QUOTE(TOS @ Oct 2 2023, 10:24 PM)

i think so... these are non-us domiciled treasury etfs... if you don't pay wht in the us... shouldn't need to pay wht elsewhere...Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Oct 2 2023, 11:09 PM Oct 2 2023, 11:09 PM

Return to original view | Post

#541

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 2 2023, 10:24 PM) i think so... these are non-us domiciled treasury etfs... if you don't pay wht in the us... shouldn't need to pay wht elsewhere... TOS liked this post

|

|

|

|

|

|

Oct 3 2023, 11:06 AM Oct 3 2023, 11:06 AM

Return to original view | Post

#542

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(melondance @ Sep 29 2023, 10:13 PM) depends on the types of bond, % etf holdings and how much/many of it meets US qualifying interest income requirements...you'll have to go back to the issuer and they should have calculated it out in their reports |

|

|

Oct 4 2023, 10:46 PM Oct 4 2023, 10:46 PM

Return to original view | Post

#543

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(TOS @ Oct 3 2023, 11:14 PM) One moderator from HWZ says that IB01 allows you to bypass all the withholding and estate taxes. go ask him what he meant by bypass... why just IB01... why not other treasury ucits... https://forums.hardwarezone.com.sg/threads/...#post-149574191 |

|

|

Oct 10 2023, 12:53 PM Oct 10 2023, 12:53 PM

Return to original view | Post

#544

|

Senior Member

6,249 posts Joined: Jun 2006 |

|

|

|

Oct 10 2023, 02:21 PM Oct 10 2023, 02:21 PM

Return to original view | Post

#545

|

Senior Member

6,249 posts Joined: Jun 2006 |

|

|

|

Oct 19 2023, 09:26 AM Oct 19 2023, 09:26 AM

Return to original view | Post

#546

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Oct 19 2023, 07:58 AM) I only remembered that ziet did this video after melondance mentioned it. At least now I know where to refer ppl to if they ask for this. This will be Plan C. Plan A =Cimb sg->Cimb my, Plan B = wise. Plan B I suspect I'll rarely use due to expensive wise fees, what more Plan C |

|

|

|

|

|

Nov 17 2023, 08:07 AM Nov 17 2023, 08:07 AM

Return to original view | Post

#547

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Mattrock @ Nov 16 2023, 07:30 PM) During the recent TD Ameritrade SG shutdown, I managed to get my account transferred to TD Ameritrade USA. However, I learnt that they do not allow foreign account holders to name any beneficiaries. ? i tot you are approved AI... how come move to tda usa?Upon checking with my Will executor, they said the repatriation of any assets from the US normally is quite troublesome and may take years and lot of costs involved. So now I am mulling closing out that account, bring back funds to Malaysia in USD and then open an IBKR SG account. afaik i may be wrong... ibkr sg is for sg residents only... my residents goes to ibkr usa TOS liked this post

|

|

|

Jan 8 2024, 10:35 AM Jan 8 2024, 10:35 AM

Return to original view | Post

#548

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Jan 8 2024, 08:23 AM) USD now is RM4.65, a drop of 5% (5% is the annual returns in RHB MCA I think) is RM4.42. If lower, then you'll actually start losing money. you also have ppl saving usd for kid's study... or just hedging against myr... but ibkr is not the best vehicle for theseSo, normally ppl exchange into USD to buy US stocks |

|

|

Feb 19 2024, 09:35 AM Feb 19 2024, 09:35 AM

Return to original view | Post

#549

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(kart @ Feb 19 2024, 08:09 AM) IBKR CS replied that when IBKR deducted the GBP cash in my account for the Preferential Offering, the forex conversion to GBP was not yet settled at that time, so I need to pay interest to IBKR. here you go... https://www.interactivebrokers.com/en/educa...nt-holidays.php-- Well, I can understand that we should wait T + 2 working day, for the trade of stock to be settled, before we can proceed to perform further trading of the stock, such as selling the stock. However, the forex conversion in IBKR should immediately be settled, and the SGD cash in my account was already deducted to pay for the forex conversion. Moreover, I did not withdraw GBP cash out from my IBKR Cash Account, because GBP cash was used to pay for Preferential Offering. I just cannot really understand why we should wait T + 2 working day, for the forex conversion to be settled. don't assume... kart liked this post

|

|

|

Feb 19 2024, 09:53 AM Feb 19 2024, 09:53 AM

Return to original view | Post

#550

|

Senior Member

6,249 posts Joined: Jun 2006 |

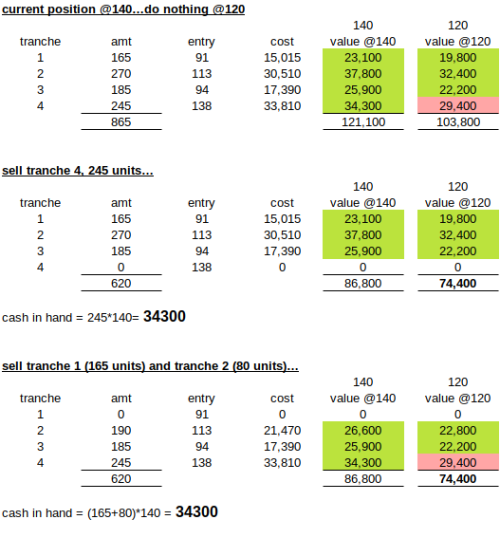

QUOTE(cybermaster98 @ Feb 18 2024, 10:58 PM) No. The objective is not to earn more profits. The objective is to trim to get out of later positions (currently in the green) which will go negative once the market corrects. So instead of holding some negative positions, ive trimmed them to increase my cash balance in order to buy in lower later. your motivation to sell the Dec 2023 tranche is purely to avoid seeing red... for that trancheyour balance remains the same regardless of selling the first few tranches or the last few tranches... This post has been edited by dwRK: Feb 19 2024, 11:17 AM |

|

|

Feb 19 2024, 12:06 PM Feb 19 2024, 12:06 PM

Return to original view | Post

#551

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Feb 19 2024, 11:37 AM) now the mystery is why i don't see this in my SGDUSD conversion. currently i'm (like many here) exploiting the "recurring investment" bug/loophole to convert SGD to USD for free upon stock purchase. i've been manually duplicating all entries to my Excel after that commission fee bug that i see in monthly/daily report you have sgd sitting in settled cash account... ibkr takes that, does the conversion for you, and buys your recurring stock... all is well...he had just enough sgd as settled cash... when he buys gbp, settled cash account becomes empty waiting on T+2... |

|

|

Feb 19 2024, 03:02 PM Feb 19 2024, 03:02 PM

Return to original view | Post

#552

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Feb 19 2024, 12:13 PM) hmm..https://www.reddit.com/r/singaporefi/commen...y_user/jpy65z7/ your's is cash or margin/portfolio account?ok this doesn't make sense either as I bought $IBIT immediately after manually converting to USD in mid Jan. When does the interest get reflected in statements? you say buy ibit immediately was it market order or limit order executed same day as your manual conversion? interest should get reflected next day i think... ibkr has a doc somewhere showing the maths and how its done... afaik... you buy and ibkr auto convert... this is considered 1 trade, so no t+2 for fx conv leg... if you do fx conv 1st, then buy... is considered 2 trades... 1st trade must settled 1st... This post has been edited by dwRK: Feb 19 2024, 03:07 PM |

|

|

Feb 19 2024, 03:46 PM Feb 19 2024, 03:46 PM

Return to original view | Post

#553

|

Senior Member

6,249 posts Joined: Jun 2006 |

hmmm... i got no ideas for further forensic checks...

i wonder if base currencies plays a part... anyways going forwards... maybe next time you manually convert sgd to usd... see how fast it gets settled... yada yada... |

|

|

|

|

|

Feb 22 2024, 09:55 AM Feb 22 2024, 09:55 AM

Return to original view | Post

#554

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(cybermaster98 @ Feb 21 2024, 11:39 PM) The sentence in bold is what you (and others) keep repeating without providing the WHY here you go...Re-entering at a higher price point doesn't lose me any money for sure UNTIL there is a correction/crash (which happens more often that most ppl anticipate) and then those positions go negative (again no loss because its still on paper) but it does lower my buffer.  can you now see why we say doesn't matter which tranche you sell from, only the units matter? both gives you same cash in hand... both still sucks the same when price drop to 120... only difference is color... |

|

|

Feb 28 2024, 07:58 AM Feb 28 2024, 07:58 AM

Return to original view | Post

#555

|

Senior Member

6,249 posts Joined: Jun 2006 |

|

|

|

Feb 29 2024, 09:27 AM Feb 29 2024, 09:27 AM

Return to original view | Post

#556

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(gashout @ Feb 29 2024, 04:57 AM) Anyone knows if 6 to 7 digit amount of funds in IBKR.. When withdrawing won't have any issues? just keep your paperwork n paper trails... why worry if you have nothing to hide?They're definitely funds which have paid tax. I don't want to see problems where it's frozen by banks or there are issues happening. Hence. Till today I never dare to park so much funds outside a country that'll go back to my bank account eventually. kena audit is part of life... This post has been edited by dwRK: Feb 29 2024, 09:29 AM |

|

|

Feb 29 2024, 02:31 PM Feb 29 2024, 02:31 PM

Return to original view | Post

#557

|

Senior Member

6,249 posts Joined: Jun 2006 |

|

|

|

Mar 3 2024, 11:08 PM Mar 3 2024, 11:08 PM

Return to original view | Post

#558

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Mar 3 2024, 10:36 PM) if you have more than $25k in assets, can switch to margin account where u can daytrade without waiting for cash settlement it is not a bug https://www.interactivebrokers.com/en/tradi...rgin-stocks.php i haven't turn on margin trading as there's supposedly a bug affecting half of those who are doing recurring investing (probably fixed by now). funds don't get auto converted from SGD to USD and IBKR assumes they want to borrow USD purpose of margin account is to access margin loans if required problem is you get some noobs who doesn't know shit making fuss out of own ignorance... anyways mine is margin acc... |

|

|

Mar 3 2024, 11:30 PM Mar 3 2024, 11:30 PM

Return to original view | Post

#559

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Mar 3 2024, 11:14 PM) thanks for the info... maybe the bug is causing the auto conversion?... anyways... not a problem i worry... cheers... https://ibkrcampus.eu/trading-lessons/mecha...overseas-trade/ QUOTE When the Client enters a foreign stock transaction, Credit Manager checks the associated currency account for availability: If foreign currency is available – Credit Manager permits the stock trade and debits the currency account If foreign currency is NOT available – Credit Manager creates a Margin Loan using base currency as collateral and THEN permits the transaction. imho... logically the sg guy case... 1st time should be deduct $20, margin loan $1380... 2nd time margin loan $1400... reoccurring or not shouldn't be treated differently... anyways... This post has been edited by dwRK: Mar 4 2024, 12:15 AM |

|

|

Mar 10 2024, 08:53 PM Mar 10 2024, 08:53 PM

Return to original view | Post

#560

|

Senior Member

6,249 posts Joined: Jun 2006 |

|

| Change to: |  0.3740sec 0.3740sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 11:20 AM |