QUOTE(vfoong @ Apr 1 2020, 06:03 PM)

Hi guys,

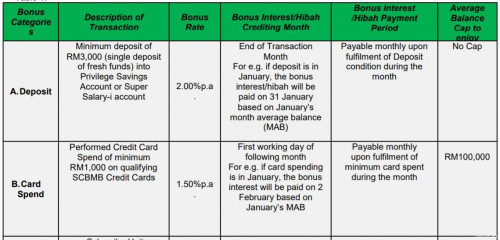

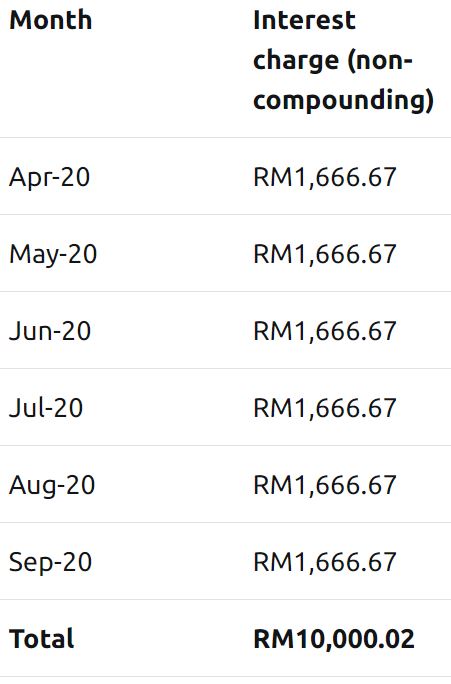

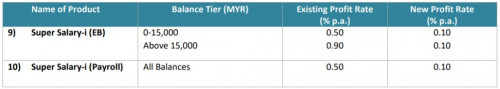

Just applied for this account mid month, having moved from OCBC 360. Anyone notice any discrepancy in the calculation for the spend bonus (1.5%) for March? From my calculations it is more like 1% (and I've factored in the fact that the spend bonus only applies to MAB up to 100,000)

So conclusion from me it was more like 0.5% (base) + 2% (save) + 1% (spend). I to plan to call the bank and clarify why this is. Just wondering if anyone has noticed this? If your MAB is less than 100,000 the spend bonus should be 0.75 times of your save bonus.

01/04/2020 BONUS-INTEREST-CARD SPEND MYR 127.40 Just applied for this account mid month, having moved from OCBC 360. Anyone notice any discrepancy in the calculation for the spend bonus (1.5%) for March? From my calculations it is more like 1% (and I've factored in the fact that the spend bonus only applies to MAB up to 100,000)

So conclusion from me it was more like 0.5% (base) + 2% (save) + 1% (spend). I to plan to call the bank and clarify why this is. Just wondering if anyone has noticed this? If your MAB is less than 100,000 the spend bonus should be 0.75 times of your save bonus.

My amount has maxed out.

I can't help you to verify.

Apr 1 2020, 06:15 PM

Apr 1 2020, 06:15 PM

Quote

Quote

0.0551sec

0.0551sec

1.07

1.07

7 queries

7 queries

GZIP Disabled

GZIP Disabled