Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Jun 1 2020, 12:51 PM Jun 1 2020, 12:51 PM

|

|

QUOTE(cclim2011 @ Jun 1 2020, 12:46 PM) aiya. my boost transaction 1k on saturday still unposted... Very likely, you won't be getting the Card Spend Bonus Interest: QUOTE In determining whether the minimum card spend has been fulfilled for the relevant calendar month, the Retail Spend charged to the qualifying SCBMB Credit Card will be consolidated based on the transaction posting date. https://av.sc.com/my/content/docs/campaign-tc-psa.pdf |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 01:31 PM Jun 1 2020, 01:31 PM

|

|

QUOTE(joshtlk1 @ Jun 1 2020, 01:28 PM) Hi I have a privilege savers account with SC. But when I applied last time, I got rejected for their credit card. Now I would want to apply for their credit card again, can I just apply for any of their credit card and it will be linked to the SC privilege account? Or is it just specific cards? QUOTE Card SpendBonus Interest Rate on credit card spend is applicable to all SCBMB credit cards (“qualifying SCBMB Credit Card”). https://av.sc.com/my/content/docs/campaign-tc-psa.pdf They didn't listen down; should be most of their credit cards except those business cards (I guess). This post has been edited by GrumpyNooby: Jun 1 2020, 01:31 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 06:11 PM Jun 1 2020, 06:11 PM

|

|

QUOTE(GrumpyNooby @ Jun 1 2020, 07:09 AM) Guys, Base Interest and Save Bonus Interest for May 2020 are in. Card Spend Bonus Interest for May 2020 is expected to be credited by end of today (first working day of the following month) as per product T&C.  Card Spend Bonus Interest for May 2020 is in! |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 06:41 PM Jun 1 2020, 06:41 PM

|

|

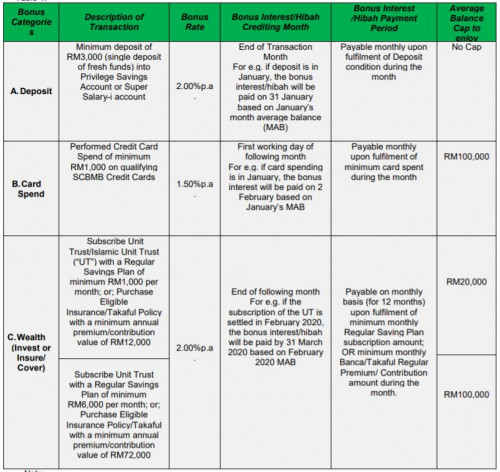

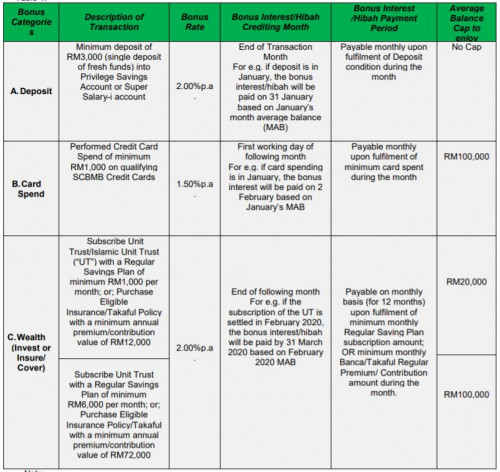

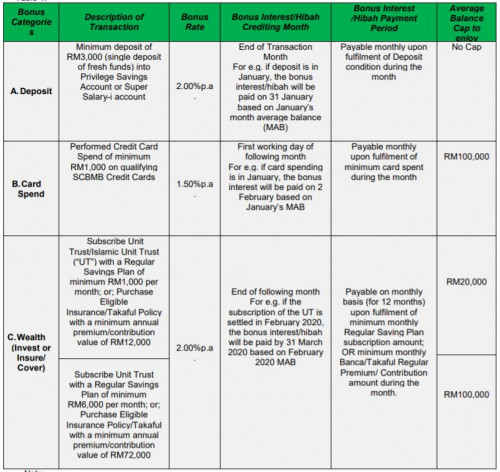

QUOTE(ncool15 @ Jun 1 2020, 06:37 PM) Guys, i got this Privelege saver account debit card in November 2019. So do i just transfer in rm3000 to thr account monthly to enjoy 2% interest PA? Also how does the investing works? Appreciate any help. 2.1% pa to be exact. For the Invest Bonus Interest of 2% pa, you need to buy qualified UT with monthly topup of RM 1k or insurance policy with annual premium of RM 12k. The bonus interest is only applicable to first RM 20k of MAB in your PSA.  T&C: https://av.sc.com/my/content/docs/campaign-tc-psa.pdf |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 08:48 PM Jun 1 2020, 08:48 PM

|

|

QUOTE(cclim2011 @ Jun 1 2020, 07:15 PM) i got it. 1k transaction unposted yet (shown unposted). but before opening the psa i did other spending. so not sure which qualified me to the card spend bonus. but number a bit weird. I have base 0.6, card spend 11.53, saving 12.13 11.53 is a bit weird. shouldnt it be ~9.07 my three days balances is 61k, 80k, 80.5k. average 73833.3. I went to double check the calculation and you're right that the Card Spend Bonus Interest is more than what I calculated. Yours is 27.12% more than entitlement and mine is 26.67% more I tried to play with the numbers in Excel and the Card Spend Bonus Interest Rate is at 1.9% pa (0.4% pa more). Not sure if it's an error in their system because of the 0.4% reduction in the base interest rate recently. So coincident! This post has been edited by GrumpyNooby: Jun 1 2020, 08:50 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 1 2020, 09:22 PM Jun 1 2020, 09:22 PM

|

|

QUOTE(cclim2011 @ Jun 1 2020, 09:21 PM) oh really... i see. let's see if they retract They may issue an adjustment entry. Who knows! By the way, your May MAB is RM 7145.16129 not RM 73833.3 (as in your earlier post). |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 07:29 AM Jun 2 2020, 07:29 AM

|

|

QUOTE(mitodna @ Jun 2 2020, 07:26 AM) new to this account (less than 1 month), didn't get the deposit bonus, saw the card spend bonus, is it it will credit later or i just missed the criteria? thank you. Did you deposit in min RM 3k as single deposit of fresh funds from other bank in the month of May? The Deposit or Save Bonus Interest is credited in on the same day as Base Interest. This post has been edited by GrumpyNooby: Jun 2 2020, 07:39 AM |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 08:51 AM Jun 2 2020, 08:51 AM

|

|

QUOTE(datolee32 @ Jun 2 2020, 08:46 AM) I saw there is hibah and hibah bonus in my account, may i know what are them refer to? Hibah is Islamic Banking term for interest. Your account is Super Salary-i (Payroll) from SC Saadiq. This post has been edited by GrumpyNooby: Jun 2 2020, 08:51 AM |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 08:59 AM Jun 2 2020, 08:59 AM

|

|

QUOTE(datolee32 @ Jun 2 2020, 08:54 AM) I see, is Hibah and Hibah bonus refer to the saving 0.1% interest? Hibah should be Base Interest (0.1%) Hibah Bonus For The Month XXXX should be Deposit or Save Bonus Interest (2%) Bonus-Hibah-Card Spend should be Card Spend Bonus Interest (1.5%) |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 10:10 AM Jun 2 2020, 10:10 AM

|

|

QUOTE(LostAndFound @ Jun 2 2020, 10:07 AM) My descriptions with a Saddiq account look like this:- HIBAH CREDIT - 0.1% BONUS HIBAH FOR THE MONTH 0520 - 2% BONUS INTEREST-CARD SPEND - 1.9% (dunno where the 0.4% came from this month) Surprised to see Interest word there, checked back even past month also had the same description. Haram wei =p Obviously you're accurate since you're holding that account. I was merely giving him a rough idea of what to expect from the transaction description. |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 10:24 PM Jun 2 2020, 10:24 PM

|

|

QUOTE(datolee32 @ Jun 2 2020, 10:20 PM) Hi all. Wanna check the interest calculation of this account, if i transfer fresh fund by mid of the month, the interest calculation start from 1st day or the day after I transfer fresh fund? The system needs to compute MAB of the month. MAB = sum of daily balance of the day (cut off time is midnight) divided by number of days of the month |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 10:59 PM Jun 2 2020, 10:59 PM

|

|

QUOTE(datolee32 @ Jun 2 2020, 10:56 PM) Thank you for your reply. As long as I transfer 3k fresh fund in any date of the calendar month, the MAB interest will start counting by the 1st day of the month right? MAB starts from 1st till last day of the month. FF of RM 3k must reach in any day of the month. The earlier the better as your MAB will be higher. Base interest and bonus interest are applied on the MAB of the month. |

|

|

|

|

|

GrumpyNooby

|

Jun 2 2020, 11:32 PM Jun 2 2020, 11:32 PM

|

|

QUOTE(cclim2011 @ Jun 2 2020, 11:30 PM) hi for fresh fund... i always have doubts. say i instant transfer out today 15k to pay credit cards of other banks. then mid of the month i transfer 3k in. is that fresh fund? or must be 15k + 3k = 18k? thanks. RM 3k only. |

|

|

|

|

|

GrumpyNooby

|

Jun 3 2020, 06:55 AM Jun 3 2020, 06:55 AM

|

|

Use back May 2020 as an example: QUOTE Case 1 with MAB of above RM 100k

If your opening balance on the 1st (end day) is RM 100000 and you deposit RM 3k on 2nd, your MAB is RM 102903.2258

If your opening balance on the 1st (end day) is RM 100000 and you deposit RM 3k on 31st, your MAB is RM 100096.7742

So, your base interest and deposit bonus interest will be calculated based on the MAB which is no cap. Difference of interest earned is RM 5.00

But your card spend bonus interest will be capped on the 1st RM 100k, so it won't have effect for MAB above RM 100k.

Case 2 with MAB of below RM 100k

If your opening balance on the 1st (end day) is RM 50000 and you deposit RM 3k on 2nd, your MAB is RM 52903.22581

If your opening balance on the 1st (end day) is RM 50000 and you deposit RM 3k on 31st, your MAB is RM 50096.77419

So, your base interest and deposit bonus interest will be calculated based on the MAB which is no cap. Difference of interest earned is still RM 5.00

As for your card spend bonus interest, the difference of interest earned will be RM 3.58

Total in difference of interest earned will be RM 8.58 Above scenarios are only true if and only if that there's no other transaction happened in between 3rd to 31st and your account activity is static. Correct me if my calculation is wrong. This post has been edited by GrumpyNooby: Jun 3 2020, 08:26 AM |

|

|

|

|

|

GrumpyNooby

|

Jun 5 2020, 10:03 AM Jun 5 2020, 10:03 AM

|

|

QUOTE(7498 @ Jun 5 2020, 09:59 AM) Hi, I am new to this account. Would like to ask, to be qualified of the 2% deposit bonus interest, I need to deposit min 3k fresh fund into this account every month? Since I don't have 3k savings per month, can I deposit 10k the first month, end of first month I withdraw 3k and deposit back in the 2nd month to get the 2% bonus interest in 2nd month? Would like to ask, to be qualified of the 2% deposit bonus interest, I need to deposit min 3k fresh fund into this account every month? Yes, min RM 3k as in FF from other banksSince I don't have 3k savings per month, can I deposit 10k the first month, end of first month I withdraw 3k and deposit back in the 2nd month to get the 2% bonus interest in 2nd month? Yes, ensure that the RM 3k comes from other banks as FF |

|

|

|

|

|

GrumpyNooby

|

Jun 5 2020, 10:43 PM Jun 5 2020, 10:43 PM

|

|

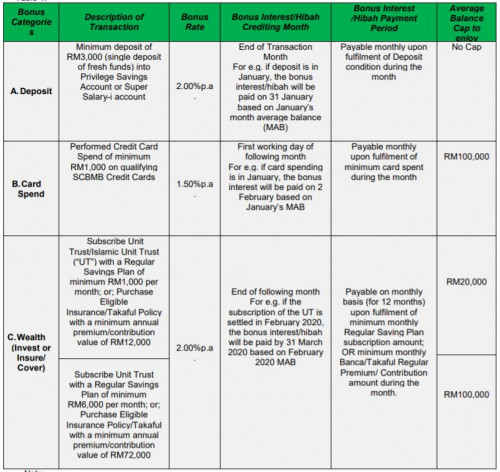

QUOTE(tiramisu83 @ Jun 5 2020, 10:41 PM) hi all, is the daily interest credit into account everyday or only credit at the end of the month in one shot?  Refer to the table to understand when each category of interest will be credited into account. |

|

|

|

|

|

GrumpyNooby

|

Jun 7 2020, 08:04 AM Jun 7 2020, 08:04 AM

|

|

QUOTE(cclim2011 @ Jun 7 2020, 01:11 AM) FF = fresh fund? if come from other bank, under what condition it is not considered FF? Within same day? Thanks. If you transferred within accounts under SC and SC Saadiq, it is not considered as fresh fund. Alternatively, you can make a single deposit of RM 3k with cash at SC or SC Saadiq branches OTC or using CDM/CRM. That will be counted as FF. This post has been edited by GrumpyNooby: Jun 7 2020, 08:33 AM |

|

|

|

|

|

GrumpyNooby

|

Jun 13 2020, 04:35 PM Jun 13 2020, 04:35 PM

|

|

QUOTE(datolee32 @ Jun 13 2020, 04:26 PM) Hi, I would like to ask about monthly average balance calculation. If i deposit RM 1k at 11pm tonight, interest from RM1k count today or tomorrow? Should be today. Somebody mentioned that the cut off time of the day is midnight strike. |

|

|

|

|

|

GrumpyNooby

|

Jun 13 2020, 04:42 PM Jun 13 2020, 04:42 PM

|

|

QUOTE(Anangie @ Jun 13 2020, 04:26 PM) I have performed the credit card payment last month. PSA account money was deducted but found that the money is not credited into cr card on same day. But you credit card credit limit will be updated once the payment has made from your PSA account?  |

|

|

|

|

|

GrumpyNooby

|

Jun 13 2020, 04:48 PM Jun 13 2020, 04:48 PM

|

|

QUOTE(Anangie @ Jun 13 2020, 04:46 PM) I did not checked on credit card limit. As i perform future date payment (which is on credit card due date) and i checked on that day, found that the payment yet credited into cc, the payment was only reflected after that, but not in same day. I believe so. If I remember correctly, even you pay using Instant Fund Transfer/DuitNow from other bank, the online ledger isn't updated immediately right? But your credit limit will be reflected after payment made. |

|

|

|

|

Jun 1 2020, 12:51 PM

Jun 1 2020, 12:51 PM

Quote

Quote

0.0288sec

0.0288sec

1.10

1.10

7 queries

7 queries

GZIP Disabled

GZIP Disabled