Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Feb 26 2020, 11:33 AM Feb 26 2020, 11:33 AM

|

|

QUOTE(Darkcloudz @ Feb 26 2020, 11:29 AM) hi guys, may i know how much i need to deposit in order to open a saving account with STD CHRT? rm250? I opened it with RM 0. I did an instant interbank fund transfer once the account is activated and viewable in SC Web/App, This post has been edited by GrumpyNooby: Feb 26 2020, 11:34 AM |

|

|

|

|

|

GrumpyNooby

|

Feb 26 2020, 11:44 AM Feb 26 2020, 11:44 AM

|

|

QUOTE(Darkcloudz @ Feb 26 2020, 11:42 AM) i just need a basic saving account for payroll purpose. still some bank may require a min deposit right? Yes. BSA needs RM 20. Some accounts need higher. Some banks may hide BSA too. This post has been edited by GrumpyNooby: Feb 26 2020, 11:44 AM |

|

|

|

|

|

GrumpyNooby

|

Feb 26 2020, 09:23 PM Feb 26 2020, 09:23 PM

|

|

QUOTE(chezzcake2 @ Feb 26 2020, 08:53 PM)  start using since 2017 the interest is paid by monthly and calculated by daily..and it's more than 4% PA if u know what i mean..( without the investment tier ) why put in FD and locked ur money? just join us and take out ur fd from others bank FD for amount greater than RM 100k |

|

|

|

|

|

GrumpyNooby

|

Feb 27 2020, 04:41 PM Feb 27 2020, 04:41 PM

|

|

QUOTE(jieGeGe @ Feb 27 2020, 04:39 PM) Join their Premium customer and they have some Promo FD rate. Last year 4.7% FD for 6 month 30% Casa 70% FD What is min AUM for Premiere banking? |

|

|

|

|

|

GrumpyNooby

|

Mar 1 2020, 11:24 AM Mar 1 2020, 11:24 AM

|

|

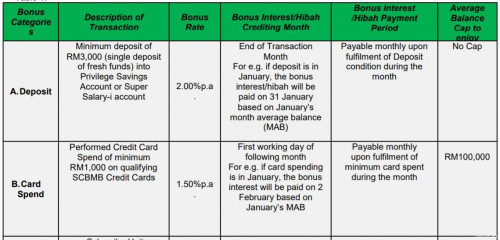

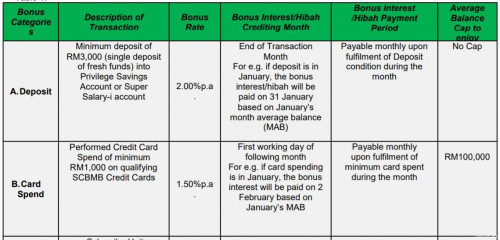

QUOTE(jojo_Lim @ Mar 1 2020, 11:22 AM) Hi All, just some questions, i opened the SC account on last month 20th of Feb, from the 21st to 31th i deposit money several times to the account in different date and i am sure that my i have met the requirements for getting 4.0 inteset rate. today i checked my account transactioons and noticed only 2 transactions records which is CR interest and one bonus interst, should we see 2 bonus interst transaction instead of one ? Your card spending bonus interest will be credited on the next working day which is tomorrow for March 2020. This post has been edited by GrumpyNooby: Mar 1 2020, 11:24 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 1 2020, 11:33 AM Mar 1 2020, 11:33 AM

|

|

QUOTE(jojo_Lim @ Mar 1 2020, 11:31 AM) Thanks for your clarification,  my credit card spending was before i open the saving account, am i still eligible for the bonus ? I believe should be as long as it does fall within the same calendar month which is February 2020. |

|

|

|

|

|

GrumpyNooby

|

Mar 1 2020, 11:52 AM Mar 1 2020, 11:52 AM

|

|

QUOTE(jojo_Lim @ Mar 1 2020, 11:51 AM) Thanks again :thumbsup: i just called the customer service and the their response is against what communicated to me when the SC staff asked me toopen the account. he told me that i should spent after the account opened. i questioned him again then he opened a case for me, what a non-acknowledable staff  i will wait tomorrow and see will i get the bonus :thumbsup: My account is also opened last month after I had the CC for > 1 year. I believe shouldn't be a problem. Let's see tomorrow. This post has been edited by GrumpyNooby: Mar 1 2020, 12:12 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 1 2020, 02:22 PM Mar 1 2020, 02:22 PM

