Outline ·

[ Standard ] ·

Linear+

Wahed Invest Malaysia, Good, Ok2, Bad?

|

abcn1n

|

Mar 7 2020, 12:25 AM Mar 7 2020, 12:25 AM

|

|

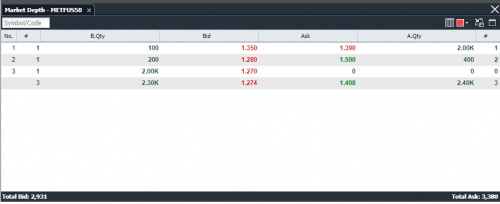

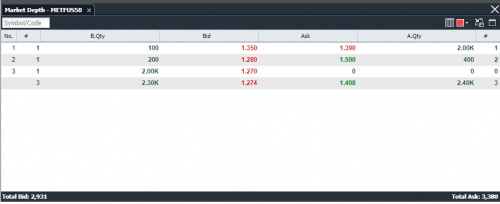

QUOTE(balf @ Mar 6 2020, 05:17 PM) if u looking for any sense in the market...no there is not necessary to have any sense. What i can tell u is that METFUS50 has its own index methodology to calculate the price, and the problem in malaysia ETF is that the trading volume is too low. Like today, there is no trading in the market and thus the price didn't move up & down. however, when the price goes too far from the NAV, the market price will do self-adjustment eventually. historical price against NAV can be found here: https://www.myetf.com.my/en/MyETF-Series/My...rical-NAV-PriceIf I understand correctly, looking at the 5th March, isn't it scary that the price we pay is much higher than the NAV--in fact it seems to be the widest so far. If so, then price will have to drop right, and then our porfolio value will decline |

|

|

|

|

|

abcn1n

|

Mar 7 2020, 10:18 AM Mar 7 2020, 10:18 AM

|

|

QUOTE(balf @ Mar 7 2020, 09:16 AM) it will adjust towards NAV eventually as i said, so yes it will drop eventually if NAV keep on moving downward. Thanks. I don't see this NAV and price graph in Stashaway though. |

|

|

|

|

|

abcn1n

|

Mar 8 2020, 12:45 AM Mar 8 2020, 12:45 AM

|

|

QUOTE(zacknistelrooy @ Mar 7 2020, 09:01 PM) Finally someone asking the right question. Don't look at price but look at the buy and sells Yes if there no volume but if there is volume and the transactions are happening way above the NAV then that is a concern The Wahed ETF (HLAL) listed in US does a way better job at pricing the ETF The ETF purchased by are traded more and have better pricing. | Date | NAV | Transactions | | 6-Mar | 1.2246 | No volume | | 5-Mar | 1.2629 | 3600 buy @ 1.40 | | 4-Mar | 1.211 | 101,000 buy @ 1.39 & 700 buy @ 1.39 | | 3-Mar | 1.2495 | 900 buy @ 1.35 & 430,000 buy @ 1.37 | | 2-Mar | 1.1902 | 800 sell @ 1.28 & 325,000 buy @ 1.24 | | 28-Feb | 1.1911 | 200 shares @ 1.28 & 300,000 @ 1.33 & 228,000 sell @ 1.33 |

Even on Friday if I wanted to buy the ETF, the price on offer was 1.39 which is way higher than the NAV Where do you see the bid, ask and transaction price for the METUS50 and for our local ETF that Wahed manage? If its thinly traded, then its really no good. From what I read previously, the KLSE ETF is thinly traded and that's why we should not play with it due to the wide bid ask spread. |

|

|

|

|

|

abcn1n

|

Mar 8 2020, 11:16 PM Mar 8 2020, 11:16 PM

|

|

QUOTE(zacknistelrooy @ Mar 8 2020, 10:42 PM) For METFUS50 is through my old brokerage account  For the HLAL ETF you can use the following website when the US market opens: CODE https://markets.cboe.com/us/equities/market_statistics/book/AAPL/ Thanks. |

|

|

|

|

|

abcn1n

|

Mar 21 2020, 12:46 AM Mar 21 2020, 12:46 AM

|

|

QUOTE(epie @ Mar 19 2020, 02:48 PM) -8.2% for me Sell everything...time to cutloss You bought bonds, then sell when you lost $1k+. Now you are cutting loss in Wahed at 8.2% loss. Aren't you going to bleed like this if you keep selling when you lose $? |

|

|

|

|

|

abcn1n

|

Mar 21 2020, 10:04 PM Mar 21 2020, 10:04 PM

|

|

QUOTE(epie @ Mar 21 2020, 09:41 PM) yeah...it is call a cut loss hehe Hope you have lots of $ or that your investments in these 2 are small as if you keep doing this thing, its not good |

|

|

|

|

|

abcn1n

|

Apr 20 2020, 12:27 AM Apr 20 2020, 12:27 AM

|

|

QUOTE(GrumpyNooby @ Apr 16 2020, 03:10 PM) Wahed has a competitor: BEST Invest will see itself competing with Wahed Invest, which is also a shariah-compliant robo-advisor. Headquartered in America, Wahed Invest requires a minimum investment of RM100. Unlike BEST Invest, Wahed Invest does not allow you the option to create your own portfolio if you wish to. https://ringgitplus.com/en/blog/personal-fi...9jxCiYq51DBesvMSo anybody tried this? |

|

|

|

|

|

abcn1n

|

Apr 20 2020, 11:38 AM Apr 20 2020, 11:38 AM

|

|

QUOTE(tadashi987 @ Apr 20 2020, 09:53 AM) i tried installed, user interface is not bad but not very tempting for me to go ahead because basically it is just selling unit trust funds through mobile application, just like Opus selling their own funds through their own platform. and what made it different a bit is just that they will do risk profiling once you opened account then suggest u a portfolio that suit to your risk profile, whereby you have freedom not to follow the suggested one. Thanks. Hmmm...only unit trust. Hopefully they have ETF as Rakuten Trade don't allow me to do ETF. I prefer to do my own portfolio |

|

|

|

|

|

abcn1n

|

Apr 24 2020, 12:51 AM Apr 24 2020, 12:51 AM

|

|

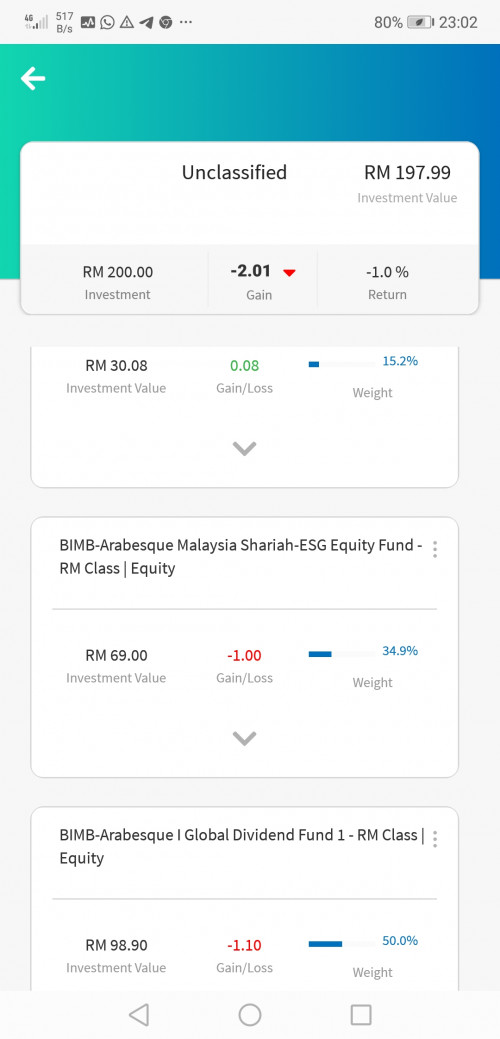

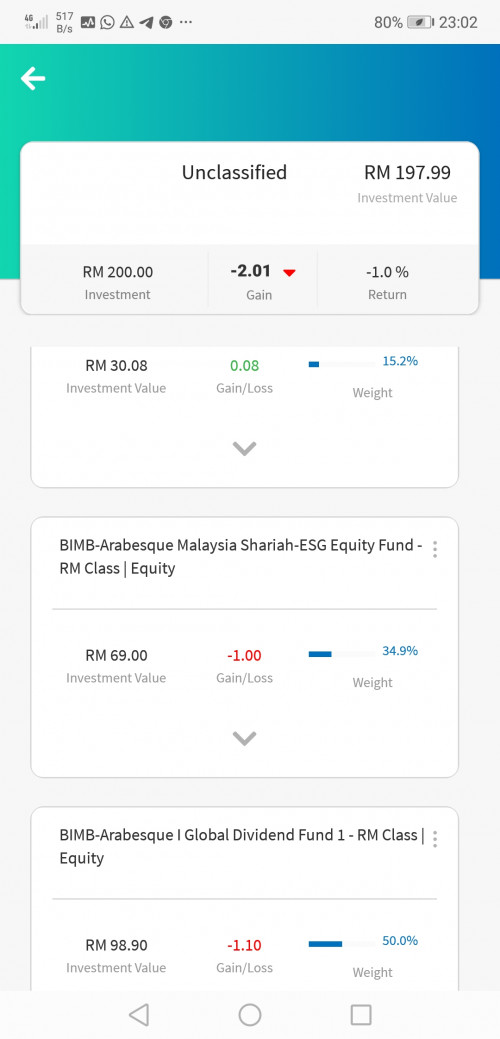

QUOTE(teratak @ Apr 23 2020, 11:05 PM) I try it... Currently loss 1%  Thanks. |

|

|

|

|

|

abcn1n

|

May 19 2020, 12:05 AM May 19 2020, 12:05 AM

|

|

QUOTE(honsiong @ May 11 2020, 01:54 PM) Some forumer pointed this out last week, the ETFs Wahed invested in seem to have massively inflated price over their net asset value: MMIDUS50Tread carefully. QUOTE(honsiong @ May 16 2020, 01:08 PM) I gonna see if on Monday the US50 ETF still has a >10% spread, this is ridiculous. If the authorized participants stop creating new units again, you all are going to see ETF price dislocate from its NAV badly, meaning the +10% gain you see do not exist, it's fake. The -10% drop did not come from the underlying assets price drop, its just the price correcting back to what its worth the NAV. This happens when its a thinly traded ETF. Obviously not good unless one happen to be the lucky one that sold when price above NAV. Thanks for the sharing. |

|

|

|

|

|

abcn1n

|

May 20 2020, 02:30 AM May 20 2020, 02:30 AM

|

|

QUOTE(zstan @ May 19 2020, 09:46 PM) QUOTE(zstan @ May 19 2020, 09:52 PM) Our new fund to replace the current ETF for the US Stocks that you have currently will provide greater liquidity due to the larger exchange where it is listed in. Hmmm will we get a true US based ETF? Hopefully a good US ETF and not one where in June where people start investing, see price much higher than NAV |

|

|

|

|

|

abcn1n

|

May 22 2020, 01:53 AM May 22 2020, 01:53 AM

|

|

QUOTE(ameli7a @ May 21 2020, 01:48 PM) I just can't understand why Wahed decided to upgrade the US Stocks when there is sudden price drop in METFUS50 last week. I am very sure switching fund now had incurred a lot of losses to many investors. Luckily, mine is just a small amount and I don't know about the rest. What kind of strategy by Wahed @@ If Wahed announced it before May 12 on them selling the US ETF and converting it to cash before purchasing the new ETF, those that are smart, would have liquidated their portfolio then as around 15 May2020, the ETF price was about 20% higher than the ETF's NAV. And when they liquidated your US ETF portfolio portion, that price premium would likely have reduced a lot (as selling is greater than buying) as can be seen from 15 May, ETF's price and NAV were very similar. One/a few of the posters here actually have been highlighting on this price and NAV difference and I believe some of us have been hit by that. https://www.myetf.com.my/en/MyETF-Series/My...rical-NAV-PriceThis post has been edited by abcn1n: May 22 2020, 01:54 AM |

|

|

|

|

|

abcn1n

|

Jun 6 2020, 01:16 AM Jun 6 2020, 01:16 AM

|

|

Is it possible to choose to invest in HLAL and sukuk for Wahed only? Don't want the Malaysia stock part

|

|

|

|

|

|

abcn1n

|

Jun 8 2020, 12:31 AM Jun 8 2020, 12:31 AM

|

|

QUOTE(vanpersie91 @ Jun 6 2020, 01:31 AM) Thanks. What is the % for the various funds ie % for HLAL, % for Malaysia stock etc. I want the largest % for HLAL |

|

|

|

|

|

abcn1n

|

Jun 8 2020, 01:40 PM Jun 8 2020, 01:40 PM

|

|

QUOTE(vanpersie91 @ Jun 8 2020, 01:10 PM) Refer their website for fund allocation according to risk selected Thanks QUOTE(GrumpyNooby @ Jun 8 2020, 01:18 PM) Link: https://wahedinvest.com/portfolio/65% in HLAL for Very Aggressive portfolio Thanks |

|

|

|

|

|

abcn1n

|

Sep 16 2020, 12:21 AM Sep 16 2020, 12:21 AM

|

|

Recently opened a Wahed account using a referral code but did not receive any bonus. When I opened, they accepted the referral code , so am wondering why no bonus?

|

|

|

|

|

|

abcn1n

|

Sep 16 2020, 02:05 PM Sep 16 2020, 02:05 PM

|

|

QUOTE(4eyeco @ Sep 16 2020, 08:50 AM) How long has it been? I forgotten when I received it, but it did take some time for it to be reflected Less than a week since opening account. BTW, the bonus is $20 right? This post has been edited by abcn1n: Sep 16 2020, 02:06 PM |

|

|

|

|

|

abcn1n

|

Sep 16 2020, 07:25 PM Sep 16 2020, 07:25 PM

|

|

QUOTE(tsutsugami86 @ Sep 16 2020, 04:49 PM) Your account need invest at least RM 100 and wait 30 days, then you only can get the bonus. Thanks. I have already invested at least a $100. Is it 30 working days or 30 calendar days? |

|

|

|

|

|

abcn1n

|

Sep 16 2020, 10:16 PM Sep 16 2020, 10:16 PM

|

|

QUOTE(4eyeco @ Sep 16 2020, 08:56 PM) Thanks |

|

|

|

|

|

abcn1n

|

Oct 31 2020, 07:08 PM Oct 31 2020, 07:08 PM

|

|

QUOTE(GrumpyNooby @ Oct 31 2020, 04:02 PM) Latest valuation, ROI drops to below 10% QUOTE(zstan @ Oct 31 2020, 06:52 PM) Wow, both of you still positive ROI? Mine is negative already |

|

|

|

|

Mar 7 2020, 12:25 AM

Mar 7 2020, 12:25 AM

Quote

Quote

0.0670sec

0.0670sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled