pay? Like 5 year have been pay 11k, so 2.5% of 11k? Guarantee cash = divided or different thing? The guarantee cash they will send cheque? It's a guaranteed payout to you. You have an option to choose to deposit with the insurance company or to payout to you every year. Nowadays payment will be transferred to your bank account that you've indicated to AIA to bank into |

|

|

Jun 8 2020, 11:32 PM Jun 8 2020, 11:32 PM

Return to original view | Post

#105

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(rocketm @ Jun 8 2020, 10:46 PM) Yes, whether to have medical card might not be important as what I understand is without the medical card we need to pay first then claim with the insurance company with the bills, while doctor will charge higher price if notice the patient is having the medical card thus reduce the annual limit. The medical card will act as a subsidy to your existing savings for medical emergencies. It is for my mother, 64 this December, still working, no medical history before only have joint paint (if I could remember correctly). Worse case scenario still got government hospital if budget constraints |

|

|

Jun 9 2020, 12:40 AM Jun 9 2020, 12:40 AM

Return to original view | Post

#106

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Derrick16 @ Jun 9 2020, 12:38 AM) Hi, may i know what is the estimated premium range for income protection plan, assuming to insured for RM4k per month. Hmm I don’t get you, you mean you are earning 4K and wish to cover how many years of your income ?Probably you can tell me as below Age Occupation Gender Smoker or non smoker What’s the amount you’re looking to cover ? |

|

|

|

|

|

Jun 9 2020, 04:35 PM Jun 9 2020, 04:35 PM

Return to original view | Post

#107

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(LostAndFound @ Jun 9 2020, 04:28 PM) Hi all, I (36M) currently have a GE plan (investment linked):- Topping up on policy will need to check with your existing agent as they will check with the existing policy cash value plus new premium required.life coverage 150k critical illness 150k medical RM150/990k annual limit Paying RM325 a month. My wife (35) is uninsured except for work insurance. We just paid off our home so now looking at medical/life insurance for both. 2 children (4/6 yrs). Annual net income is about 85k for me and 45k for my wife. I'm comfortable with my medical coverage, but my life coverage seems quite small. Does it make more sense to:- 1. Increase my life coverage with current provider (GE) either by topup or buying separate life plan? 2. Buy a life coverage plan with another provider (fi.life?) At my current age, 20 year term seems a bit short (although it will cover the most 'dangerous' part of life in terms of expenses la). How much should I expect to pay to top up to 1 million (meaning +850k) full life coverage? Frustrating that there's no way to compare ringgit-for-ringgit coverage between the providers. Also for my wife's insurance needs, at the very least I want to get about 1 million medical plan for her (life coverage not sure yet), is it better to stick with current provider or should I diversify to other provider? It will be suggestive to cover at least 10x annual income for death or disability 5x annual income for critical illness as income replacement. It will be cheaper to buy a separate life policy than topping up though as life policy only offers bigger discounts per thousand sum assured. Fortunately I’m able to provide premium to premium comparison for different company but will need to finalize an elaborate financial plan for your family. You can diversify to different companies if you want just the absolute best coverage for the same or lower premium. |

|

|

Jun 10 2020, 01:11 AM Jun 10 2020, 01:11 AM

Return to original view | Post

#108

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ahwai @ Jun 10 2020, 12:45 AM) My client this year 63 years old has been buying medical card from me (annual limit 150k) for the past 10 years. Her annual premium when she was 50 - 59 years old is RM 1303 per year. Then now 60 plus she paying RM 1,738 yearly. Maybe this card will suit your requirement. Here is some better plans. Age 50 - 59 RM1329 yearly Annual Limit 1 Mil QUOTE(ahwai @ Jun 10 2020, 12:54 AM) I bought for my mum an affordable card Annual Limit 1 mil150k annual limit R&b 200 Non level. Premium per year 60-64 is 1738 65-69 is 2607 R&B 200 60 - 64 - 2204 65 - 69 - 3169 |

|

|

Jun 10 2020, 10:11 AM Jun 10 2020, 10:11 AM

Return to original view | Post

#109

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(drbone @ Jun 7 2020, 11:11 PM) QUOTE(lifebalance @ Jun 7 2020, 11:14 PM) QUOTE(GE-DavidK @ Jun 7 2020, 11:37 PM) Depending on the age of the mother (due to the payor waiver rider and mother's risk) as well as the amount life insurance/CI coverage you want for the child's medical card. I would say it's from RM200 per month onwards. QUOTE(lifebalance @ Jun 7 2020, 11:38 PM) QUOTE(drbone @ Jun 10 2020, 06:52 AM) Is there any better plan than Great eastern smart protect junior . This plan is coming to rm240/month. Told you so earlier ago. How is Melaka btw ?This post has been edited by lifebalance: Jun 10 2020, 10:12 AM |

|

|

Jun 10 2020, 09:53 PM Jun 10 2020, 09:53 PM

Return to original view | Post

#110

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(123azerty @ Jun 10 2020, 09:51 PM) Hello, I am a 25F and thinking to get my first insurance. It will be advisable to get an overall policy hence an investment link policy. A decent start can be around 200 monthly for you.Should I get life insurance or a medical card, with or without investment-linked? I am thinking to just start with something basic and add-on as I grow older to increase coverage etc.. What is estimated premium for those? Age: 25 Gender: F Occupation: Banker Non-Smoker Thanks sifus! |

|

|

Jun 11 2020, 05:47 PM Jun 11 2020, 05:47 PM

Return to original view | Post

#111

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jun 12 2020, 09:43 AM Jun 12 2020, 09:43 AM

Return to original view | Post

#112

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Hoochygal @ Jun 12 2020, 02:43 AM) My current insurance have expired. What you're referring to are traditional policies. Most of them you find nowadays are tied to savings plan or just Life / Critical Illness, you won't be able to add on medical card coverage.So im looking for something similar to start back. After 20 yr, it has guarantee return, and some medical coverage like Critical Illness, no investment link plan, and i can less income tax life issurance portion. Is this call a life insurance or endownment? I dont have much knowledge on insurance, as previously my uncle was an agent, so he just recommend and we trust him and just buy. Could anyone recommend me the name of product i should buy and from which insurance like aia, great eastern, allianz? - Mainly just to maximized my income tax 2020. - Somewhere around rm2-2.4k yearly. - Guarantee lumpsum, the more the better. - No investment link - Include majority medical coverage even better Tqvm You will find that traditional policies offers limited coverage with a higher premium since there is an element of guaranteed return. Depending on your thinking thoughts. I would rather keep insurance as a coverage rather than a guaranteed surrender value which will only payout 100% back to you at age 80 or 100. If you surrender earlier, the value is definitely lesser than 100%. If you're a 20 year old today, assuming sum assured 100k is guaranteed back to you at age 100, your money is only worth RM708.32 of today's value. Whereas you could have paid over 50k to 100k premium over the 80 years. (some policies nowadays do offer shorter payment term I.e 3 years, 5 years, 10 years, 20 years) The importance of insurance is on payout in the present day and not when you are at the age of 100. If you need the insurance money today, how are you going to transport yourself to your future age 100 to take your money to use? Whereas if you've opted for an investment link policy, easily you can get 3 - 10x of the coverage compared to a traditional policy for a similar premium depending on your age and the product that you have bought. But if you've made up your mind on only traditional policies, I won't mind selling it to you after you know what is the pros and cons I've mentioned on the above so that you won't have any regrets/complaints in the future. |

|

|

Jun 12 2020, 04:35 PM Jun 12 2020, 04:35 PM

Return to original view | Post

#113

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(0601430 @ Jun 12 2020, 04:32 PM) hmm strange but my case, 3months now still no result yet until today. And did your agent do anything for you to find out? 4th March - Submit all documents for claims 24th March - Ask for status, they replied currently under processing, when I ask what is the average time to process a claim, she reply me to give them 5 working days to process... ok I give them another 5 working days 2nd April - still no result or reply, I send in another email to ask the status... this time, she tells me that she forward my enquiry to department in charge, and said "if you not hear from us within 5 working days, please reply to this email", What the................... 6th April - Finally got reply on 6th April, asking for additional documents, one of it need letter from HR... MCO, all office closed, delayed 19th May - all additional documents ready, submit to insurance 28th May - Send email ask for claim status, auto acknowledgement said 5 working days to reply my email, but no reply 2nd June - Send another email ask for claim status, auto acknowledgment said 5 working days to reply, but also no reply 10th June - Send another email with all capital letter, only they reply my 28th May email. this time they reply to give them 7 working days, What the...... talk like I juz submit documents yesterday until today, no reply at all... you said 3 days to know the result, in my case, already more than 3mths not yet know the result zzzz Another suggestion is to walk in branch to find out what's causing the delay |

|

|

|

|

|

Jun 13 2020, 01:26 PM Jun 13 2020, 01:26 PM

Return to original view | IPv6 | Post

#114

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(LostAndFound @ Jun 13 2020, 01:18 PM) When exploring options for insurance for female 35 years (next birthday) non smoker, I spoke to both a GE agent and an AIA agent. No idea what was discussed for them to come up that plan for you. GE agent said RM220 monthly for 990k annual limit room&board 150 (with minimal 12k life protection) AIA agent said RM300 for their 150 package (500k annual limit, 20k life protection). Seems like a huge difference for reduced coverage, which means I must be missing something, but I also dunno how to ask further as they seem directly comparable to me. Can the insurance agents here suggest what the possible differences could be to cause the huge difference in cost? Thanks for all who offered to meet me to draw up a plan, but I very much prefer posting publicly in LYN for everyone's benefit (if that's okay with you). Based on the available info, sustainability will be the main impact as a higher budget wil likely result to that. Cost of insurance as well as certain company will charge higher than others. Replies that you will get here will be basic info. End of the day, you decide who you want to engage their expertise and live with their advise. |

|

|

Jun 13 2020, 02:05 PM Jun 13 2020, 02:05 PM

Return to original view | IPv6 | Post

#115

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(LostAndFound @ Jun 13 2020, 02:02 PM) 'Sustainability' means the ability to maintain premium price without increase for X number of years? No, it means that estimated years the policy may last provided no increase in price. If there is a revision, then the premium payable will need to be increased as well. Meaning your 300 monthly may not stay as 300 over 10 years if there is an increase then maybe you need to top up to 350 for example |

|

|

Jun 15 2020, 11:10 AM Jun 15 2020, 11:10 AM

Return to original view | Post

#116

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Housedude @ Jun 15 2020, 11:04 AM) Hey guys, Provided she is health, no limitation will be imposed.I have some questions to ask regarding insurance. So I'll keep it simple. My mum is a widow aged 65, I've lost my dad 5 years ago. My mum goes for full-body health screening annually and is quite healthy. Non-smoker and non-drinker. She is obviously not young anymore, when I lost my father to liver cancer, it was a huge financial impact as he did not have any insurance. My family's income is normal, around 350k annually from dividends, rentals and salary etc. As my father left his business shareholdings to my mother's name. I am hoping to buy a nicer house for my mother to spend her advanced years in, with a better environment than my current place. However with my mother's old age I am worried that any sudden medical situations would put us at risks as you all know certain illnesses can be very expensive to treat. As such, my question is if it is possible for someone her age to still get medical insurance, what kind of insurance premiums should we be expecting to pay? and what are the limitations imposed considering her age. I would also love to hear any suggestions for any insurance policies. Thanks Guys, Assuming Age 65 Coverage RM1,000,000 Premium 2,204 Yearly This post has been edited by lifebalance: Jun 15 2020, 11:11 AM |

|

|

Jun 15 2020, 02:49 PM Jun 15 2020, 02:49 PM

Return to original view | Post

#117

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(0601430 @ Jun 15 2020, 02:44 PM) Actually it was my agent help me submit all my documents thru online, i gave him all my docs on 3rd March, the next day he help me submit all the docs, he even screenshot the submission and send to me in whatsapp... i login online check and it is really submitted... even the day the insurance reply for additional documents, he directly call me bout it on the day he received the notice... i guess my agent is really do his job... just that the insurance company process my claim is not yea strange right? i send email last friday to ask bout the status again, as at today 2.30pm, no reply lucky your client's claims go thru without problem... i got user online, but there is no where to see the claim status, only wait for online letter notification... i use credit card to pay my medical fee, now enter the 3rd month, i paid the interest almost 2k, pay for free, pay for nothing... too bad, couldnt claim the interest with the insurance due to their slow in process the claims... |

|

|

Jun 15 2020, 03:00 PM Jun 15 2020, 03:00 PM

Return to original view | Post

#118

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(BacktoBasics @ Jun 15 2020, 02:55 PM) what do you think about the sustainability if I opt to top up one lump sum of lets say RM 2k to lengthen the sustainability rather than having a higher premium of RM 50 per month for the next 40 years. Yeah you can do so, it's called a single premium top-up.this would be a good idea? No right and wrong whether to do it as a regular or single top-up. As long as you know that doing such top up is to lengthen your policy sustainability. QUOTE(0601430 @ Jun 15 2020, 02:55 PM) where to complain to where? all this while i send asking status and "angry" email to their customer service email, but it seems like no use also There is a complaint email address that insurance company would have. Another add-on is to CC Bank Negara Malaysia (BNM) for this matter. They will start to do their things very fast |

|

|

Jun 15 2020, 03:05 PM Jun 15 2020, 03:05 PM

Return to original view | Post

#119

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(BacktoBasics @ Jun 15 2020, 03:02 PM) but again still there is no guarantee right as in if i do a single top-up but the sustainability may still drop maybe due to medical costs going up or the ILP part not doing well.... No one can guarantee their prices. Just like your Fish Seller at Market can't guarantee the fish price stays the same next 20 years.what would be your best advice?> Just get the necessary insurance coverage you need. Let the investment worry itself. The insurance company has shown their worse and best scenario and it's usually 2 - 3 years difference. 2% return by the insurance company is very achievable. Cheers. |

|

|

Jun 15 2020, 04:03 PM Jun 15 2020, 04:03 PM

Return to original view | Post

#120

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(QD_buyer @ Jun 15 2020, 03:35 PM) Hi all, nope, most of the time it will be auto assigned back to the manager who recruited her once she resigns.Recently my agent (who eventually became a good friend) asked me to transfer my policy to another agent which is her friend, as she said she need to resign from her agency to take a break and migrate overseas temporarily. She will come back after a year and rejoin the business. In term of servicing the policy she said can deal with her directly. As I do not know her friend nor do I want to communicate with him, I would like to know if there some sort of "assignment agreement" that both of them need to draw? Thanks! |

|

Topic ClosedOptions

|

| Change to: |  0.1404sec 0.1404sec

0.79 0.79

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:32 PM |