QUOTE(diffyhelman2 @ Mar 11 2024, 01:06 PM)

not quite, see below.

thanks, I actually found a more updated list (7 Feb) here

https://www.ssga.com/library-content/produc...eation-2024.pdf

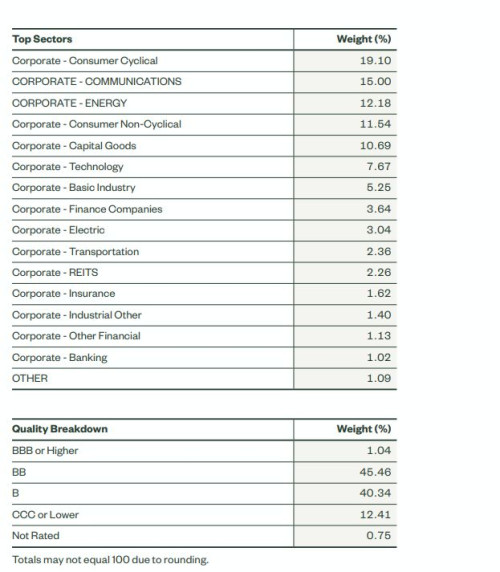

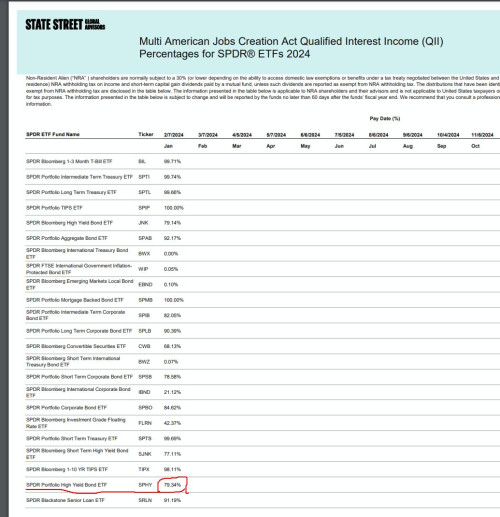

if you look at SPBO (corp bond) 85% of the income is qualified interest, SPHY (junk bond) is 79%. and the average tenure is 4-5 years for their holdings. the part that is not qualified is for those issuers who are non US companies issuing corp debt in the US market.

this makes it very attractive fund for me, as the expense ratio is only 5bp, and effective yield after factoring in a tax drag of 30% for the 20-25% of the porfolio that is not QII is about 5.1-7%.

even corporate long term bond (SPLB) fund is 90% QII.

PS: interestingly even BIL is not 100% QII, 99.7% only. maybe that explains the 0.01 that you didnt get back in refund?

i am not wrong... thanks, I actually found a more updated list (7 Feb) here

https://www.ssga.com/library-content/produc...eation-2024.pdf

if you look at SPBO (corp bond) 85% of the income is qualified interest, SPHY (junk bond) is 79%. and the average tenure is 4-5 years for their holdings. the part that is not qualified is for those issuers who are non US companies issuing corp debt in the US market.

this makes it very attractive fund for me, as the expense ratio is only 5bp, and effective yield after factoring in a tax drag of 30% for the 20-25% of the porfolio that is not QII is about 5.1-7%.

even corporate long term bond (SPLB) fund is 90% QII.

PS: interestingly even BIL is not 100% QII, 99.7% only. maybe that explains the 0.01 that you didnt get back in refund?

you showed a list of qii funds... these funds will have a mixed of taxable corporate bonds and non-taxable bills...

as for bil not 100% qii... because it also holds cash...

Mar 11 2024, 01:42 PM

Mar 11 2024, 01:42 PM

Quote

Quote

0.2516sec

0.2516sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled