QUOTE(majorarmstrong @ Aug 24 2020, 03:52 PM)

Obviously that person is you.You said want to raise your amount from 20k to 200k, then you may feel the "kick".

Opus Touch, Self-Service UT Platform

|

|

Aug 24 2020, 04:41 PM Aug 24 2020, 04:41 PM

Return to original view | IPv6 | Post

#301

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Aug 24 2020, 04:53 PM Aug 24 2020, 04:53 PM

Return to original view | IPv6 | Post

#302

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Aug 24 2020, 04:51 PM) i really saja see see look look apa fund they have You mentioned before that you want to try here, try there.so far i also dont know why they want to create so many type of fund basically almost the same thing lo their exposure almost all same same not much different from IPF Maybe you try first and share us your experience. |

|

|

Aug 24 2020, 06:33 PM Aug 24 2020, 06:33 PM

Return to original view | IPv6 | Post

#303

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 26 2020, 05:39 AM Aug 26 2020, 05:39 AM

Return to original view | IPv6 | Post

#304

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 26 2020, 06:46 PM Aug 26 2020, 06:46 PM

Return to original view | IPv6 | Post

#305

|

|||||||||||||||||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

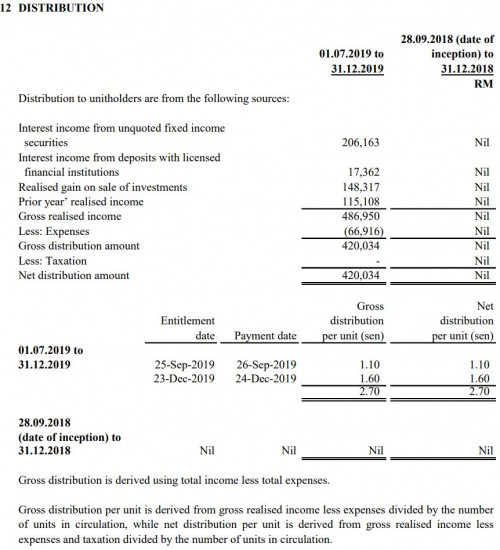

Distribution declared:

|

|||||||||||||||||||||||||

|

|

Aug 26 2020, 07:59 PM Aug 26 2020, 07:59 PM

Return to original view | IPv6 | Post

#306

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Aug 26 2020, 09:14 PM Aug 26 2020, 09:14 PM

Return to original view | IPv6 | Post

#307

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Aug 26 2020, 09:11 PM) i am still very noob when come to income distribution Are you sure of this?to me i see got distribute no distribute is the same thing after distribute price drop so it is like same same You have been asking and talking about distribution for weeks. This post has been edited by GrumpyNooby: Aug 26 2020, 09:18 PM |

|

|

Aug 27 2020, 05:21 AM Aug 27 2020, 05:21 AM

Return to original view | IPv6 | Post

#308

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(yklooi @ Aug 27 2020, 03:50 AM) YES, that is very true for the amount of money you have in a UT fund before or after distribution is (about) the same. I'm not going to explain anymore.This is NOT correct....as after the dust of the distribution had been settled,...any movement in the NAV will affect the total amount of money in your UT fund. if the next day, the NAV drops 0.9% your money will be impacted by 0.9% also if the next day, the NAV rises 0.1%, your money will be impacted by 0.1% also (as after the dust of the distribution had been settled, the amount of money you have in a UT fund before or after distribution is (about) the same.) I had explained many many times including examples quoted from experts at other fund houses. |

|

|

Aug 27 2020, 10:48 AM Aug 27 2020, 10:48 AM

Return to original view | Post

#309

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(AnasM @ Aug 27 2020, 10:41 AM) Assume IPF have total fund size of RM 1000, with RM 10 per unit so total 100 unit. Distribution that you received is nett and you're not required to pay income tax for it.If IPF want to declare dividend of RM 1 per unit. Does it mean after distribution, the total fund size will be RM 1000 also?(assuming the bond price is static not moving) So u mean that IPF no need to give tax to government for the dividend distribution? This post has been edited by GrumpyNooby: Aug 27 2020, 10:48 AM |

|

|

Aug 27 2020, 12:31 PM Aug 27 2020, 12:31 PM

Return to original view | Post

#310

|

All Stars

12,387 posts Joined: Feb 2020 |

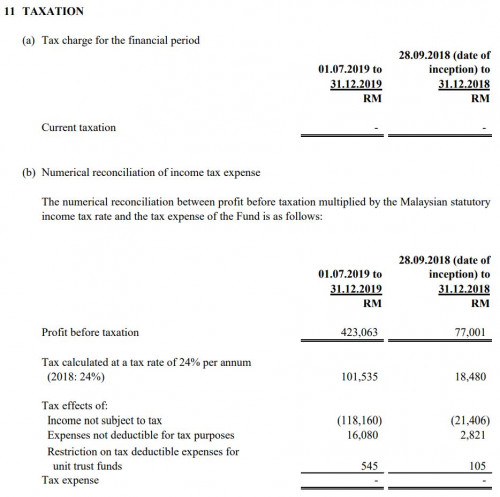

From IPF semi-annual report: FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019 Whether the fund pays taxes to the government or not:  And distribution declared by the fund:  If got time, do dig the annual or semi-annual report: https://www.opusasset.com/wp-content/upload...v=1598497343409 funboy555 liked this post

|

|

|

Aug 27 2020, 02:22 PM Aug 27 2020, 02:22 PM

Return to original view | Post

#311

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 28 2020, 09:20 AM Aug 28 2020, 09:20 AM

Return to original view | Post

#312

|

All Stars

12,387 posts Joined: Feb 2020 |

For 2 days, both IPF and SIPF dropped a lot:

IPF: 1.0976 -> 1.0925 (-0.46%) SIPF: 1.0504 -> 1.0474 (-0.29%) |

|

|

Aug 28 2020, 09:23 AM Aug 28 2020, 09:23 AM

Return to original view | Post

#313

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Aug 28 2020, 10:05 AM Aug 28 2020, 10:05 AM

Return to original view | Post

#314

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 28 2020, 10:07 AM Aug 28 2020, 10:07 AM

Return to original view | Post

#315

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 28 2020, 10:09 PM Aug 28 2020, 10:09 PM

Return to original view | IPv6 | Post

#316

|

All Stars

12,387 posts Joined: Feb 2020 |

SIPF: 1.0474 -> 1.0456 (-0.17%)

|

|

|

Aug 31 2020, 06:48 PM Aug 31 2020, 06:48 PM

Return to original view | IPv6 | Post

#317

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(iqlas @ Aug 31 2020, 06:41 PM) If i understand correctly, transfer fee= withdrawal fee? If you're selling the fund, the process is called redemption.So let say i have rm5k in mpf and withdraw it to maybank account, the fee is rm5 ringgit right? Most of the funds have no redemption fee and proceeds from selling fund is usually fund transfer to nominated bank account. iqlas liked this post

|

|

|

Aug 31 2020, 07:28 PM Aug 31 2020, 07:28 PM

Return to original view | IPv6 | Post

#318

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Aug 31 2020, 07:07 PM) Transfer is normally holdings tansfer to and from another fund house.It could be either transfer in or tranafer out. iqlas liked this post

|

|

|

Sep 1 2020, 09:17 AM Sep 1 2020, 09:17 AM

Return to original view | Post

#319

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV for 31/08/2020:

IPF: 1.0908 (+0.0003) SIPF: 1.0459 (+0.0003) |

|

|

Sep 1 2020, 02:37 PM Sep 1 2020, 02:37 PM

Return to original view | Post

#320

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.0850sec 0.0850sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 03:13 PM |