Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

dwRK

|

Jun 13 2023, 10:56 PM Jun 13 2023, 10:56 PM

|

|

QUOTE(TOS @ Jun 13 2023, 08:57 PM) Transferred 24k MYR to 6945.42 SGD at 4.02 pm using Sunway Money. SGD.MYR rate (from investing.com) is about 3.4425, so some 38 basis-point spread. Money received same day today at 5:11 pm. when i graduated... i had zero money...  |

|

|

|

|

|

dwRK

|

Jun 29 2023, 02:23 PM Jun 29 2023, 02:23 PM

|

|

QUOTE(TOS @ Jun 29 2023, 10:49 AM) Did anyone notice something odd about IBKR's profit calculation today? My SGX counters are making lots of money... » Click to show Spoiler - click again to hide... « But IBKR shows the same figure with a negative sign in front of them plus highlighted in red... The one that's suppose to lose money (OCBC) is in the green instead.  » Click to show Spoiler - click again to hide... « prices are different |

|

|

|

|

|

dwRK

|

Jul 17 2023, 11:38 AM Jul 17 2023, 11:38 AM

|

|

QUOTE(TOS @ Jul 17 2023, 09:22 AM) If VT gives dividend, that should be declared only if you bring back the money (keyword: "received in Malaysia"). As for your reinvestment case, I think you should still declare them in part K of your BE-form as the reinvestment is not done at the fund level (you reinvest yourself). If no declaration is needed for the reinvestment case, that might be a big tax loophole... dwRK can help correct if I am wrong. This part I am not so sure. Yea, you are right. No distributions from the funds mean everything is in the form of capital gain of ETF prices, which are non-taxable and need not be declared anyway. your tax liability is distributed dividends... it doesn't matter what you do with it next... for now taxable only when you bring it in... you will try to argue is original capital or profits... i dunno how tax man rank priority... they can say all repatriation draws down dividend first before profit n capital... no such loophole on accumulating... there will be paperwork on dividends received and shares bought... you declare tax the same as distribution etfs on your portion... |

|

|

|

|

|

dwRK

|

Jul 17 2023, 03:47 PM Jul 17 2023, 03:47 PM

|

|

QUOTE(Hoshiyuu @ Jul 17 2023, 03:05 PM) Nope, for my case, my experience is exclusively limited to VWRA, which is poorly integrated into IBKR - there's no dividend report, no reinvestment record what-so-ever on IBKR. Supposedly I do not need to pay tax on dividend income where the headline tax is no less than 15% (https://www.hasil.gov.my/media/p0lntthw/20221229-guidelines-tax-treatment-in-relation-to-income-received-from-abroad-amendment.pdf) but I am not sure if I need to declare it still. VWRA dividend is handled at the fund level, so technically speaking, I don't have a dividend to tax and it's all capital gains? (For example, in UK, supposedly UK doesn't tax it at all because the shareholder of the fund explicitly does not receive them, which is inline with the lack of documents available on IBKR and Vanguard Mexico). But quite a few discussion disagrees but they didn't clarify if their "dividend reinvestment" is done at broker level or fund level. So I am not too sure about this myself. As for the dividend details itself, since IBKR doesn't have them, the best thing I can realistically do is to sift through the Vanguard annual reports to find and calculate it myself unfortunately, if I really had to declare it somehow. keep life simple... search and print div report... if shows zero... print that also for irb if they ask lor... had a div reinvestment plan before... taxed first before reinvesting... anyways... dun go look for trouble...  |

|

|

|

|

|

dwRK

|

Jul 17 2023, 05:24 PM Jul 17 2023, 05:24 PM

|

|

QUOTE(TOS @ Jul 17 2023, 03:53 PM) That is what I have in mind also. I am looking at VWRA documents, can't find any theoretical "distribution" amounts... The annual report does not mention anything about that except showing financial statements and holdings details. guarantee some fine prints somewhere they talk about tax on dividend... that is probably all you will find... but should also have div received lah... up to individual investors to understand their tax obligations in cash (distribution) - taxable, in kind (accumulating) - not taxable... try argue that with tax man... but if some tax is already paid for accumulating... ok lah... anyways... not my headache... hahaha This post has been edited by dwRK: Jul 17 2023, 05:46 PM |

|

|

|

|

|

dwRK

|

Jul 26 2023, 01:51 PM Jul 26 2023, 01:51 PM

|

|

QUOTE(TOS @ Jul 26 2023, 12:07 PM) Need help from IT pros. I can't login to IBKR Trader workstation (TWS) using NTU campus internet. Firewall doesn't show/display any blocking messages. Has NTU block any ports needed by IBKR? » Click to show Spoiler - click again to hide... « No such issue using my home's internet. Already tried with latest, stable, and beta. All 3 versions won't connect... try pornhub n see...  NTU dns sent ibkr request traffic to blackhole most likely case... you can ping and see what it returns... would be same as all censored sites... |

|

|

|

|

|

dwRK

|

Sep 2 2023, 08:44 AM Sep 2 2023, 08:44 AM

|

|

QUOTE(TOS @ Sep 2 2023, 08:19 AM) An interesting chart, depicting the changing face of Europe's largest enterprise. How time has changed... Source (no paywall): https://www.reuters.com/markets/europe/drug...any-2023-09-01/nice chart... makes me thinks of stone ages... bronze ages... etc different era... different titans... ev n ai related next? This post has been edited by dwRK: Sep 2 2023, 08:46 AM |

|

|

|

|

|

dwRK

|

Sep 4 2023, 03:10 PM Sep 4 2023, 03:10 PM

|

|

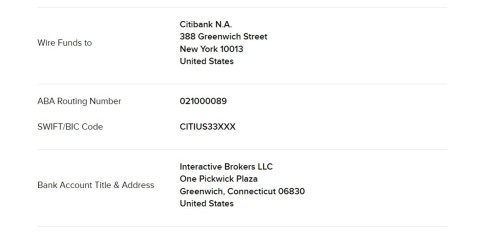

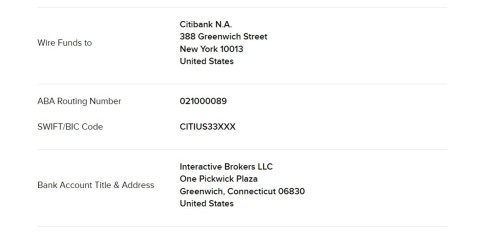

QUOTE(joeblow @ Sep 4 2023, 02:49 PM) Hi, Can I check anyone has tried this method Bank Wire to fund their money from Malaysia to IBKR? I got a deal from HSBC Malaysia to convert ringgit to USD that's around 0.58 to 0.7% difference from google/XE rate. If I use Fintech eventual rate also around 0.5% and above. The TT charge is rm80 and the amount is more than 100k usd. But I have hear of stories bank wire cannot be done? Anyone have tried and can go through?  if hsbc do it for you ...just do it lor... why ask ppl who couldnt do it? edit... oh you asking ppl who has done it ... sorry read too fast earlier... This post has been edited by dwRK: Sep 4 2023, 03:12 PM |

|

|

|

|

|

dwRK

|

Sep 4 2023, 03:54 PM Sep 4 2023, 03:54 PM

|

|

QUOTE(Hoshiyuu @ Sep 4 2023, 03:21 PM) Maybe you mixed up the story? If I am not wrong, most of the concerns early on was that their USD bank wire is via a third-party (Wise) and not under their name. IBKR historically strongly discourage or even block such attempts as it has too much risk of being related to money laundering. For standard bank wire, there's nothing to worry about if you are wiring from an account that is under your name (no joint-ownership) AFAIK. Just remember to set the notification and tag on the relevant IBKR info as instructed. issue is... sometimes some local banks refuse to process wire to overseas brokers... anytime you write reason for transfer is investment, forex, share, trading, etc... immediately reject... This post has been edited by dwRK: Sep 4 2023, 03:55 PM |

|

|

|

|

|

dwRK

|

Sep 4 2023, 05:43 PM Sep 4 2023, 05:43 PM

|

|

QUOTE(joeblow @ Sep 4 2023, 05:14 PM) I checked with the bank and another bank. Both said not advisable because of the BNM regulation. Once you put investment then a lot of internal investigation. If you eg send to your own name account overseas then not much check. Yes my fear is the audit (troublesome) and also they will reject and return. I think I will just follow their advice, hsbc my to hsbc singapore then to IBKR even though all same name and I have no loan. Purpose is just to check those who have done it before and if troublesome. I remember someone saying only Maybank will work? I also don't know if it is IBKR who is rejecting. My amount is quite big, I just sold off a property. rm30k a day takes too long. ibkr wont reject unless sender/receiver not same person n suspicious reason local banks avoid wire money out for 'investment' is because a lot of investment scams... bnm ruling on outbound remittance for investment is very clear and you should be able to send out... is just local banks don't want the trouble just in case... |

|

|

|

|

|

dwRK

|

Sep 4 2023, 08:16 PM Sep 4 2023, 08:16 PM

|

|

QUOTE(Hoshiyuu @ Sep 4 2023, 05:52 PM) ...surely even bank can't beat spot rate + flat fee at such high amounts?) it is not flat fee... y'all have been paying the min fee is all... lol... |

|

|

|

|

|

dwRK

|

Sep 28 2023, 07:20 PM Sep 28 2023, 07:20 PM

|

|

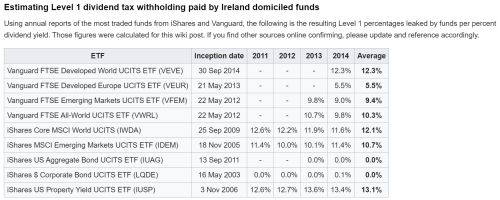

ibkr should not have to apply wht on qualifying interest/dividend income in the first place...

i doubt they pay irs first and then claim it back next year to refund y'all...

anyways...

|

|

|

|

|

|

dwRK

|

Sep 28 2023, 10:48 PM Sep 28 2023, 10:48 PM

|

|

QUOTE(TOS @ Sep 28 2023, 07:30 PM) As far as I know, the WHT deductions appear on my IBKR activity statement: » Click to show Spoiler - click again to hide... « And previous info from our friend Gwynbleidd confirms this. You can read the posts from here onwards: https://forum.lowyat.net/index.php?showtopi...ost&p=107454178yes i know what they are doing... but why? they don't pay irs... because its not required... so essentially, they took 30% of your money for their own use, until next year... This post has been edited by dwRK: Sep 29 2023, 12:00 AM |

|

|

|

|

|

dwRK

|

Sep 29 2023, 12:01 AM Sep 29 2023, 12:01 AM

|

|

QUOTE(TOS @ Sep 28 2023, 10:53 PM) Woah this I don't know. Upon further reading looks like no withholding is necessary in the first place. https://www.ssga.com/library-content/produc...us-en-ssiit.pdfNot sure if they apply the withholding due to ease of administration. You think can complaint? customer can ask/complain whatever  |

|

|

|

|

|

dwRK

|

Sep 29 2023, 03:55 PM Sep 29 2023, 03:55 PM

|

|

QUOTE(xander2k8 @ Sep 29 2023, 03:18 PM) Nothing to do with IBKR because the ruling is from IRS itself 🤦♀️ in order to prove that the holders are holding and refunded accordingly show me proof of what you say please. |

|

|

|

|

|

dwRK

|

Sep 29 2023, 09:38 PM Sep 29 2023, 09:38 PM

|

|

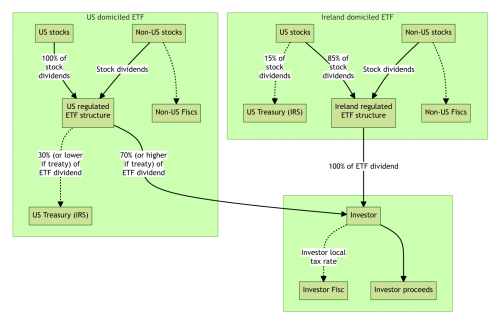

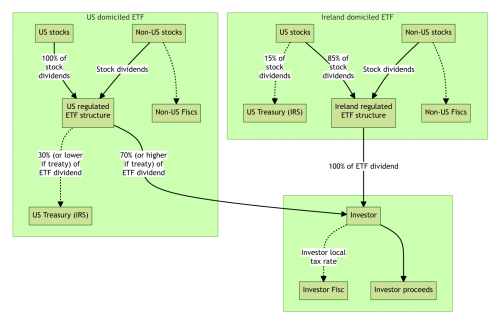

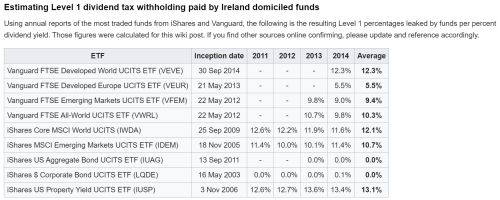

QUOTE(melondance @ Sep 29 2023, 07:07 PM) I referred to Bogleheads Wiki on ETF Taxes, I didn't verify it though.  Furthermore, Irish domiciled ETF doesn't just pay 15% flat WHT, it pays 15% WHT for US stocks only. So meaning if your ETF holds non-US stock, you pay only WHT to other countries that apply.  Source: https://www.bogleheads.org/wiki/Nonresident..._domiciled_ETFschart is wrong imho... did not look at table |

|

|

|

|

|

dwRK

|

Sep 29 2023, 09:45 PM Sep 29 2023, 09:45 PM

|

|

QUOTE(xander2k8 @ Sep 29 2023, 04:59 PM) Stated here clearly 🤦♀️ which is why ITIN is needed in order to prove as NRA identity to reclaim part of WHT https://www.irs.gov/individuals/internation...specific-incomeSo it is not the broker fault 🤦♀️ but they following the law and providing clearly on it in order to prevent seizure from IRS no... where did it mention anything about qualifying dividends that you have to pay wht tax first and then you claim it back later? what has itin got to do with anything about getting refund from irs/broker?... folks are getting refund on wht for qualifying dividends from tbils... but i doubt they have itins... so how are they getting refunds if they don't have itins as you have mentioned? |

|

|

|

|

|

dwRK

|

Sep 29 2023, 09:53 PM Sep 29 2023, 09:53 PM

|

|

QUOTE(melondance @ Sep 29 2023, 05:21 PM) I think this is for US Bond ETF, doesn't happen to Irish Domiciled US Bond ETF right? ireland and usa have a tax treaty... so they pay only 15% wht for usa listed stuff... hence you get 85% of div because of it... |

|

|

|

|

|

dwRK

|

Sep 29 2023, 11:45 PM Sep 29 2023, 11:45 PM

|

|

QUOTE(Toku @ Sep 29 2023, 11:22 PM) https://www.ssga.com/library-content/produc...eation-2023.pdfAccording to above link's table, BIL is 99.67% tax exempted in Jul dividend distribution. If your deduction by IBKR during Jul match the expected %. Looking at its trend, it should progress to 100% tax exemption soon. That is the good news. If I understand what the document says correctly.....I am not so sure. you cannot look at trend... it depends on what BIL "has" imho... if 100% deployed to treasuries you get 100%... if only 97% deployed... hence holding 3% cash with interest income... you get maybe 97.2%... just saying... |

|

|

|

|

|

dwRK

|

Oct 2 2023, 10:16 PM Oct 2 2023, 10:16 PM

|

|

QUOTE(xander2k8 @ Sep 30 2023, 01:24 AM) They would know 🤦♀️ because you need to submit W8 form as to prove your NRA tax status https://www.irs.gov/individuals/internation...nra-withholdingno man... you don't understand my whole questioning from the get go... but that's ok... i have no stake and don't need an answer...  |

|

|

|

|

Jun 13 2023, 10:56 PM

Jun 13 2023, 10:56 PM

Quote

Quote

0.0334sec

0.0334sec

1.32

1.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled