QUOTE(tadashi987 @ May 5 2020, 09:52 AM)

ya so far so good, but one thing i dont like about it is that not sure why sukuk/bond they would go for RHB islamic bond fund

RHb bond fund doesn't known to be good, hearsay there is few round of dropping because of default credit or so

personally feel syariah bond fund best is Amanah Syariah Trust (excluding nomura which is wholesale bond fund)

Afaik that fund held onto some of the Maju Expressway (MEX) bonds and their rating was downgraded

Can't remember if there were any other issue for the fund

QUOTE(tadashi987 @ May 5 2020, 03:29 PM)

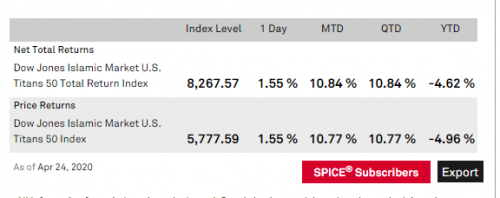

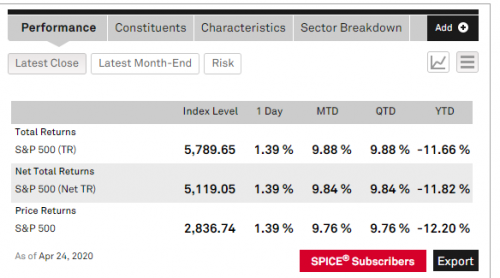

It is indeed outperforming the S&P 500 but not to this extent

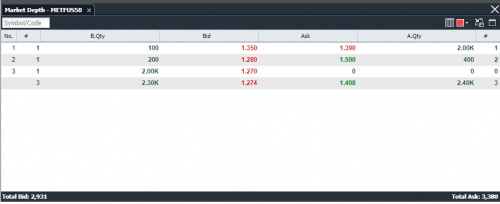

The premium has now grown to 20% from NAV

I had a look at the transactions for the ETF and the last sell was on 17th April 2020. Has been all buys from that time.

I suspect that with the performance, there are people adding even more funds forcing even more buys that is driving up the prices more than normal

I have never seen an ETF have this kind of disconnect before because arbitrage usually kicks in

What are your thoughts and happy to hear if you don't believe in my theory

Mar 3 2020, 08:30 PM

Mar 3 2020, 08:30 PM

Quote

Quote

0.0838sec

0.0838sec

1.51

1.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled