QUOTE(rocketm @ Oct 22 2021, 01:49 PM)

How about HLAL (US portfolio only)? Why any deposit and withdrawal from this portfolio will incur 1% charge?

They are introduce more and more charge making me think that whether is it good to invest with Wahed for long term.

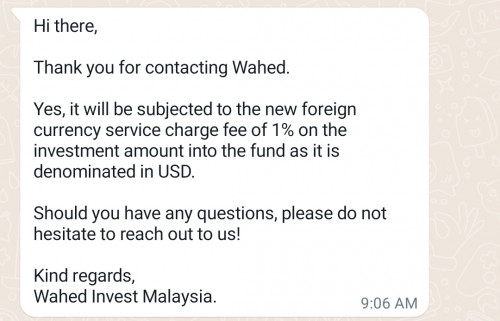

Same 1% incurred because is it in USD as Wahed is not able to absorb the FX charge just like FPX charges before

If you rather buy HLAL you will better off buying VOO or IVV long term for cheaper expense ratio

QUOTE(rocketm @ Oct 22 2021, 03:35 PM)

I have limited budget and want to limit the cost on foreign exchange so I choose Wahed but recently they have many charges coming out.

SA only have 1 charge (0.2%-0.8%) annual fee and 0.1% on foreign exchange regardless on how many different type of portfolio the investors have right?

SA fixed charges all the way with lower charges as your portfolio gets bigger

QUOTE(JJ93 @ Oct 22 2021, 04:15 PM)

Their new charges really will add up. 1% in 1% out plus 0.79% annual management fees. 🤯

Yes. SA fees are as what you mentioned. There's no extra fees for their newly launched thematic portfolios too.

Don’t forget FPX of RM1 for those who like to DCA

Sep 22 2021, 05:49 PM

Sep 22 2021, 05:49 PM

Quote

Quote

0.0208sec

0.0208sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled