QUOTE(zstan @ Mar 6 2020, 03:21 PM)

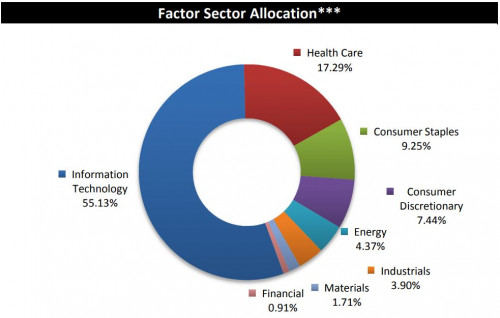

maybe you should read the annual report of METUS50 to see what kind of funds does it track. US Market down doesn't mean all the company that they track goes down. and different sectors have different weightage. To see the direct correlation you'd have to analyse all 50 companies' performance individually.

When 3 markets plus Russell 2000 down > 3% at the same time overnight but MyETF-US50 has little impact, does that even make sense at all?Dow Jone Industrial Average - 30 big/mega cap on several sector *can be ignored*

S&P 500 - 500 companies from several sectors *a good indication of broader market*

NASDAQ - tech sector heavy index, no pure financial *could be good selection to form Shariah complaint fund*

Russell 2000 - mid to small cap companies

MyETF-US50 Top 10 Holdings

MyETF-US50 Sectors Allocation

This post has been edited by GrumpyNooby: Mar 6 2020, 03:53 PM

Mar 6 2020, 03:26 PM

Mar 6 2020, 03:26 PM

Quote

Quote

0.0224sec

0.0224sec

0.27

0.27

6 queries

6 queries

GZIP Disabled

GZIP Disabled