Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Apr 9 2020, 08:12 PM Apr 9 2020, 08:12 PM

Return to original view | IPv6 | Post

#81

|

All Stars

12,387 posts Joined: Feb 2020 |

Somebody jinxed it since February 2020.

|

|

|

|

|

|

Apr 10 2020, 02:28 PM Apr 10 2020, 02:28 PM

Return to original view | IPv6 | Post

#82

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(wym6977 @ Apr 10 2020, 02:17 PM) It still the best saving account with high interest compared to FD in the mkt... not difficult to meet the fulfillment if you have their CC eg LFC, JOP which still give reasonably good CB.. Previously if you have > 100k, at 2.5% pa it was still a good deal apart from FD. Now with the revision to 2.1% pa, need to think if want to keep beyond 100k. |

|

|

Apr 10 2020, 03:00 PM Apr 10 2020, 03:00 PM

Return to original view | IPv6 | Post

#83

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 11 2020, 10:46 PM Apr 11 2020, 10:46 PM

Return to original view | IPv6 | Post

#84

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Eurobeater @ Apr 11 2020, 10:43 PM) It's a digital credit card:https://www.sc.com/my/promotions/digitalcreditcards/ |

|

|

Apr 12 2020, 01:14 PM Apr 12 2020, 01:14 PM

Return to original view | IPv6 | Post

#85

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 15 2020, 09:30 PM Apr 15 2020, 09:30 PM

Return to original view | IPv6 | Post

#86

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 15 2020, 09:46 PM Apr 15 2020, 09:46 PM

Return to original view | IPv6 | Post

#87

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Apr 15 2020, 09:43 PM) then go hong leong bank la.. they also got some high interest saving account 3.0% if not wrong With MCO still in full force, all banks won't entertain new account opening. again better dont waste time on all this stupid high interest saving account because with OPR expected to get another slash in May, OCBC 3.4 will be even lower and SCB 3.6 also will be lower just throw inside ambank fd promotion lo if u dont plan to touch the money for 6 months to a year I am hoping we can win this covid19 war and stabilize back our economy Don't have existing account with HL and AmBank. |

|

|

Apr 15 2020, 09:50 PM Apr 15 2020, 09:50 PM

Return to original view | IPv6 | Post

#88

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 16 2020, 01:42 PM Apr 16 2020, 01:42 PM

Return to original view | Post

#89

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 16 2020, 02:06 PM Apr 16 2020, 02:06 PM

Return to original view | Post

#90

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gold_mine99 @ Apr 16 2020, 02:06 PM) Base interest reduced to 0.1% pahttps://av.sc.com/my/content/docs/my-revisi...legeaver-tc.pdf |

|

|

Apr 16 2020, 09:40 PM Apr 16 2020, 09:40 PM

Return to original view | IPv6 | Post

#91

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Apr 16 2020, 09:39 PM) Please move the discussion to here:https://forum.lowyat.net/topic/4750563/+5280#entry96365694 |

|

|

Apr 17 2020, 08:13 PM Apr 17 2020, 08:13 PM

Return to original view | IPv6 | Post

#92

|

All Stars

12,387 posts Joined: Feb 2020 |

Delivering a more consistent and streamlined digital banking experience.

As we evolve in sync with your digitally-connected lives, we continue to streamline our products and services to deliver an enhanced digital banking experience. In keeping with this consistency, we have decided to rename Online Mutual Funds [OMF] service to SmartDirect. SmartDirect enables you to buy, sell, and switch more than 200 mutual funds available in more than 5 different currencies, all from the convenience of your smartphone or by internet banking. For existing customers, we have taken all necessary measures to ensure the name change does not affect your access to SmartDirect service. Should you have any further enquiries or require clarification, please do not hesitate to visit any of our branches for assistance or call us at 1300 888 888 or +603 7711 8888 (if you are calling from overseas). https://av.sc.com/my/content/docs/notificat...smartdirect.pdf |

|

|

Apr 19 2020, 08:34 AM Apr 19 2020, 08:34 AM

Return to original view | IPv6 | Post

#93

|

All Stars

12,387 posts Joined: Feb 2020 |

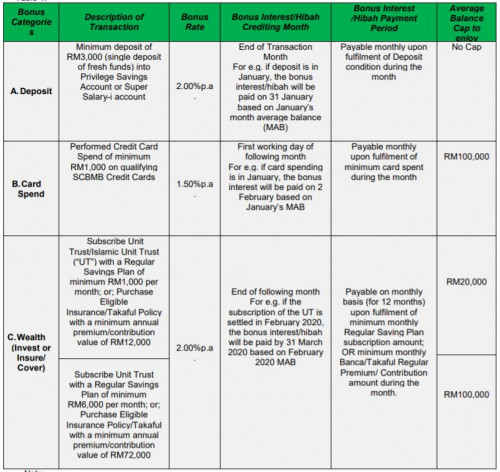

QUOTE(Ryk @ Apr 19 2020, 04:21 AM) Title of Up to 5.6% attract me to here Base interest: 0.1%I’m a bit confused for this saving plan, means u save while spending with the card only manage to get 5.6%? Deposit fresh fund of 3k: 2% Spend 1k with credit card: 1.5% (capped for RM 100k) Invest 1k every month in wealth products: 2% (capped for RM 20k)  This post has been edited by GrumpyNooby: Apr 19 2020, 10:35 AM |

|

|

|

|

|

Apr 19 2020, 01:48 PM Apr 19 2020, 01:48 PM

Return to original view | IPv6 | Post

#94

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 20 2020, 07:37 AM Apr 20 2020, 07:37 AM

Return to original view | Post

#95

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(paogeh @ Apr 20 2020, 12:25 AM) so SCB -3.5% still beat OCBC -3.4% ..... is it worth to move from OCBC to SCB for the peanut 0.1% ? RM100K - 0.1% = RM100 ....... if only RM10K ===> RM10 ...... per annual .... QUOTE(!@#$%^ @ Apr 20 2020, 12:26 AM) But you have more than RM 100k and close to RM 200k.Maybe you need both. |

|

|

Apr 20 2020, 08:55 AM Apr 20 2020, 08:55 AM

Return to original view | Post

#96

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 20 2020, 06:34 PM Apr 20 2020, 06:34 PM

Return to original view | IPv6 | Post

#97

|

All Stars

12,387 posts Joined: Feb 2020 |

Conditional high yield saving account offers flexibility & instant liquidity without fear of losing interest due to premature withdrawal of eFD.

As !@#$%^, everybody has his/her own purpose of money. Who doesn't want high yielding interest. |

|

|

Apr 22 2020, 09:26 AM Apr 22 2020, 09:26 AM

Return to original view | IPv6 | Post

#98

|

All Stars

12,387 posts Joined: Feb 2020 |

Found something weird that SC PSA has statement date.

|

|

|

Apr 22 2020, 12:38 PM Apr 22 2020, 12:38 PM

Return to original view | IPv6 | Post

#99

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Cookie101 @ Apr 22 2020, 12:35 PM) It has monthly statement. My statement for SC credit card (statement date: 9th) and PSA (statement date: 19th) are sent out separately. What’s weird with it? Unless u hold a cc too then it’s under consolidated statements that show everything there. Or u opt out as a stand-alone statement The consolidated statement doesn't have details on SC credit card. The configuration isn't set by me. The bank officer who opened/processed the account opening set it, Usually, you get statement for saving account at early of the month not middle of the month. The cut-off date is just weird. This post has been edited by GrumpyNooby: Apr 22 2020, 12:41 PM |

|

|

Apr 23 2020, 04:26 PM Apr 23 2020, 04:26 PM

Return to original view | IPv6 | Post

#100

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.0278sec 0.0278sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 09:23 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote