so now the benchmark for housing loan rate is ... 2.85%?

BNM Cut Rate Again But Not Benefit For New Loan, BNM Cut Rate Again But Not Benefit For N

BNM Cut Rate Again But Not Benefit For New Loan, BNM Cut Rate Again But Not Benefit For N

|

|

Jul 8 2020, 09:44 AM Jul 8 2020, 09:44 AM

|

Senior Member

1,296 posts Joined: Nov 2019 |

so now the benchmark for housing loan rate is ... 2.85%?

|

|

|

|

|

|

Jul 8 2020, 09:45 AM Jul 8 2020, 09:45 AM

Show posts by this member only | IPv6 | Post

#302

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(blanket84 @ Jul 8 2020, 09:38 AM) I don't understand the part where you said because right now the rate other people getting is the same, it means that spread has increased if the old loans rate is also based on the latest BR (after OPR cut), then compare it against new loan rate, if similar, then I think okay.. but somehow, the BR not necessary must drop in line with OPR drop, so need to watch out...Shouldn't it be the same mathematically? If the spread has increased, BR+Spread should be higher, no? |

|

|

Jul 8 2020, 09:50 AM Jul 8 2020, 09:50 AM

Show posts by this member only | IPv6 | Post

#303

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jul 8 2020, 09:53 AM Jul 8 2020, 09:53 AM

Show posts by this member only | IPv6 | Post

#304

|

All Stars

13,759 posts Joined: Jun 2011 |

|

|

|

Jul 8 2020, 09:53 AM Jul 8 2020, 09:53 AM

|

Senior Member

1,520 posts Joined: May 2008 |

QUOTE(WahBiang @ Jul 8 2020, 09:45 AM) if the old loans rate is also based on the latest BR (after OPR cut), then compare it against new loan rate, if similar, then I think okay.. but somehow, the BR not necessary must drop in line with OPR drop, so need to watch out... Yes. I do understand that BR doesn't necessarily drop according to OPR drop. But BR for a single bank would be the same across the board for all right? So, if an old client of a bank is paying 3.2% interest, and the new client also being offered 3.2%, shouldn't it mean that for both of them BR+spread is the same? |

|

|

Jul 8 2020, 10:17 AM Jul 8 2020, 10:17 AM

Show posts by this member only | IPv6 | Post

#306

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(blanket84 @ Jul 8 2020, 09:53 AM) Yes. I do understand that BR doesn't necessarily drop according to OPR drop. But BR for a single bank would be the same across the board for all right? So, if an old client of a bank is paying 3.2% interest, and the new client also being offered 3.2%, shouldn't it mean that for both of them BR+spread is the same? So far BR all drop in tandemSpread is fixed |

|

|

|

|

|

Jul 8 2020, 10:25 AM Jul 8 2020, 10:25 AM

|

Senior Member

1,296 posts Joined: Nov 2019 |

|

|

|

Jul 8 2020, 10:27 AM Jul 8 2020, 10:27 AM

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(cy91 @ Jul 8 2020, 10:25 AM) BR depends on the bank's cost of funds.If their cost of fund increase so will their BR whether OPR is adjusted or not. The fixed spread is the key factor here, so get as low of a spread as possible. |

|

|

Jul 8 2020, 10:59 AM Jul 8 2020, 10:59 AM

Show posts by this member only | IPv6 | Post

#309

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(blanket84 @ Jul 8 2020, 09:53 AM) Yes. I do understand that BR doesn't necessarily drop according to OPR drop. But BR for a single bank would be the same across the board for all right? So, if an old client of a bank is paying 3.2% interest, and the new client also being offered 3.2%, shouldn't it mean that for both of them BR+spread is the same? yes, but what if they don't want to drop?QUOTE(Zwean @ Jul 8 2020, 10:17 AM) Not necessary, you may check the historical BR rates movement vs OPR movement across few banks over the past few years... the timing of BR drop can be delayed by quite some time as well.This post has been edited by WahBiang: Jul 8 2020, 11:00 AM |

|

|

Jul 8 2020, 11:13 AM Jul 8 2020, 11:13 AM

|

Junior Member

13 posts Joined: Jan 2013 |

I'm in dilemma and become more confuse now (sorry, its my first property)

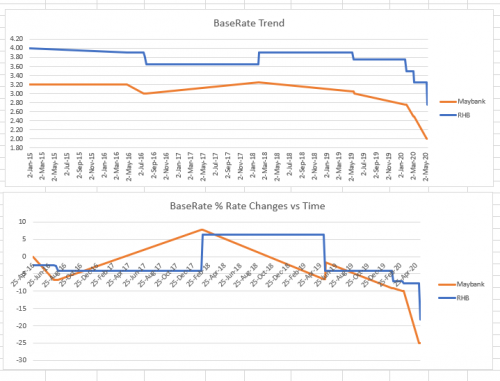

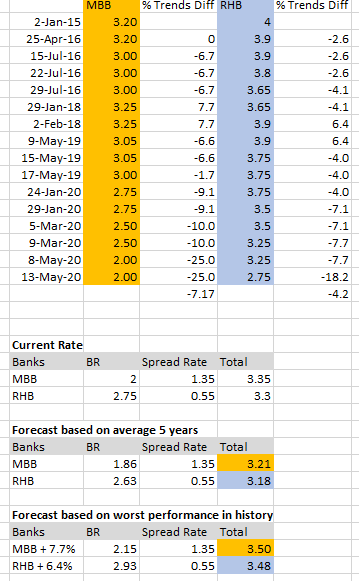

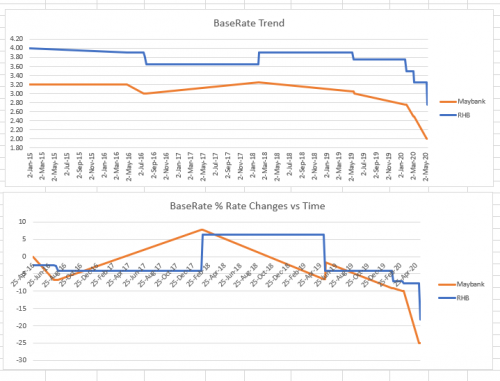

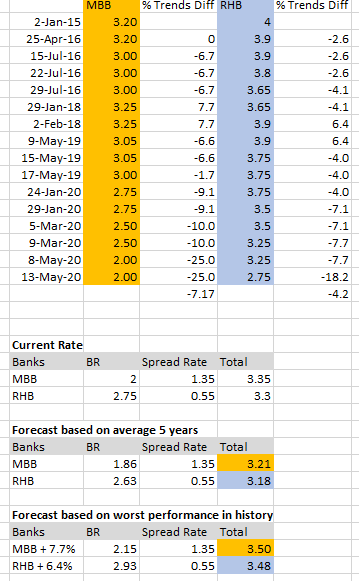

When I did my research, spread rate seems to be fixed. SO for example, in my situation, i have 2 offers last week: MBB= 2.0 (BR) + 1.35(SR) = 3.35 RHB= 2.75(BR) + 0.55(SR) = 3.30 So based on the discussion here, aiming on lower SR, it is a wise choice to go for RHB then? I charted a trend graph as well to see the health of the banks.  Did a very basic forecast (again, apologies as finance is not my strong suite, just trying to get a calculative decision - aware that there's tons of other factors that can impact the forecast) Any guru to guide me on the decisioning here?  |

|

|

Jul 8 2020, 11:18 AM Jul 8 2020, 11:18 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

i wonder if anyone still have those blr - x.x% package.

if got those then the loan damn cheap. imagine many many years ago, there were those blr - 1% package. fast forward now if blr is 2.5% then including the negative spread means only 1.5%? |

|

|

Jul 8 2020, 11:35 AM Jul 8 2020, 11:35 AM

Show posts by this member only | IPv6 | Post

#312

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(kochin @ Jul 8 2020, 11:18 AM) i wonder if anyone still have those blr - x.x% package. BR and BLR is different.if got those then the loan damn cheap. imagine many many years ago, there were those blr - 1% package. fast forward now if blr is 2.5% then including the negative spread means only 1.5%? BLR is higher than BR Internally they still have BLR |

|

|

Jul 8 2020, 12:10 PM Jul 8 2020, 12:10 PM

Show posts by this member only | IPv6 | Post

#313

|

Senior Member

3,718 posts Joined: Nov 2015 |

QUOTE(kochin @ Jul 8 2020, 11:18 AM) i wonder if anyone still have those blr - x.x% package. if they set BLR = BR, then definitely we got negative interest like those happened in JPn... if got those then the loan damn cheap. imagine many many years ago, there were those blr - 1% package. fast forward now if blr is 2.5% then including the negative spread means only 1.5%? QUOTE(Zwean @ Jul 8 2020, 11:35 AM) true, old loans are still based on BLR... |

|

|

|

|

|

Jul 8 2020, 12:29 PM Jul 8 2020, 12:29 PM

|

Junior Member

172 posts Joined: Sep 2014 |

QUOTE(popiah88 @ Jul 8 2020, 11:13 AM) I'm in dilemma and become more confuse now (sorry, its my first property) really good forecast, from the forecast RHB bank more advantage rather than MBB.When I did my research, spread rate seems to be fixed. SO for example, in my situation, i have 2 offers last week: MBB= 2.0 (BR) + 1.35(SR) = 3.35 RHB= 2.75(BR) + 0.55(SR) = 3.30 So based on the discussion here, aiming on lower SR, it is a wise choice to go for RHB then? I charted a trend graph as well to see the health of the banks.  Did a very basic forecast (again, apologies as finance is not my strong suite, just trying to get a calculative decision - aware that there's tons of other factors that can impact the forecast) Any guru to guide me on the decisioning here?  but i already sign for MBB for islamic loan. my current 3.4%. |

|

|

Jul 8 2020, 01:04 PM Jul 8 2020, 01:04 PM

Show posts by this member only | IPv6 | Post

#315

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jul 8 2020, 01:59 PM Jul 8 2020, 01:59 PM

|

Junior Member

708 posts Joined: Apr 2008 |

I am now dilemma which bank to took for house loan. priority is HLB which offer me 2.88 (BR)+0.32 (SR)

however, heard HLB has the right not follow Bank negara to drop the 0.25% BR. which will occasionally make my loan higher then others later on. any sifu pls advice |

|

|

Jul 8 2020, 02:03 PM Jul 8 2020, 02:03 PM

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(shaoching @ Jul 8 2020, 01:59 PM) I am now dilemma which bank to took for house loan. priority is HLB which offer me 2.88 (BR)+0.32 (SR) You "heard"..however, heard HLB has the right not follow Bank negara to drop the 0.25% BR. which will occasionally make my loan higher then others later on. any sifu pls advice Wait for confirmation then decide if not in a big rush. |

|

|

Jul 8 2020, 02:04 PM Jul 8 2020, 02:04 PM

Show posts by this member only | IPv6 | Post

#318

|

All Stars

13,759 posts Joined: Jun 2011 |

|

|

|

Jul 8 2020, 02:09 PM Jul 8 2020, 02:09 PM

|

Junior Member

13 posts Joined: Jan 2013 |

QUOTE(shaoching @ Jul 8 2020, 01:59 PM) I am now dilemma which bank to took for house loan. priority is HLB which offer me 2.88 (BR)+0.32 (SR) Well, spread rate is fixed after the loan signed. But their BR need to reflect the OPR too as well right? Banks do have the option to not follow, but if they do that, they will lose to competitions.however, heard HLB has the right not follow Bank negara to drop the 0.25% BR. which will occasionally make my loan higher then others later on. any sifu pls advice This post has been edited by popiah88: Jul 8 2020, 02:49 PM |

|

|

Jul 8 2020, 02:47 PM Jul 8 2020, 02:47 PM

|

Junior Member

13 posts Joined: Jan 2013 |

QUOTE(popiah88 @ Jul 8 2020, 11:13 AM) I'm in dilemma and become more confuse now (sorry, its my first property) I think to conclude my question, should we pick a loan with lower or higher spread rate, IF the total interest is the same? And why?When I did my research, spread rate seems to be fixed. SO for example, in my situation, i have 2 offers last week: MBB= 2.0 (BR) + 1.35(SR) = 3.35 RHB= 2.75(BR) + 0.55(SR) = 3.30 So based on the discussion here, aiming on lower SR, it is a wise choice to go for RHB then? I charted a trend graph as well to see the health of the banks.  Did a very basic forecast (again, apologies as finance is not my strong suite, just trying to get a calculative decision - aware that there's tons of other factors that can impact the forecast) Any guru to guide me on the decisioning here?  Eg: MBB= 2.0 (BR) + 1.35(SR) = 3.35 RHB= 2.75(BR) + 0.6(SR) = 3.35 |

| Change to: |  0.0228sec 0.0228sec

0.42 0.42

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 05:14 PM |