|

|

QUOTE(yap1992 @ Mar 1 2020, 02:15 PM) I did ask the same question when I was opening SC acc and I was told that only spending after the acc opening matters. If so, then too bad! Have to wait till April 2020. |

|

|

|

|

|

GrumpyNooby

|

Mar 2 2020, 06:13 PM Mar 2 2020, 06:13 PM

|

|

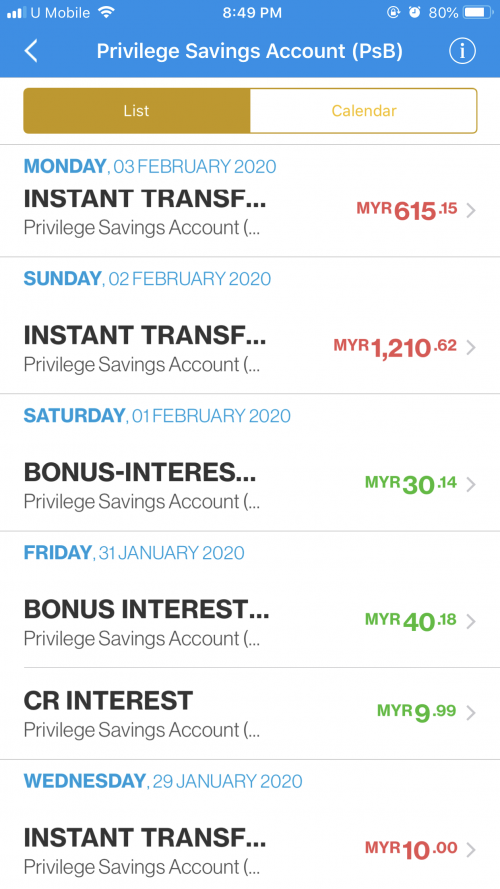

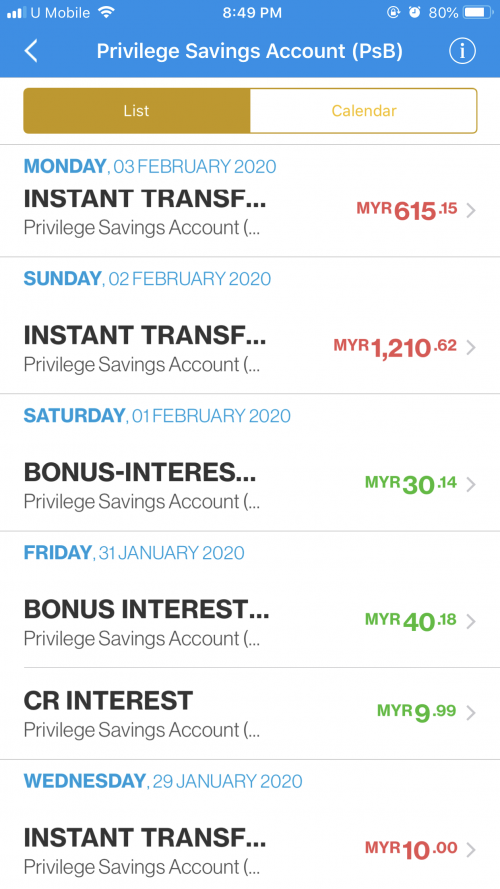

Card Spend bonus interest of 1.5% are in!

|

|

|

|

|

|

GrumpyNooby

|

Mar 2 2020, 09:06 PM Mar 2 2020, 09:06 PM

|

|

QUOTE(David_Yang @ Mar 2 2020, 09:06 PM) What you meant by "not here"? 02/03/2020 BONUS-INTEREST-CARD SPEND This post has been edited by GrumpyNooby: Mar 2 2020, 09:19 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 2 2020, 10:18 PM Mar 2 2020, 10:18 PM

|

|

QUOTE(David_Yang @ Mar 2 2020, 10:14 PM) I not have this. Maybe because debit card and not credit card? This one is given upon fulfilling credit card spending of min RM 1k  This post has been edited by GrumpyNooby: Mar 3 2020, 07:49 AM This post has been edited by GrumpyNooby: Mar 3 2020, 07:49 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 3 2020, 07:13 AM Mar 3 2020, 07:13 AM

|

|

QUOTE(MGM @ Mar 3 2020, 03:53 AM) Super salary-I also enjoys the same bonus interests? Payment of bonus rate for Card Spent & Wealth categories may be made via SuperSalary-i account https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfI believe so. |

|

|

|

|

|

GrumpyNooby

|

Mar 3 2020, 06:19 PM Mar 3 2020, 06:19 PM

|

|

QUOTE(MGM @ Mar 3 2020, 06:07 PM) After checking my statement, mine is actually Super Salary (Payroll) Account, not the islamic one. Similar benefits? I think no Eligibility4. This Campaign is open to existing and new customers with Privilege Savings Account and Super Salary-i (Payroll) (“Super Salary-i”) (“Promotion Account”) effective from 1 February 2020) who have maintained their accounts (all accounts with SCBMB and SCSB including but not limited to the Privilege Savings Account, Super Salary-i and credit card account(s)) in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. The Super Salary-i account is based on the Shariah concept of Tawarruq. (hereinafter referred to as “Eligible Accountholders”) https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfEven Super Salary-i has 2 variant Super Salary-i (EB) and Super Salary-i (Payroll). |

|

|

|

|

|

GrumpyNooby

|

Mar 3 2020, 06:32 PM Mar 3 2020, 06:32 PM

|

|

QUOTE(Eurobeater @ Mar 3 2020, 06:30 PM) Just a heads up that BNM has just cut the OPR by another 0.25%. Expect SCB to amend the TnC of this product soon. They didn't do that during the January 2020 revision. This post has been edited by GrumpyNooby: Mar 3 2020, 06:33 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 5 2020, 03:36 PM Mar 5 2020, 03:36 PM

|

|

QUOTE(David_Yang @ Mar 5 2020, 03:29 PM) Somewhere I read that Debit card also qualifies (like with OCBC), but I cannot find anymore. I don't know. Please call CS or your banker to clarify. The word debit card doesn't appear in the TnC except for Clause 15 of the need to tie the account to a debit card. https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfThis post has been edited by GrumpyNooby: Mar 5 2020, 05:00 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 6 2020, 08:59 AM Mar 6 2020, 08:59 AM

|

|

QUOTE(bokbokchai @ Mar 6 2020, 08:59 AM) Roughly how much cash to open this account ya? It didn't say. Just bring RM 250 for safe. |

|

|

|

|

|

GrumpyNooby

|

Mar 6 2020, 09:46 AM Mar 6 2020, 09:46 AM

|

|

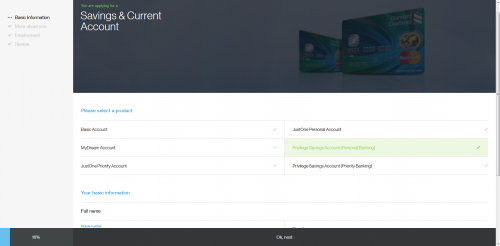

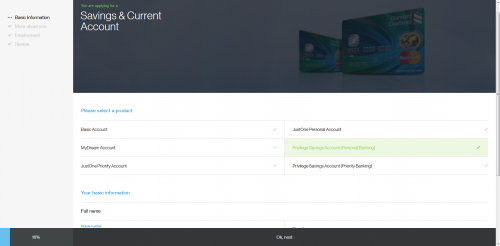

QUOTE(ckh6003 @ Mar 6 2020, 09:45 AM) Just curious, can we open a/c via online ?  I guess you're just making an appointment to the nearest branch. You still need to do biometric verification with your NRIC. This post has been edited by GrumpyNooby: Mar 6 2020, 09:47 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 7 2020, 11:06 PM Mar 7 2020, 11:06 PM

|

|

QUOTE(westernkl @ Mar 7 2020, 11:06 PM) Overnight Policy Rate governed by Bank Negara Malaysia |

|

|

|

|

|

GrumpyNooby

|

Mar 7 2020, 11:53 PM Mar 7 2020, 11:53 PM

|

|

Additional reading: OPR down to 2.5% for first time in a decade https://www.theedgemarkets.com/article/opr-...rst-time-decade |

|

|

|

|

|

GrumpyNooby

|

Mar 9 2020, 07:14 AM Mar 9 2020, 07:14 AM

|

|

QUOTE(kart @ Mar 9 2020, 06:06 AM) If I choose not to get SC Debit Card, am I still eligible to get the additional Save Interest of 2%, assuming that I will deposit RM 3000 once per month via IBFT into my Privilege$aver savings account? Thank you for your information.  No as per TnC - Clause 15. https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfThis post has been edited by GrumpyNooby: Mar 9 2020, 07:16 AM |

|

|

|

|

Feb 26 2020, 11:33 AM

Feb 26 2020, 11:33 AM

Quote

Quote

0.0502sec

0.0502sec

1.58

1.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled