[quote=Unkerpanjang,Sep 2 2021, 06:40 AM]

Another issue with SSPN is transparency. Correct me if I am wrong, but I could not find SSPN-related annual reports, financial statements and/or holdings summary/details. How do they invest your money to give you 4% annually? How many % in bonds/stocks etc. The exact details should be published in some form of reports, but I could not find it anywhere in the official PTPTN/SSPN portal.

https://www.ptptn.gov.my/pengenalan-sspn-i-sideAs this is off-topic, feel free to quote my post and reply in the SSPN thread.

[/quote]

Bro, connect the dots among ASB, TH, Bank Rakyat, Sspn, and all the other Govt financial vehicles. Important is to seize the opportunity, n keep quiet. There's alway shades of grey. Their motto is to help the xxxx....if u r lucky, u board the free ride. U think the Govt of the day won't bail out Sspn?

Don't u think that EPF, kwap, etc pumping in Tiger Bank, etc is all part of acceptable market manipulation? Free market dictates some companies go bankrupt, but in reality there's alway sacred animals n Org too big to fail.

[/quote]

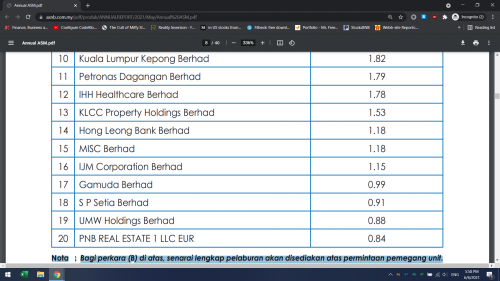

I don't want to comment on that, but I think there is no harm in revealing their investment holdings like EPF/PNB has done. PNB is actually composed of 2 funds, while the ASM1/2/3 holdings are published the proprietary fund is not, so it is not exactly transparent. But at least the immediate holdings are known to us, better than nothing.

[quote=!@#$%^,Sep 2 2021, 08:40 AM]

round number doesn't mean need to buy. u can sell also. haha

[/quote]

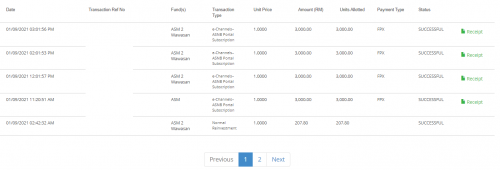

If don't have spare cash and there are good opportunities elsewhere I might do that, otherwise, I think I will top-up, but at a slower pace than other direct international investments so that I can reduce my heavy weights over time in ASNB products. Top-up on dividend day looks fine from yesterday's experience. No need to spam and fish every day I guess.

Jun 6 2021, 05:59 PM

Jun 6 2021, 05:59 PM

Quote

Quote

0.0432sec

0.0432sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled