Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

MattSally

|

Apr 2 2025, 08:34 PM Apr 2 2025, 08:34 PM

|

|

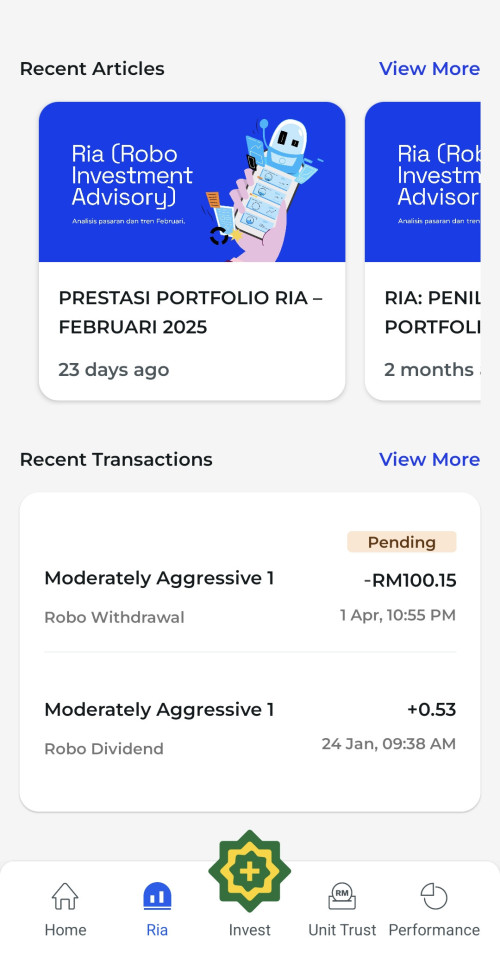

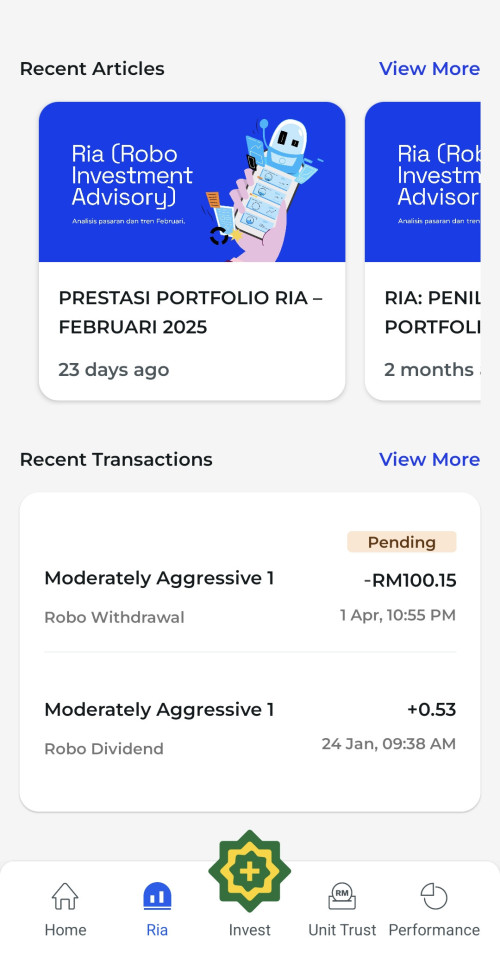

QUOTE(Iceman74 @ Apr 2 2025, 07:14 PM) Nope... me also wtf. Until now not yet approved  Looking at all the pros and cons of all the different investments available, I still find it difficult not to prefer ASM FP Funds. Maybe a better return with EPF but liquidity is an issue. VP Funds are not performing well, RIA doesn’t seem to be doing much. I keep being reminded of the old saying ‘If it isn’t broke, don’t fix it!’ ASM FP Funds do not deliver a spectacular dividend but they are reliable. In today’s geo political situation, I think that is very important. |

|

|

|

|

|

MattSally

|

Apr 7 2025, 01:57 PM Apr 7 2025, 01:57 PM

|

|

KLSE is taking a real hammering thanks to Trump. All stocks around the world are down, with NASDAQ down 27% since Trump was elected. KLSE is down over 4% so far today. Buckle up. It's going to be a bumpy ride and ASB3, ASM2, ASM3 dividends will be badly affected if this mess isn't sorted quickly.

|

|

|

|

|

|

MattSally

|

Apr 8 2025, 01:01 PM Apr 8 2025, 01:01 PM

|

|

QUOTE(!@#$%^ @ Apr 7 2025, 07:59 PM) I kind of agree. But the opportunity is only really there for people who are already very wealthy and who can afford to take a risk - like Trump and his billionaire friends. I wouldn’t be surprised to see ASM2 ASM3 dividends fall to 4% this year - with reserves needed to even give that. This post has been edited by MattSally: Apr 8 2025, 01:42 PM |

|

|

|

|

|

MattSally

|

Apr 9 2025, 04:34 PM Apr 9 2025, 04:34 PM

|

|

QUOTE(!@#$%^ @ Apr 9 2025, 04:17 PM) i think many looking for bargain elsewhere in the turmoil You may be right but I am not in the position of being able to take the gamble so I’ll stick with ASM, even if dovidends are down a bit. |

|

|

|

|

|

MattSally

|

Apr 10 2025, 02:53 PM Apr 10 2025, 02:53 PM

|

|

QUOTE(coolguy_0925 @ Apr 9 2025, 11:10 PM) They certainly are greatly affected unless rebound happening All the funds hold substantial % of MAYBANK and it has dropped more than 10% So, Trump blinked first! KLSE back up almost 5% today. I haven't checked Maybank share price but we do seem to be moving back in the right direction - until the next intervention from Agent Orange of course! |

|

|

|

|

|

MattSally

|

Apr 10 2025, 09:27 PM Apr 10 2025, 09:27 PM

|

|

QUOTE(nexona88 @ Apr 10 2025, 09:17 PM) The earliest fund we can see the impact is ASB 3 Didik around June end... From there, can somehow estimate the dividend for ASM 2 & 3 later on 😄 Whatever ASB3, ASM2/3 declare, it will be lower than we all expected and hoped for only a few weeks ago I think. |

|

|

|

|

|

MattSally

|

Apr 11 2025, 12:33 AM Apr 11 2025, 12:33 AM

|

|

QUOTE(ericlaiys @ Apr 10 2025, 11:59 PM) dont happy so fast. usa just increased china to 145%. us market now start to back to red Yes, just seen that but the markets do seem to have slightly less uncertainty in them at the moment. I do think that Trump needs to find a way to remove tariffs on China too. The problem is that Trump has made it personal and he will not want to suffer the loss of face if he drops tariffs on China. This post has been edited by MattSally: Apr 11 2025, 12:33 AM |

|

|

|

|

|

MattSally

|

Apr 12 2025, 06:40 PM Apr 12 2025, 06:40 PM

|

|

With this 90 day pause on tariffs to all countries (apart from China) this takes us beyond the end of June when ASB3 dividend will be declared. Hopefully this period of ‘relative’ stability will allow stock markets to settle down and maybe not have such a negative impact on dividends. I would accept the same as last year for ASB3 but I will now (notwithstanding my comments in a previous post) be disappointed with anything lower than last year’s dividends.

|

|

|

|

|

|

MattSally

|

Apr 13 2025, 02:46 PM Apr 13 2025, 02:46 PM

|

|

QUOTE(oks911 @ Apr 13 2025, 02:43 PM) Next week bursa rocket to the moon! I would be very happy to see KLSE anywhere above 1550. But now that Trump has backtracked even further and exempted Smart Phones and Computers from China from tariffs, I think circa 1600 is possible. This post has been edited by MattSally: Apr 13 2025, 02:47 PM |

|

|

|

|

|

MattSally

|

Apr 14 2025, 04:43 PM Apr 14 2025, 04:43 PM

|

|

KLSE is up but Trump has cast doubt on Chinese tariffs yet again so who knows where we might be heading next!

|

|

|

|

|

|

MattSally

|

Apr 17 2025, 09:19 AM Apr 17 2025, 09:19 AM

|

|

QUOTE(coolguy_0925 @ Apr 16 2025, 10:30 PM) but but but some said disappointed with 5% and wanna all in EPF  In times of uncertainty people buy gold. In the Fund market, ASM/ASB FP Funds are as close to gold as you will get. Dividends may fall but you won't make a loss. This post has been edited by MattSally: Apr 17 2025, 09:21 AM |

|

|

|

|

|

MattSally

|

Apr 30 2025, 02:35 PM Apr 30 2025, 02:35 PM

|

|

Now ‘only’ RM4.30 to US$1. Hopefully we are not too invested in US$ when it comes to dividend pay out.

|

|

|

|

|

|

MattSally

|

May 2 2025, 01:50 PM May 2 2025, 01:50 PM

|

|

If anyone would like to go fishing we have just withdrawn 180k from ASM2.

|

|

|

|

|

|

MattSally

|

May 5 2025, 04:42 PM May 5 2025, 04:42 PM

|

|

RM4.20 to the $ now. Pros and cons when it comes to dividend announcement.

ASB3 at the end of June will be a good indicator for ASM2/3. Last year ASB3 declared 5.25%. I would hope for 5.5% this year and 5.0% for ASM2/3.

|

|

|

|

|

|

MattSally

|

May 7 2025, 06:16 PM May 7 2025, 06:16 PM

|

|

KLSE is just about back at 1550 and the trend is still positive. Hopefully this will now continue for the rest of the year.

|

|

|

|

|

|

MattSally

|

May 9 2025, 08:03 PM May 9 2025, 08:03 PM

|

|

QUOTE(ericlaiys @ May 9 2025, 12:48 PM) Enough time for a decent dividend (5%) to be generated from fund performances. |

|

|

|

|

|

MattSally

|

May 11 2025, 11:15 AM May 11 2025, 11:15 AM

|

|

QUOTE(nexona88 @ May 10 2025, 02:14 PM) As long don't go below 5% already good enough... That's the main thing.... If indeed goes lower, expect another round of withdrawal 😕 The important thing, for me, is to continue to see a year on year improvement. Last year ASM2/3 each returned 4.75% so we need to see 5% this year. It can't really be any higher (though not entirely impossible) due the ASM1 dividend of 5% at the end of March. If there are sufficient funds in reserve, I think this would be a good time to use them (if necessary) to ensure a 5% dividend for ASM2/3 this year. The general trend is good and the short term disruption caused by Trump will steadily wash out of the equation I think, so maybe it's time for ASNB to show their support for their own product by ensuring 5% this year for ASM2/3. It would also be a pro active measure to give people cause to think twice before making large withdrawals. This post has been edited by MattSally: May 11 2025, 11:17 AM |

|

|

|

|

|

MattSally

|

May 12 2025, 11:02 AM May 12 2025, 11:02 AM

|

|

QUOTE(nexona88 @ May 11 2025, 07:54 PM) If I remember correctly... ASM1 dividend could be little higher... Around 5.2% if 100% payout ratio... I assume the 0.2% is for expenses or reserve $$$... Trump is one really unstable person.... Keep on change policies.... I suspect he is manipulate the market for own benefits or his political funders.... Once you see he opened mouth , market dropped... Later on another post... After like certain period..., Suddenly market up..... And finally.... ASNB might have max up their market with ASMx funds.... There's might be no more room for more take ups.... Only when existing unitsholders sold their might be new influx of $$$$..... You just see ASM3.... They keep up opened the units like there's endless pool of units available..... I suspect there's big sell down @ mass withdrawal that cannot be taken up by new $$$$.... All agreed. If ASNB wants to stimulate interest in ASM3 it has to make the dividends attractive. Not just 0.25% better than FD but attractive and a realistic alternative to EPF. This year, I think that figure is 5%. This post has been edited by MattSally: May 12 2025, 11:03 AM |

|

|

|

|

|

MattSally

|

May 13 2025, 03:51 PM May 13 2025, 03:51 PM

|

|

A good day for the KLSE so far today on the back of reduced tariffs between China and USA. Deal only agreed for 90 days but every little helps towards the dividends.

|

|

|

|

|

|

MattSally

|

May 20 2025, 04:33 PM May 20 2025, 04:33 PM

|

|

Hopefully that represents positive news for dividends later this year.

|

|

|

|

|

Apr 2 2025, 08:34 PM

Apr 2 2025, 08:34 PM

Quote

Quote 0.1706sec

0.1706sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled