QUOTE(TOS @ Oct 3 2024, 10:15 AM)

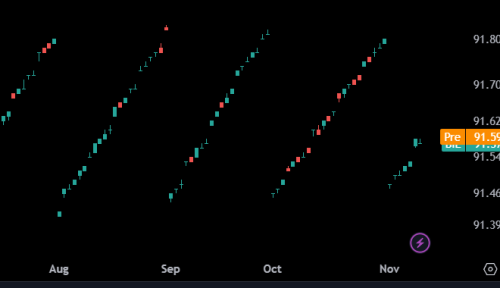

Then you have to wait for hours just for another fella to sell to you at somewhere near the expected market price... The wait can be so long that the order is filled the next morning during US aftermarket

---------------------------

PhD is usually a 4-year programme in Singapore. One of the girls I dated with on NTU campus finished her's in 3 years! Some people can take as long as 5.

In Europe PhD is usually 3-year because they always start with a one- to two-year Masters before proceeding to PhD, so everything is covered...

In the US PhD can take 6 years or 7 years... it's a long journey over there though the training can be better compared to elsewhere. But the cost of living is rising faster than the stipend increment. A lot of PhD students in the States live from mouth to foot, or rely on spouse who works in Silicon Valley earning 5-6 digits a month in USD to foot the bill.

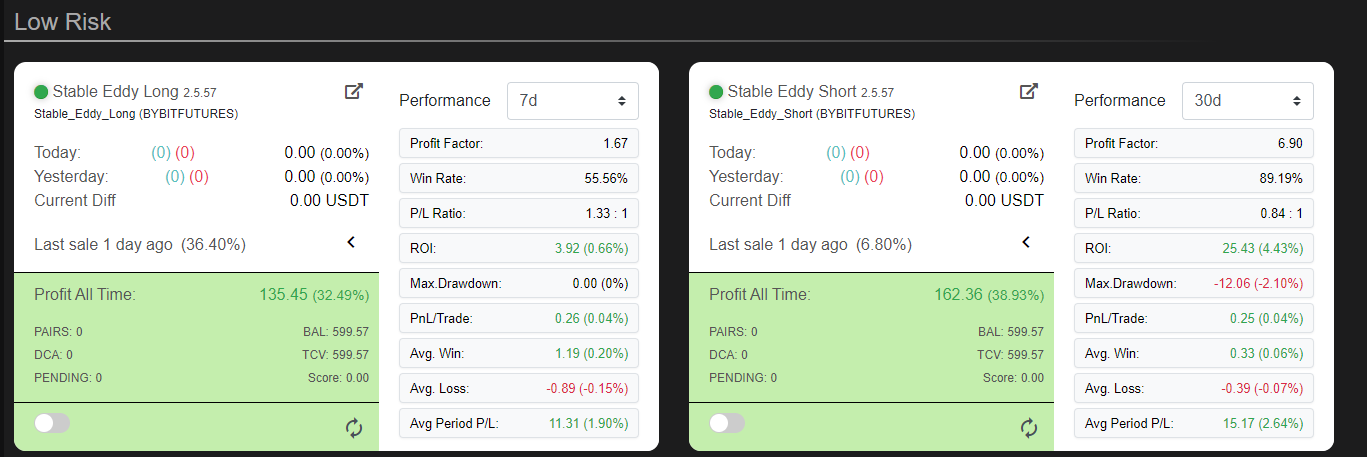

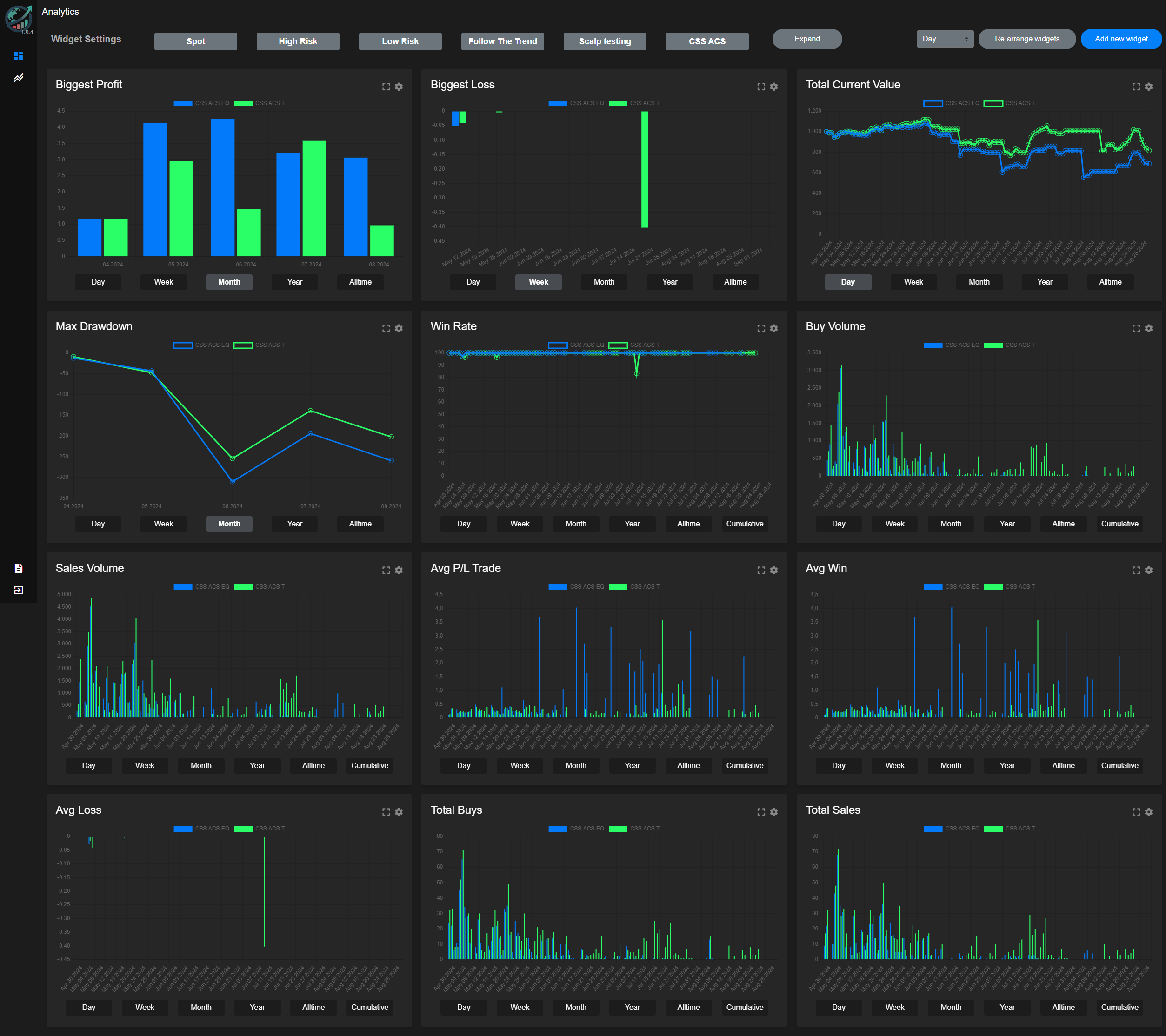

anyways... just reminding that algo/bot trading can be our personal millennium fund...

also dun forget about ai... i know a guy who doesn't know programming but managed to talk ai into developing a trading stats management program... ai and quant are like dream partners, sadly i old liao hard to learn new tricks... hahaha... friend was showing off what the ai can do... really amazing stuff...

Oct 3 2024, 11:11 AM

Oct 3 2024, 11:11 AM

Quote

Quote

0.2786sec

0.2786sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled