QUOTE(popiah88 @ Jul 8 2020, 11:13 AM)

I'm in dilemma and become more confuse now (sorry, its my first property)

When I did my research, spread rate seems to be fixed.

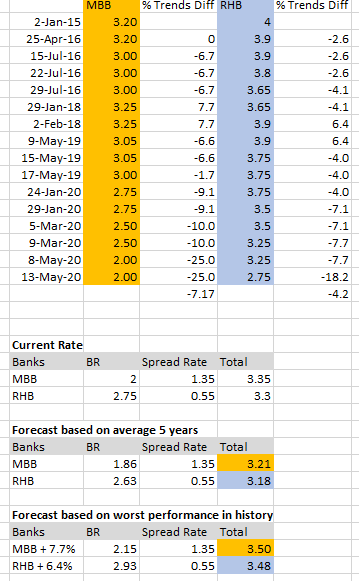

SO for example, in my situation, i have 2 offers last week:

MBB= 2.0 (BR) + 1.35(SR) = 3.35

RHB= 2.75(BR) + 0.55(SR) = 3.30

So based on the discussion here, aiming on lower SR, it is a wise choice to go for RHB then?

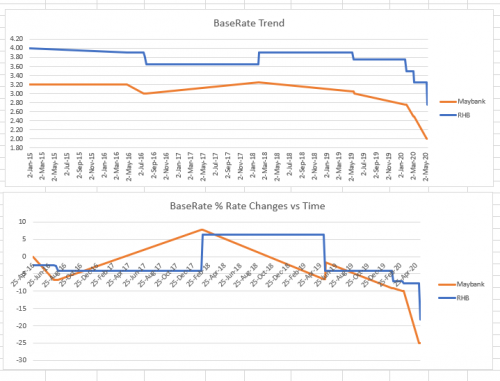

I charted a trend graph as well to see the health of the banks.

Did a very basic forecast (again, apologies as finance is not my strong suite, just trying to get a calculative decision - aware that there's tons of other factors that can impact the forecast)

Any guru to guide me on the decisioning here?

really good forecast, from the forecast RHB bank more advantage rather than MBB.When I did my research, spread rate seems to be fixed.

SO for example, in my situation, i have 2 offers last week:

MBB= 2.0 (BR) + 1.35(SR) = 3.35

RHB= 2.75(BR) + 0.55(SR) = 3.30

So based on the discussion here, aiming on lower SR, it is a wise choice to go for RHB then?

I charted a trend graph as well to see the health of the banks.

Did a very basic forecast (again, apologies as finance is not my strong suite, just trying to get a calculative decision - aware that there's tons of other factors that can impact the forecast)

Any guru to guide me on the decisioning here?

but i already sign for MBB for islamic loan. my current 3.4%.

Jul 8 2020, 12:29 PM

Jul 8 2020, 12:29 PM

Quote

Quote 0.0243sec

0.0243sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled