Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Apr 23 2020, 09:10 PM Apr 23 2020, 09:10 PM

|

|

QUOTE(cucikaki @ Apr 23 2020, 09:06 PM) Could be but that's just CGS-CIMB own analysis. Those guys in FD thread are more nervous now. With extension of current MCO to 15/2/2020, not sure if AmBank allows new account opening at the branch after 28/4/2020 |

|

|

|

|

|

GrumpyNooby

|

Apr 23 2020, 09:29 PM Apr 23 2020, 09:29 PM

|

|

QUOTE(David_Yang @ Apr 23 2020, 09:28 PM) No uncle, this is also the SC analysis. Got update from them on Monday, SC expects 0.5% cut in May and then another 0.25, so 1.75% for the rest of 2020! And also OCBC told me to prepare for the May cut and the 1.75  The 12 month Ambank 3.5% will be DOUBLE the OPR, you said you don´t want to go, but maybe it is time to give the money to your kids and grandchildren and send them to AmBank  I put into SAMY, Wahed, MyTheo, FSM and PRS. I had shared my views in the FD thread that there'll be at least 2 more OPR cuts this year with min 0.5% cut in the pipeline. The article didn't catch me in surprise at all. This post has been edited by GrumpyNooby: Apr 23 2020, 09:31 PM |

|

|

|

|

|

GrumpyNooby

|

Apr 26 2020, 01:00 PM Apr 26 2020, 01:00 PM

|

|

QUOTE(MGM @ Apr 26 2020, 12:56 PM) Have to spend how much, cant load into ewallet? Spend Bonus requirement: 1. OCBC needs merely RM 500 with debit or credit card 2. SC needs RM 1000 with credit card That's the huge difference he tried to highlight! |

|

|

|

|

|

GrumpyNooby

|

Apr 26 2020, 05:18 PM Apr 26 2020, 05:18 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Apr 26 2020, 05:26 PM Apr 26 2020, 05:26 PM

|

|

QUOTE(taiping... @ Apr 26 2020, 05:24 PM) Thanks! Can I use this to transfer to perhaps bigpay and get cashback? I’ve read the conditions. Is it The CC to bigpay is considered online transaction? How many percent can get back for online transaction Sorry noob here. Still getting a hang on cashbacks Yes both both cards. That is what MGM meant for the beginning. |

|

|

|

|

|

GrumpyNooby

|

Apr 29 2020, 06:37 PM Apr 29 2020, 06:37 PM

|

|

You can do more now via Digital Banking Source: Email

|

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 05:28 AM May 1 2020, 05:28 AM

|

|

Base interest & Save Bonus interest are in!

|

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 11:20 AM May 1 2020, 11:20 AM

|

|

|

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 12:27 PM May 1 2020, 12:27 PM

|

|

QUOTE(!@#$%^ @ May 1 2020, 12:25 PM) anything changed in the t&c? Base interest revised to 0.1% |

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 12:33 PM May 1 2020, 12:33 PM

|

|

QUOTE(taiping... @ May 1 2020, 12:32 PM) So in total is 3.2% only Without purchasing unit trust 3.6% to be correct 0.1%+2%+1.5% |

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 08:04 PM May 1 2020, 08:04 PM

|

|

QUOTE(cucikaki @ May 1 2020, 08:02 PM) Thanks for the update but it's weird since today's not working day for Malaysia. I was expecting it to be in next Monday. This post has been edited by GrumpyNooby: May 1 2020, 08:05 PM |

|

|

|

|

|

GrumpyNooby

|

May 1 2020, 08:05 PM May 1 2020, 08:05 PM

|

|

QUOTE(MiKE7LIM @ May 1 2020, 08:00 PM) thanks! gonna try this out monthly interbank transfer 3K consider bank in right ..spending with SC card constantly above 1K cant wait for them to call me to activate this acc As long as the money doesn't come from within SC. |

|

|

|

|

|

GrumpyNooby

|

May 2 2020, 09:04 AM May 2 2020, 09:04 AM

|

|

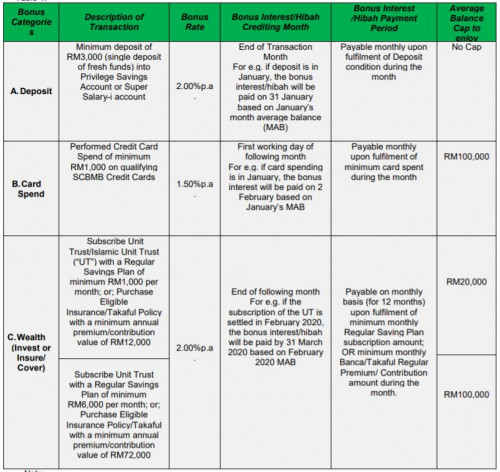

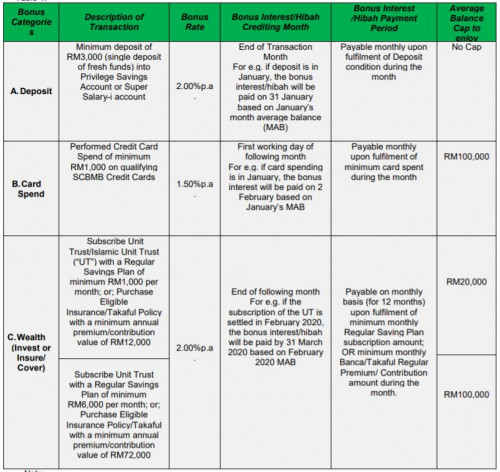

QUOTE(zenquix @ May 2 2020, 09:00 AM) interests should be auto system calculated and generated But they already mentioned when the interest of each category will be credited in the account:  |

|

|

|

|

|

GrumpyNooby

|

May 2 2020, 09:08 AM May 2 2020, 09:08 AM

|

|

QUOTE(zenquix @ May 2 2020, 09:08 AM) yeah.. i suspect the coding is more "weekday" than "non-public holiday working day" Not complaining but just feel weird. |

|

|

|

|

|

GrumpyNooby

|

May 3 2020, 06:57 PM May 3 2020, 06:57 PM

|

|

QUOTE(MalaysianFire @ May 3 2020, 06:56 PM) you think OCBC might cut further ? Every bank has potential to cut further if there's a downward revision of OPR. Result is due in next one/two days. |

|

|

|

|

|

GrumpyNooby

|

May 5 2020, 03:41 PM May 5 2020, 03:41 PM

|

|

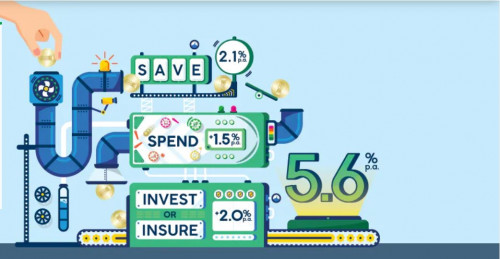

Base interest is at 0.1%.

They'll slash from Bonus interests.

My guess 0.25% from Save Bonus Interest and another 0.25% from Spend Bonus Interest. If luckier, could be 0.15% for both categories.

Invest Bonus Interest may not be touches since that had some tighter restriction and will bring in extra revenue to the bank via wealth products sale.

|

|

|

|

|

|

GrumpyNooby

|

May 5 2020, 05:04 PM May 5 2020, 05:04 PM

|

|

QUOTE(David_Yang @ May 5 2020, 05:03 PM) My guess: Base 0.1 Save 0.5 Spend 1.5 Invest 2.0 They need to see how their neighbour move first.  Currently at 3.4% This post has been edited by GrumpyNooby: May 5 2020, 05:05 PM |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 12:43 PM May 8 2020, 12:43 PM

|

|

QUOTE(MGM @ May 8 2020, 12:41 PM) Just open PSA, so if start depositing this month >RM3K n use CC >1K, I can start collecting the 3.6% Interest for May even though it is a partial month? Yes. |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 02:42 PM May 8 2020, 02:42 PM

|

|

QUOTE(Eurobeater @ May 8 2020, 02:37 PM) As long as SCB hasn't made any sudden announcements. Afaik, no changes from SCB yet Be patient 21 days before 1/6/2020. Maybe it could come in weekends though.  |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 03:56 PM May 8 2020, 03:56 PM

|

|

QUOTE(David_Yang @ May 8 2020, 03:45 PM) I have the feeling SC is too serious to change the May rules on Friday, 29th  (I know according to their TnC they could do it even on Sunday 31st) Hopefully they will not proove me wrong. Because of this PC? Standard Chartered Malaysia cuts base rate by 50bps effective May 14https://www.theedgemarkets.com/article/stan...ffective-may-14 |

|

|

|

|

Apr 23 2020, 09:10 PM

Apr 23 2020, 09:10 PM

Quote

Quote

0.0647sec

0.0647sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled