Outline ·

[ Standard ] ·

Linear+

Opus Touch, Self-Service UT Platform

|

GrumpyNooby

|

Aug 12 2020, 10:15 AM Aug 12 2020, 10:15 AM

|

|

QUOTE(majorarmstrong @ Aug 12 2020, 10:13 AM) i thought that is the rule? even now i am puzzle i follow @TS saja like i said i am completely new to this this week is my 2.5 weeks old in Opus Did he say he is going to buy back today?  |

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 10:57 AM Aug 12 2020, 10:57 AM

|

|

QUOTE(tan_aniki @ Aug 12 2020, 10:55 AM) yes, i'm buying back ppl still thinking ding dong will make a loss but they haven't really study into it yet OK, it's a sign to go in again!  |

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 07:54 PM Aug 12 2020, 07:54 PM

|

|

QUOTE(ironman16 @ Aug 12 2020, 07:50 PM) if like this u loss the sales charge already lo?  Bond fund normally won't have sales charge or very low sales charge. |

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 07:57 PM Aug 12 2020, 07:57 PM

|

|

QUOTE(vanitas @ Aug 12 2020, 07:56 PM) Also, switch or not also pay (if any) sales charge already. So sales charge is not the concern here, but I don't see any meaning of switching. PBOND is with Public Mutual. So he is transferring from Public Mutual to one of the wholesales fund in Opus. This post has been edited by GrumpyNooby: Aug 12 2020, 08:01 PM |

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 08:07 PM Aug 12 2020, 08:07 PM

|

|

QUOTE(vanitas @ Aug 12 2020, 08:02 PM) Yes, or can simply sell all at PM and buy again from Opus. Either way, sales charge is not a concern, as the transfer doesn't impose any fee. But this is quite meaningless unless uncle want to play withdrawal and top up game. I have no idea why he wanted to do so as if the wholesales fund recommended by Opus can generate skyrocketing double digit return in short period. This post has been edited by GrumpyNooby: Aug 12 2020, 08:08 PM |

|

|

|

|

|

GrumpyNooby

|

Aug 13 2020, 08:54 AM Aug 13 2020, 08:54 AM

|

|

IPF up 0.0005

SIPF up 0.0003

|

|

|

|

|

|

GrumpyNooby

|

Aug 13 2020, 03:32 PM Aug 13 2020, 03:32 PM

|

|

QUOTE(CSW1990 @ Aug 13 2020, 03:28 PM) I was going to register in Opus to top up for the Boost misson. any invitation code recommended? or should I just put blank at there No referral code for Opus. |

|

|

|

|

|

GrumpyNooby

|

Aug 14 2020, 09:41 AM Aug 14 2020, 09:41 AM

|

|

IPF dropped 0.0012

SIPF no change

|

|

|

|

|

|

GrumpyNooby

|

Aug 14 2020, 09:55 AM Aug 14 2020, 09:55 AM

|

|

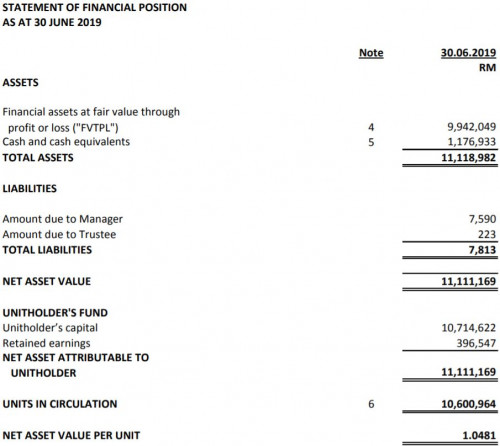

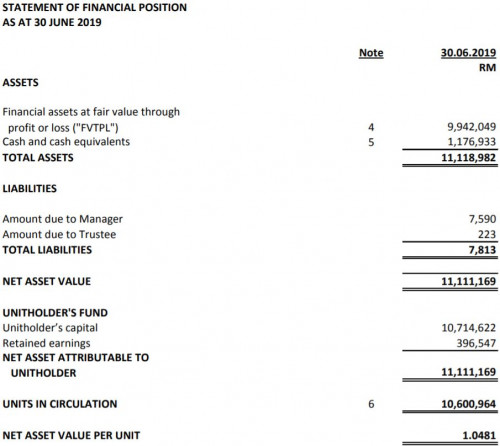

QUOTE(rojakwhacker @ Aug 14 2020, 09:52 AM) Just wonder if the number of asset can be a factor in affecting the drop? Total Assets (M MYR) (On 08/12/2020)29.622 https://www.bloomberg.com/quote/OPUSIPF:MKPart of the equation only:  |

|

|

|

|

|

GrumpyNooby

|

Aug 14 2020, 03:41 PM Aug 14 2020, 03:41 PM

|

|

Malaysia bonds blow past peers as rate cuts power rallySINGAPORE/KUALA LUMPUR (Aug 14): Malaysia’s bonds have been the star performers in emerging Asia this quarter thanks to a succession of interest-rate cuts. Stubborn deflation and a shrinking economy mean there may be more to come. Traders are betting Bank Negara Malaysia will lower borrowing costs for a fifth straight meeting in September after reducing its benchmark by a combined 125 basis points this year. Other positives powering the bond rally include a surge in foreign inflows and among the highest real yields in the region. https://www.theedgemarkets.com/article/mala...uts-power-rally

|

|

|

|

|

|

GrumpyNooby

|

Aug 19 2020, 10:45 AM Aug 19 2020, 10:45 AM

|

|

QUOTE(majorarmstrong @ Aug 19 2020, 10:29 AM) move to DIF for the pass 3 days no movement or MPF All IPF moved to DIF? Return so far superb? |

|

|

|

|

|

GrumpyNooby

|

Aug 19 2020, 12:58 PM Aug 19 2020, 12:58 PM

|

|

QUOTE(skl097 @ Aug 19 2020, 09:34 AM) wait for OPR. if next month further drop in OPR, then IPF will up record high... KUALA LUMPUR (Aug 19): Bank Negara Malaysia (BNM) may cut the overnight policy rate (OPR) to 1.50% by end of this year as Malaysian Government Securities' (MGS) yields fall to record lows amid the abundance of global liquidity, according to RAM Rating Services Bhd. RAM economist Woon Khai Jhek wrote in a note today RAM expects domestic bond yields to stay suppressed amid the abundance of global liquidity and that RAM is not discounting another round of OPR cuts by BNM. "We think (the) OPR could possibly end 2020 at 1.50%,” Woon said. https://www.theedgemarkets.com/article/bnm-...w-%E2%80%94-ram |

|

|

|

|

|

GrumpyNooby

|

Aug 19 2020, 06:31 PM Aug 19 2020, 06:31 PM

|

|

QUOTE(majorarmstrong @ Aug 19 2020, 06:30 PM) I did not movr I meant to ask you guys to move since dif don't have much action I have no privilege to move into DIF. Only SIPF and MPF (which I have no interest at all). |

|

|

|

|

|

GrumpyNooby

|

Aug 20 2020, 05:55 AM Aug 20 2020, 05:55 AM

|

|

QUOTE(tadashi987 @ Aug 20 2020, 12:08 AM) MPF isn't bad, in fact comparable with Stashaway simple - EIB islamic income fund  Stashaway simple - EIB islamic income fund might be slight better in performance and more stable but MPF withdrawal time is much more efficient Simple™ and MMF both are not in my radar. I'm looking beyond money market fund. |

|

|

|

|

|

GrumpyNooby

|

Aug 20 2020, 01:46 PM Aug 20 2020, 01:46 PM

|

|

QUOTE(majorarmstrong @ Aug 20 2020, 11:56 AM) Not within Opus. Explore FSM thread. |

|

|

|

|

|

GrumpyNooby

|

Aug 21 2020, 08:43 AM Aug 21 2020, 08:43 AM

|

|

Announcement

Due to a scheduled maintenance, Opus Touch will be unavailable from 21-08-2020 8:00AM until 21-08-2020 10:00AM

|

|

|

|

|

|

GrumpyNooby

|

Aug 24 2020, 09:31 AM Aug 24 2020, 09:31 AM

|

|

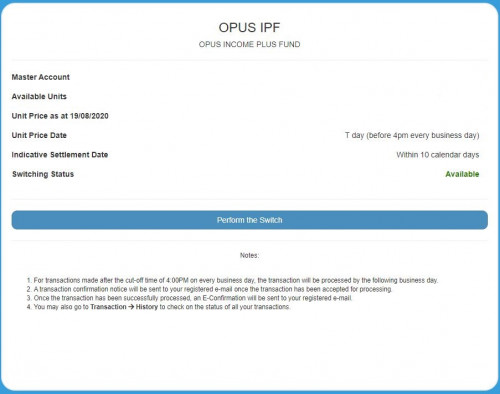

QUOTE(leo_kiatez @ Aug 24 2020, 09:30 AM) What is the benefit for performing fund switching within OT? Previously if you want to switching for Opus funds, you need to do it offline; manual forms filling and contact Opus CS. |

|

|

|

|

|

GrumpyNooby

|

Aug 24 2020, 12:03 PM Aug 24 2020, 12:03 PM

|

|

QUOTE(majorarmstrong @ Aug 24 2020, 12:01 PM) i see IPF today also boring la SIPF lagi boring, up sikit turun banyak If boring, then withdrawal all. |

|

|

|

|

|

GrumpyNooby

|

Aug 24 2020, 12:17 PM Aug 24 2020, 12:17 PM

|

|

QUOTE(majorarmstrong @ Aug 24 2020, 12:15 PM) i think the other way round i am thinking of put more boring with 20k i put 200k then see got boring or not Percentage wise is the same. I'm not sure what kind of "excitement" are you hoping to see from fixed income or bond funds. |

|

|

|

|

Aug 12 2020, 10:15 AM

Aug 12 2020, 10:15 AM

Quote

Quote

0.0810sec

0.0810sec

0.99

0.99

7 queries

7 queries

GZIP Disabled

GZIP Disabled