Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

May 12 2020, 06:14 PM May 12 2020, 06:14 PM

|

|

QUOTE(MGM @ May 12 2020, 06:09 PM) I just open this PSA last week and is thinking of transfering rm90k from SSPN to PSA or OCBC360? Would like to confirm the following: 1) IBFT is free from PSA to other banks' account? 2) What is the max IBFT per day? 3) Interest rate for this month still stay at 3.6%? 1) Yes  2) RM 50k  3) No announcement so far presumed as it is |

|

|

|

|

|

GrumpyNooby

|

May 12 2020, 06:27 PM May 12 2020, 06:27 PM

|

|

QUOTE(MGM @ May 12 2020, 06:25 PM) Thanks bro, is there a cut off time like ocbc360's 9.45pm to be considered as same day transaction? QUOTE(roarus @ Feb 28 2020, 11:27 AM) Anyone knows the daily balance cut-off time for interest calculation? QUOTE(Cookie101 @ Feb 28 2020, 04:36 PM) |

|

|

|

|

|

GrumpyNooby

|

May 13 2020, 06:02 PM May 13 2020, 06:02 PM

|

|

I got a feeling that PSA interest rate will be revised very soon and will be effective starting 1/7/2020 Based on https://av.sc.com/my/content/docs/my-announ...seniorsaver.pdf |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 07:45 PM May 14 2020, 07:45 PM

|

|

QUOTE(MiKE7LIM @ May 14 2020, 07:43 PM) managed to open this account via online method. easy and fast! looking forward to enjoy the interest from this account! No need to do biometric or NRIC verification? |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 07:50 PM May 14 2020, 07:50 PM

|

|

QUOTE(!@#$%^ @ May 14 2020, 07:44 PM) There's an APPLY tab upon logging into SC internet banking portal. Otherwise you can use the "Let's get in touch" section on PSA page or "Get In Touch" button. I'm more curious if there's any need to do the identity verification. This post has been edited by GrumpyNooby: May 14 2020, 07:51 PM |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 07:53 PM May 14 2020, 07:53 PM

|

|

QUOTE(MiKE7LIM @ May 14 2020, 07:51 PM) just like fill up form in computer , electronic signature … submission and 2-3 hours got the account. I hold standchart credit card... so its pretty simple for my case I also hold SC credit card prior to PSA opening. That time, I applied at the booth and they still need to do identity verification using the portal biometric machine. This post has been edited by GrumpyNooby: May 14 2020, 07:54 PM |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 07:59 PM May 14 2020, 07:59 PM

|

|

QUOTE(MiKE7LIM @ May 14 2020, 07:58 PM) one of the officer contact me to confirm I want to have this account, then send me the form via email. (on phone 2mins) Signed & email back (took me around 5-8mins) wait for 2-3 hours another officer call to verified and confirmed (on phone 2-3 mins ) Completed. Account available the process is easy and straight forward. Wow, so simplified already! By the way, did they request a copy of NRIC? |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 08:41 PM May 14 2020, 08:41 PM

|

|

QUOTE(MiKE7LIM @ May 14 2020, 08:40 PM) I'm impressed with SC!  They leap ahead into digital banking now! |

|

|

|

|

|

GrumpyNooby

|

May 16 2020, 09:26 AM May 16 2020, 09:26 AM

|

|

QUOTE(cclim2011 @ May 15 2020, 10:04 PM) Perhaps you'll get a call on next Monday. |

|

|

|

|

|

GrumpyNooby

|

May 16 2020, 09:10 PM May 16 2020, 09:10 PM

|

|

QUOTE(cclim2011 @ May 16 2020, 01:20 PM) didnt realize can try open online earlier. else will move out from ocbc if get to open this. I know that there's an option to open online but what I'm impressed is no need to go to the branch to complete certain procedures or to do any biometric verification. This post has been edited by GrumpyNooby: May 16 2020, 09:10 PM |

|

|

|

|

|

GrumpyNooby

|

May 16 2020, 10:56 PM May 16 2020, 10:56 PM

|

|

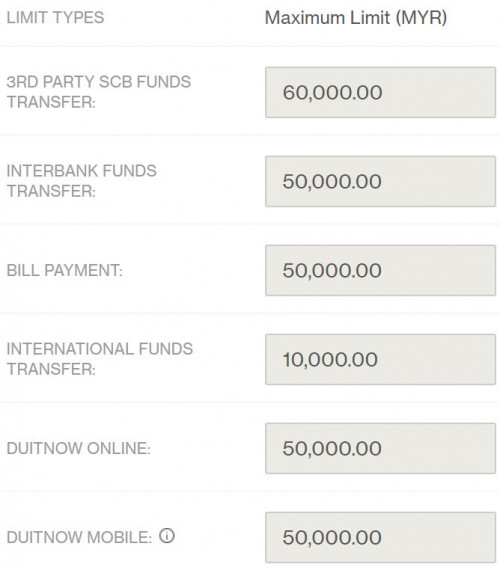

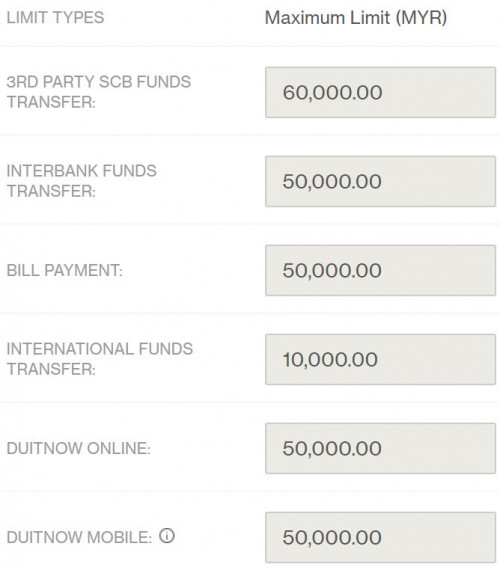

QUOTE(MGM @ May 16 2020, 10:35 PM) If I want to transfer rm60k to MBB in one day, can I transfer rm50k using IBFT and rm10k using Duitnow Online? I never transfer out that much before. My guess all except 3rd party SC funds transfer shared the same limit of RM 50k. Please explore yourself and share the outcome here. Thanks in advance. |

|

|

|

|

|

GrumpyNooby

|

May 19 2020, 11:56 PM May 19 2020, 11:56 PM

|

|

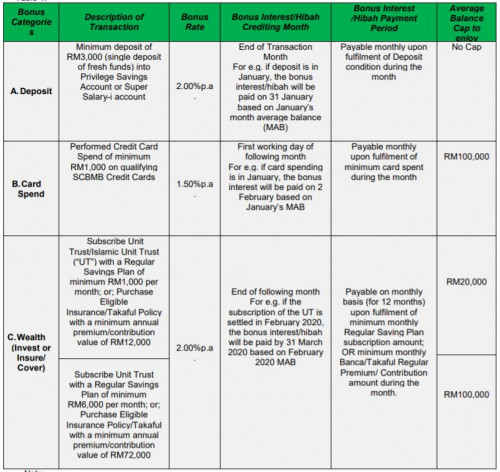

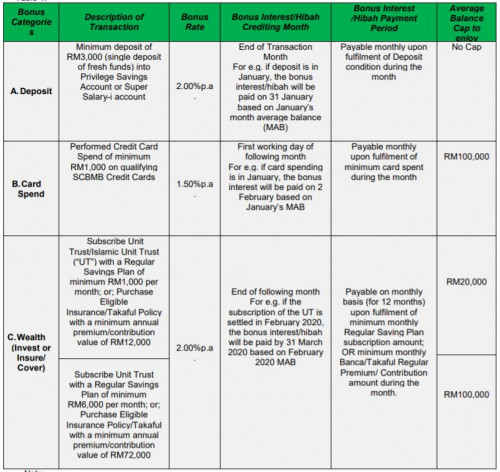

QUOTE(tiramisu83 @ May 19 2020, 11:53 PM) hi guys, if i already have Super Salary account, means i can automatically to get this rate right? Your is Super Salary or Super Salary-i? If Super Salary-i, is it Super Salary-i (Payroll)? QUOTE Eligibility 4. This Campaign is open to existing and new customers with Privilege Savings Account and Super Salary-i (Payroll) (“Super Salary-i”) (“Promotion Account”) effective from 1 February 2020) who have maintained their accounts (all accounts with SCBMB and SCSB including but not limited to the Privilege Savings Account, Super Salary-i and credit card account(s)) in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. The Super Salary-i account is based on the Shariah concept of Tawarruq. (hereinafter referred to as “Eligible Accountholders”) https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfDo take note that Super Salary-i has 2 variants: Super Salary-i (EB) and Super Salary-i (Payroll). |

|

|

|

|

|

GrumpyNooby

|

May 20 2020, 12:01 AM May 20 2020, 12:01 AM

|

|

QUOTE(tiramisu83 @ May 19 2020, 11:59 PM) my online banking only showing it is Super Salary... But long time ago this account is my salary payroll account...should consider payroll? Does it has a "-i" from SC Saadiq? This post has been edited by GrumpyNooby: May 20 2020, 12:02 AM |

|

|

|

|

|

GrumpyNooby

|

May 23 2020, 03:00 PM May 23 2020, 03:00 PM

|

|

QUOTE(cclim2011 @ May 22 2020, 11:26 PM) multiple calls asking me to go bank. saying ocmpolsory or can also meet outside. sien haha. see how then. Maybe MCO has been relaxed. They put reinstate the stringent requirement to complete biometric verification at the branch.  |

|

|

|

|

|

GrumpyNooby

|

May 23 2020, 10:36 PM May 23 2020, 10:36 PM

|

|

QUOTE(tiramisu83 @ May 23 2020, 10:33 PM) It is showing Super Salary in my online banking, there have another type of Super Salary? Your Super Salary is probably from conventional banking. Super Salary-i is from Islamic banking (SC Saadiq). Even Super Salary-i has 2 variant Super Salary-i (EB) and Super Salary-i (Payroll). The one that eligible for similar benefits/bonus as PSA is Super Salary-i (Payroll) from SC Saadiq (Islamic banking). This post has been edited by GrumpyNooby: May 23 2020, 10:38 PM |

|

|

|

|

|

GrumpyNooby

|

May 26 2020, 03:48 PM May 26 2020, 03:48 PM

|

|

QUOTE(MGM @ May 26 2020, 03:43 PM) I hope the 50k limit for transfer out is not affected by those amount that transfer in, like the Bank Islam's 50k limit. This month will be my 1st month of using PSA, >rm3k deposited into PSA and JOP & LFC principle and supp cards spending for May > rm1000. This is not Boost whereby Spending & P2P Send are sharing the limit. The displayed limit is obviously Transfer Out daily limit. |

|

|

|

|

|

GrumpyNooby

|

May 26 2020, 06:21 PM May 26 2020, 06:21 PM

|

|

QUOTE(MGM @ May 26 2020, 06:17 PM) Bank Islam is but then may be it is different cos of sspn. Referring to my post above at sspn thread. You're talking about SC limits; this is SC PSA thread. I'm answering regarding SC transfer limts. Why are we even talking about BI in SC PSA thread? Isn't that even funny to discuss about it? SC got transfer fund from or to SSPN (dedicated feature like BI) to begin with? By the way, here's the answer that you're seeking for:  Hope that would satisfy your curiosity. This post has been edited by GrumpyNooby: May 26 2020, 07:09 PM |

|

|

|

|

|

GrumpyNooby

|

May 27 2020, 07:27 AM May 27 2020, 07:27 AM

|

|

QUOTE(wyh @ May 27 2020, 12:31 AM) owh ok ok, card need to be collect or send to address ? If you're not doing it at the branch, the debit card will be sent to your mailing address. |

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 07:38 PM May 28 2020, 07:38 PM

|

|

RENAME OF ‘INSTANT TRANSFER’ TO ‘DUITNOW’ EFFECTIVE 17 MAY 2020Please be informed that effective 17 May 2020, we have renamed ‘Instant Transfer’ to ‘DuitNow’ in our Online Banking and SC Mobile App local transfer screens. The transfer history screen hasreflected the same by showing DuitNow Pay-To-Account (for bank account input transfers) and DuitNow Pay-To-Proxy (for mobile number & NRIC input transfers). Should you have any enquiries or require clarification, please do not hesitate to speak to our branch personnel, call our 24-hour Client Care Centre at 1300 888 888 (or +603-7711 8888 if you are calling from overseas) or email us at Malaysia.Feedback@sc.com Thank you. https://av.sc.com/my/content/docs/Rename-of...-to-DuitNow.pdf

|

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 07:09 AM Jun 1 2020, 07:09 AM

|

|

Guys, Base Interest and Save Bonus Interest for May 2020 are in. Card Spend Bonus Interest for May 2020 is expected to be credited by end of today (first working day of the following month) as per product T&C.  This post has been edited by GrumpyNooby: Jun 1 2020, 06:11 PM This post has been edited by GrumpyNooby: Jun 1 2020, 06:11 PM |

|

|

|

|

May 12 2020, 06:14 PM

May 12 2020, 06:14 PM

Quote

Quote

0.0643sec

0.0643sec

0.88

0.88

7 queries

7 queries

GZIP Disabled

GZIP Disabled