Outline ·

[ Standard ] ·

Linear+

Opus Touch, Self-Service UT Platform

|

TStan_aniki

|

Jul 22 2020, 09:52 PM Jul 22 2020, 09:52 PM

|

|

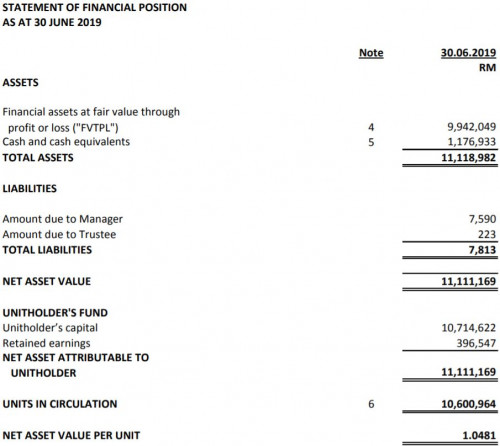

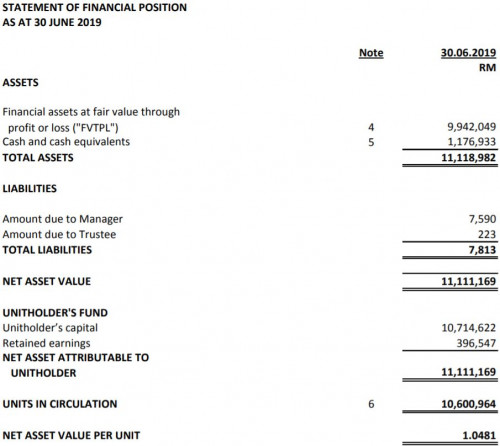

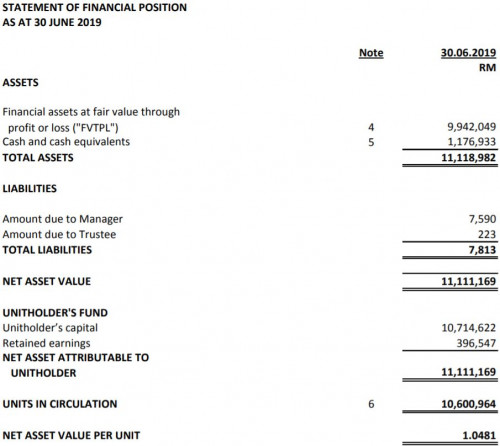

QUOTE(GrumpyNooby @ Jul 22 2020, 09:20 PM) It is all in the fund annual or semi-annual report: Example for IPF:  IPF Annual Report: https://www.opusasset.com/wp-content/upload...v=1595423869922basically NAV = [Assets (Total value after investment) - Liabilities (Management Fee)] / Units in Circulation (Total units bought by us) |

|

|

|

|

|

majorarmstrong

|

Jul 22 2020, 11:43 PM Jul 22 2020, 11:43 PM

|

|

question - after income distribution, will NAV drop?

let us just say in circulation now there is 100

then NAV = 1.00

income distribution 0.01

so now after income distribution how may in ciruclation? still 100?

Also NAV become 1.01?

|

|

|

|

|

|

RickRick88

|

Jul 23 2020, 12:01 AM Jul 23 2020, 12:01 AM

|

|

QUOTE(majorarmstrong @ Jul 22 2020, 11:43 PM) question - after income distribution, will NAV drop? let us just say in circulation now there is 100 then NAV = 1.00 income distribution 0.01 so now after income distribution how may in ciruclation? still 100? Also NAV become 1.01? If everyone choose to withdraw, the cash in the fund will reduce by 1.00 (0.01 x 100 units). Asset becomes 99, unit in circulation remains at 100 (no redemption), assuming no liability / management fee, then the NAV is 99 / 100 = 0.99. |

|

|

|

|

|

majorarmstrong

|

Jul 23 2020, 09:40 AM Jul 23 2020, 09:40 AM

|

|

Tak boleh masuk

This post has been edited by majorarmstrong: Jul 23 2020, 09:40 AM

|

|

|

|

|

|

majorarmstrong

|

Jul 23 2020, 09:41 AM Jul 23 2020, 09:41 AM

|

|

Today totally cannot login

Like stuck there

|

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 09:41 AM Jul 23 2020, 09:41 AM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 09:40 AM) I just logged in and updated my spreadsheet 15 to 30 mins ago. |

|

|

|

|

|

TStan_aniki

|

Jul 23 2020, 09:43 AM Jul 23 2020, 09:43 AM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 09:41 AM) Today totally cannot login Like stuck there i can login and updated the NAV on 1st post still waiting for SST NAV since i didn't buy that yet ok updated This post has been edited by tan_aniki: Jul 23 2020, 10:05 AM |

|

|

|

|

|

majorarmstrong

|

Jul 23 2020, 11:45 AM Jul 23 2020, 11:45 AM

|

|

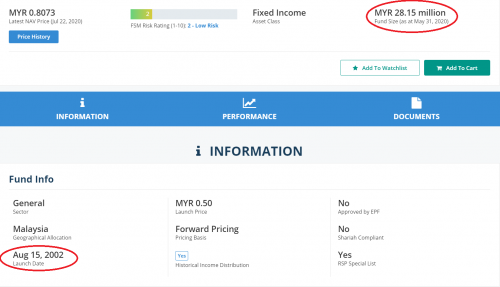

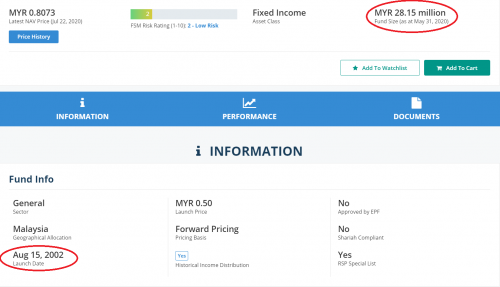

i notice that the fund size for Opus is quite small  |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 11:56 AM Jul 23 2020, 11:56 AM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 11:45 AM) i notice that the fund size for Opus is quite small  IPF is launched on 28 September 2018 Less than 2 years old only. |

|

|

|

|

|

funboy555

|

Jul 23 2020, 12:04 PM Jul 23 2020, 12:04 PM

|

Getting Started

|

QUOTE(majorarmstrong @ Jul 23 2020, 11:45 AM) i notice that the fund size for Opus is quite small   I think their fund growth in terms of AUM and performance are quite good. this one extract from one fund in FSM, 18 years also never grow. Looking at Opus Wholesales Fund, some also quite big AUM size. Just give them some times to grow. |

|

|

|

|

|

ironman16

|

Jul 23 2020, 12:39 PM Jul 23 2020, 12:39 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 11:45 AM) i notice that the fund size for Opus is quite small  Size mereka kecil tp bo tumpang kereta dgn wholesale fund ma, got sikit ikan bilis to eat. |

|

|

|

|

|

majorarmstrong

|

Jul 23 2020, 01:42 PM Jul 23 2020, 01:42 PM

|

|

QUOTE(ironman16 @ Jul 23 2020, 12:39 PM) Size mereka kecil tp bo tumpang kereta dgn wholesale fund ma, got sikit ikan bilis to eat. Betul betul For ipf perlu dca? Like weekly rm200? |

|

|

|

|

|

TStan_aniki

|

Jul 23 2020, 01:54 PM Jul 23 2020, 01:54 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 01:42 PM) Betul betul For ipf perlu dca? Like weekly rm200? no need, you want in in out out everyday or do nothing also can |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 02:00 PM Jul 23 2020, 02:00 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 01:42 PM) Betul betul For ipf perlu dca? Like weekly rm200? QUOTE(majorarmstrong @ Jul 22 2020, 09:59 PM) so kantoi la for Opus IPF perlu jual semua ka? Yesterday night just asked if want to cash out all. Now DCA pulak?  |

|

|

|

|

|

ironman16

|

Jul 23 2020, 02:20 PM Jul 23 2020, 02:20 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 01:42 PM) Betul betul For ipf perlu dca? Like weekly rm200? FI very stable, lump sum or dca oso same. Unless kena mcm covid masa march itu, semua drop la |

|

|

|

|

|

majorarmstrong

|

Jul 23 2020, 03:41 PM Jul 23 2020, 03:41 PM

|

|

QUOTE(ironman16 @ Jul 23 2020, 02:20 PM) FI very stable, lump sum or dca oso same. Unless kena mcm covid masa march itu, semua drop la faham |

|

|

|

|

|

funboy555

|

Jul 23 2020, 05:08 PM Jul 23 2020, 05:08 PM

|

Getting Started

|

QUOTE(ironman16 @ Jul 23 2020, 02:20 PM) FI very stable, lump sum or dca oso same. Unless kena mcm covid masa march itu, semua drop la Sorry what is DCA means? |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 05:09 PM Jul 23 2020, 05:09 PM

|

|

QUOTE(funboy555 @ Jul 23 2020, 05:08 PM) Dollar-cost averaging: Periodically pumping money in |

|

|

|

|

|

no6

|

Jul 23 2020, 06:23 PM Jul 23 2020, 06:23 PM

|

|

Just wandering how is Opus performance compare to SAMY ?

|

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 06:25 PM Jul 23 2020, 06:25 PM

|

|

QUOTE(no6 @ Jul 23 2020, 06:23 PM) Just wandering how is Opus performance compare to SAMY ? Opus which fund vs SAMY which risk % portfolio? The question is you're asking is basically open-ended question. And also Opus funds are dominantly in MYR while SAMY in USD (except for Simple™). This post has been edited by GrumpyNooby: Jul 23 2020, 06:27 PM |

|

|

|

|

Jul 22 2020, 09:52 PM

Jul 22 2020, 09:52 PM

Quote

Quote

0.0309sec

0.0309sec

0.94

0.94

6 queries

6 queries

GZIP Disabled

GZIP Disabled