QUOTE(kart @ Mar 9 2020, 07:38 AM)

Thank you for your reply, GrumpyNooby.  Sigh, that is just too bad.

Sigh, that is just too bad.

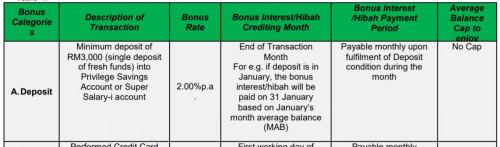

Since I am not interested at all in card spend interest of 1.5%, my sole focus is just Save Interest of 2%.

I believe that the annual fee of SC debit card is RM 8.00. And, I only intend to keep less than RM 1000 in Privilege$aver savings account. If I have anymore disposable income, I will just keep in ASNB, or invest it.

If my intended balance in Privilege$aver savings account is less than RM 1000, Save Interest of 2% and the base interest of 0.5% are inadequate to offset the annual fee of SC debit card of RM 8.00.

Note that I already have access to SC online banking website, since I have JustOne Personal Savings and Current Account, without SC Debit Card.

Sigh, maybe Privilege$aver savings account is not suitable for me.

At first I was excited like you for not having the debit card.Since I am not interested at all in card spend interest of 1.5%, my sole focus is just Save Interest of 2%.

I believe that the annual fee of SC debit card is RM 8.00. And, I only intend to keep less than RM 1000 in Privilege$aver savings account. If I have anymore disposable income, I will just keep in ASNB, or invest it.

If my intended balance in Privilege$aver savings account is less than RM 1000, Save Interest of 2% and the base interest of 0.5% are inadequate to offset the annual fee of SC debit card of RM 8.00.

Note that I already have access to SC online banking website, since I have JustOne Personal Savings and Current Account, without SC Debit Card.

Sigh, maybe Privilege$aver savings account is not suitable for me.

Then I asked my banker to double check with her team superior.

Her superior had called the HQ in KL and they said having a debit card is necessary.

Some in here said that AF for the debit card is FOC for first year.

This post has been edited by GrumpyNooby: Mar 9 2020, 07:41 AM

Mar 9 2020, 07:40 AM

Mar 9 2020, 07:40 AM

Quote

Quote

0.0630sec

0.0630sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled