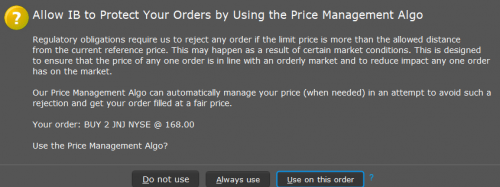

When I try to submit my order, I was asked about the "Price Management Algo"

Do you guys use it? Does it help?

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Sep 10 2021, 11:47 AM Sep 10 2021, 11:47 AM

Return to original view | IPv6 | Post

#161

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Sep 11 2021, 10:55 PM Sep 11 2021, 10:55 PM

Return to original view | IPv6 | Post

#162

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(joeblow @ Sep 10 2021, 03:49 PM) Just add the account number to your Will. But executing it is tough. So probably best to ask your lawyer. Also US shares in IB at the time of claiming is subjected to US estate duty law... At this moment I cannot find a way to avoid that and even asked IB about it. So if you know a way please let us know. https://www.businesstimes.com.sg/wealth-inv...nances-in-order langstrasse liked this post

|

|

|

Sep 16 2021, 04:08 PM Sep 16 2021, 04:08 PM

Return to original view | IPv6 | Post

#163

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(swiss228 @ Sep 16 2021, 03:38 PM) Hi all. For foreign ETFs, definitely IBKR. More choices with cheaper fees. Local FSM only limited to HK, US and MY. SG FSM only SG, US and HK ETFs. I would like to compare and contrast IBKR with Fund Supermarket. Is it better to buy ETFs in IBKR or Fund Supermarket? Any comments would be much appreciated. Tq tadashi987 and swiss228 liked this post

|

|

|

Sep 18 2021, 08:31 AM Sep 18 2021, 08:31 AM

Return to original view | IPv6 | Post

#164

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Does anyone know about WHT treatment on sponsored ADS/ADRs? TSMC dividend is subject to a 21% WHT by Taiwan, is it still subject to a further 30% WHT by US IRS? https://investor.tsmc.com/english/faq I Googled around and confirm that US and Taiwan has no tax treaty, but no information is found for the 30% US WHT for foreign (non-resident) investors. Thanks for info. langstrasse liked this post

|

|

|

Sep 18 2021, 10:46 PM Sep 18 2021, 10:46 PM

Return to original view | IPv6 | Post

#165

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Sep 18 2021, 10:17 PM) You need to search Taiwan dividend tax on Malaysia. Ibkr is smart enough to withd hold the correct amount if you fill up your tax country correctly. Thanks. I did a quick search on Google, it seems like the WHT for Malaysian investors is only 12.5%, very nice compared to other jurisdictions. https://law.moj.gov.tw/ENG/LawClass/LawAll....?pcode=Y0040226 https://investtaiwan.nat.gov.tw/faqQContent...g=eng&search=77 QUOTE 3. However, dividends paid by a company which is a resident of the TECO to a resident of the MFTC may be taxed in the TECO in accordance with the laws applicable in the TECO, but if the recipient is the beneficial owner of the dividends the tax so charged shall not exceed 12.5 per cent of the gross amount of the dividends. |

|

|

Sep 20 2021, 11:41 AM Sep 20 2021, 11:41 AM

Return to original view | Post

#166

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(HolyAssasin4444 @ Sep 20 2021, 11:33 AM) For you and for anyone else that invests in other countries besides Malaysia, can check up PWC's website regarding everything about taxes. Reviewed and updated frequently by professionals. Thanks. Very detailed list indeed. Gonna bookmark that page.https://taxsummaries.pwc.com/quick-charts/w...-rates#anchor-M |

|

|

|

|

|

Sep 22 2021, 08:03 AM Sep 22 2021, 08:03 AM

Return to original view | Post

#167

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

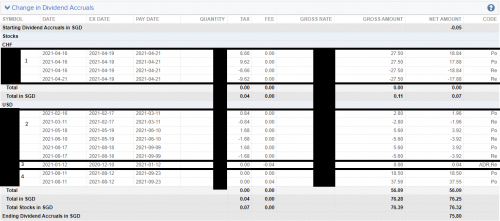

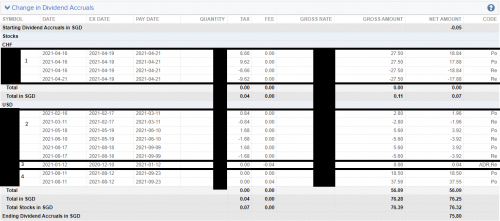

QUOTE(Takudan @ Sep 22 2021, 02:15 AM) question about dividends payout on IBKR: You can refer to the rightmost column "Code" to know the detailed transactions. how do I understand my dividend reports? i tried generating a HTML Activity statement YTD, and i see a lot of things that i don't und lol. First of all, I see two sections, Dividends This looked straightforward, it tells me the WHT and so I can correctly verify that - US stock 30% WHT - Swiss stock 35% WHT Change in dividends accrual now this table lost me...  I masked out the counters to reduce "advice distractions" so please bear with me Counter 1 and 2 were in the above section. The taxed amount tallies with above, but how do I understand this table....? why is it adding and subtracting back? Counters 3 and 4 are ADRs, in fact they do not show up in the section above on WHT - but I thought ADRs are still subject to WHT......? P.S. I'm not hunting dividends, but knowing how dividend payouts typically lower the stock counters and the reinvestment isn't happening (recall another forumer mentioned before that it does not happen if the payout doesn't amount to at least one share(?)), I want to understand how much I'm actually getting/losing, and therefore assess my position better. https://guides.interactivebrokers.com/rg/re...des_default.htm Po: Interest or Dividend Accrual Posting (Before pay date, dividends are declared) Re: Interest or Dividend Accrual Reversal (After pay date, when they turn into cash) So, the above answers 1,2 and 4 regarding the Po/Re part. For counter 4, the Re part will appear tomorrow/day after tomorrow after pay date. As for 3, I don't know much about ADRs, so you need to ask others. The fee part is negative, so you some how end up getting money from "negative fees". As for the dividends section, not sure why they don't show up but yes ADRs are subject to WHT. Another thing is due to Malaysia's tax treaty with Switzerland, Swiss stocks dividend WHT should be lower than 35%. This table https://taxsummaries.pwc.com/switzerland/co...thholding-taxes suggests 15% only. Try contact IBKR to ask for refund, you may need to fill up some "forms" in the process though I guess. This post has been edited by TOS: Sep 22 2021, 08:10 AM Takudan liked this post

|

|

|

Sep 22 2021, 10:11 AM Sep 22 2021, 10:11 AM

Return to original view | Post

#168

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Sep 22 2021, 08:40 AM) it is an accrual account.. this is used to track payments... Do you know why the ADR entry shows -0.04 for fees? Refund or something else?on ex date... an "iou" entry is created... on pay date, an opposite "completion" entry is created... the account will nett zero... this is why you see a +$10.... and later a - $10... |

|

|

Sep 22 2021, 05:37 PM Sep 22 2021, 05:37 PM

Return to original view | Post

#169

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

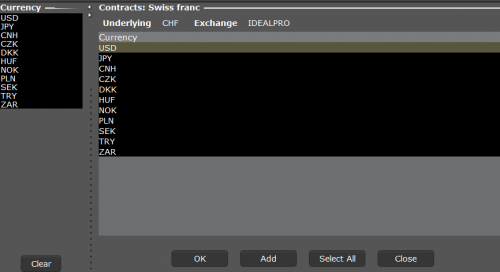

QUOTE(Takudan @ Sep 22 2021, 02:15 AM) question about dividends payout on IBKR: Takudan, just to ask you did you convert to CHF from USD? I tried searching for SGD/CHF pair but could not find any. There are limited pairs for CHF. how do I understand my dividend reports? i tried generating a HTML Activity statement YTD, and i see a lot of things that i don't und lol. First of all, I see two sections, Dividends This looked straightforward, it tells me the WHT and so I can correctly verify that - US stock 30% WHT - Swiss stock 35% WHT Change in dividends accrual now this table lost me...  I masked out the counters to reduce "advice distractions" so please bear with me Counter 1 and 2 were in the above section. The taxed amount tallies with above, but how do I understand this table....? why is it adding and subtracting back? Counters 3 and 4 are ADRs, in fact they do not show up in the section above on WHT - but I thought ADRs are still subject to WHT......? P.S. I'm not hunting dividends, but knowing how dividend payouts typically lower the stock counters and the reinvestment isn't happening (recall another forumer mentioned before that it does not happen if the payout doesn't amount to at least one share(?)), I want to understand how much I'm actually getting/losing, and therefore assess my position better.  So for your case, you will be charged commissions twice? (Once from say SGD to USD, then from USD to CHF? |

|

|

Sep 23 2021, 11:54 PM Sep 23 2021, 11:54 PM

Return to original view | Post

#170

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Takudan @ Sep 23 2021, 11:27 PM) Following up on tax treaty, I received this reply from IBKR. Long story short, forget about it If this is the case, for TSMC, it should be US <-> Taiwan too aka 21%. Then it cannot be 12.5% following Malaysia-Taiwan treaty. » Click to show Spoiler - click again to hide... « 15 CHF for each dividend event is too much for me haha, oh well. Thanks for sharing IB's reply. |

|

|

Sep 24 2021, 08:09 PM Sep 24 2021, 08:09 PM

Return to original view | Post

#171

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(boyboycute @ Sep 24 2021, 02:52 PM) Have you guys ever thought about what if IB went bankrupt due to some derivatives products? What will happen to our stocks? Where can we go seek help? This have been the lingering questions I have all these years using IB for long term portfolio. What is your opinion? Best way for me is to check their finances often. If profitable every quarter, zero debt, business should be fine. Margin part Ram answered already. esyap liked this post

|

|

|

Sep 24 2021, 11:10 PM Sep 24 2021, 11:10 PM

Return to original view | Post

#172

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(boyboycute @ Sep 24 2021, 09:56 PM) A few ways have been suggested before. Will writing is one, let your close and trusted next of kin/other parties know the passwords/usernames of the brokerage accounts is another, or you can keep the passwords/usernames in a safe place that is known to others but could not be accessed easily unless you die. tadashi987 liked this post

|

|

|

Sep 25 2021, 06:20 PM Sep 25 2021, 06:20 PM

Return to original view | Post

#173

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(homosapien8888 @ Sep 25 2021, 06:09 PM) BNM claimed it's illegal to use that platform .just wonder whether we get into the trouble if we use the foreign platform ? From the forum most use foreign platform as broker from Malaysia is way too expensive... No, BNM never says you cannot use IBKR. Bursa stuff have not much of choice ..... If they want they can block IB like what they did to other brokerage firms. You can look up on MAS/HKMA/SEC licensing for foreign brokers, if they can operate legally in SG, HK and the US, and do not appear in the "investors alert list", you can feel safe. You can also look at what your friends are doing in Singapore with IBKR: https://forums.hardwarezone.com.sg/threads/...411054/page-193 |

|

|

|

|

|

Sep 30 2021, 08:33 PM Sep 30 2021, 08:33 PM

Return to original view | Post

#174

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(victorfoo @ Sep 30 2021, 08:30 PM) one question, if cimb transfer to cimb sg, is the currency exchange good? any one can share experience? No, it is CIMB SG to CIMB MY that has rates comparable to fintech like Wise/Instarem etc. https://www.cimb.com.sg/en/personal/promoti...sfer-promo.html |

|

|

Oct 7 2021, 08:23 PM Oct 7 2021, 08:23 PM

Return to original view | Post

#175

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(HolyAssasin4444 @ Oct 7 2021, 07:37 PM) There's 3 different type of margins, Initial Margin (IM), Maintenance Margin (MM) and RegT Margin (RegT). Major in derivative! Opening any position requires a certain amount of IM and MM. For most US stocks, it's 25% (buying 10k stocks will require 2.5k IM & MM) 100k worth of stock = 25k IM MM. 200k worth of stock = 50k IM MM. Available funds is ELV - IM. Available funds can be thought of how much remaining IM you're allowed to use before not being allowed to open another position. Buying Power (BP) is just a fancy number calculated by Available Funds * 4 (ie a quick and easy way to know how big of a position you're allowed to open) Example, For someone with 25k ELV and no positions, your available funds is 25k, that's why your buying power will display 100k (25k*4). The reason why you're not allowed to buy 200k worth of stock is because that requires 50k of IM, which is more than your current ELV of 25k. Pretty much why I ignore looking at BP because it's just a secondary calculation of your available funds, which itself is a secondary calculation of IM. Overnight positions (for stocks, ignore futures) have the same IM MM requirements, 25%. Only difference is that for normal margin accounts, you're regulated by RegT rules. RegT states that all stocks may only be margined by 50% instead. This is where your RegT margin comes in. However, RegT margin requirements are only checked once a day at market close. Which means that for any overnight positions, they'll be checked for RegT margin requirements. That's why normally people say that you can only have half the amount of stock for overnight positions. Not because different requirements, but because there's an extra layer of margin requirement for you to obey. Once you upgrade to PM, this RegT rule will be removed, and you can just maintain the same amount for both intraday and overnight positions. As someone that majored in derivatives, I hate how people simplify wheeling into such rigid rules and thinking it's easy money because it's not, and there are massive tradeoffs for having so much of theta decay. Won't get into it unless you're interested, but basically very low theta decay is not a problem, it's a feature. The real problem is that rolling any ITM options becomes really costly for you simply because of the bid/ask spread. For the situation you mentioned (rolling the ITM put), I would recommend you to instead take assignment and sell calls. Due to put call parity, this is exactly the same thing but OTM calls have much tighter spreads, especially if they are near the money. Example, I've got XYZ $100 Put, getting assigned cuz XYZ is $95 now. Plan A: You want to roll to XYZ $100 Put for next month instead. Plan B: Take assignment on XYZ, and immediately sell XYZ $100 Call for next month. Both Plan A and B is synthetically the same thing, and there's no difference in doing either theoretically, but irl Plan B will be my choice because of the tighter bid/ask Edit: I can provide you a basic excel worksheet I used in the past to find out how leveraged you can get, and how big of a drawdown till you get to RegT > ELV |

|

|

Oct 8 2021, 02:18 PM Oct 8 2021, 02:18 PM

Return to original view | Post

#176

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(HolyAssasin4444 @ Oct 8 2021, 03:17 AM) I attached the Excel file, ugly but I think it does the job. Change the yellow cells, by adding how much ELV you have right now and how much percentage margin you intend to use. (50% = 1.5x your money worth of stock) The link you post is blocked by my Malwarebytes Browser Guard, which flags it as a "riskware". I presume it is just "false positive" of some sort?Then you can check the chart for the 'min(SMA)' line when it hits the x-axis. That would be how big of a loss you can take till you possibly kena margin call. For example, if you use 1.33x margin, max loss is 50% of your portfolio before in danger of kena call. If 1.66x margin then max loss 20% kena called. https://ufile.io/3q5xw81l You file should be safe right?  |

|

|

Oct 13 2021, 12:36 AM Oct 13 2021, 12:36 AM

Return to original view | Post

#177

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

For prospective/current Switzerland shares investors:

Regarding the 35% WHT issue on Swiss stocks, I have contacted a "tax specialist" from FTA (Federal Tax Administration of Switzerland) and received the following reply.  In other words, 35% is deduced automatically and you need to request for refund yourself. And Takudan IB is wrong in that tax treaty consideration is based on Malaysia (country of residence) not US/UK where the broker is based. Postage fee to Switzerland might be expensive though. Transaction cost should be taken into account. Thanks a lot to Hansel for his encouragement and support. (He suggested the "back-end" route and it worked!) |

|

|

Oct 13 2021, 09:20 AM Oct 13 2021, 09:20 AM

Return to original view | Post

#178

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Takudan @ Oct 13 2021, 02:51 AM) Nice new info! For the record..... Where to get form 60? Also, how much does it cost to mail that ya? I found Form 60 here: https://www.estv.admin.ch/estv/en/home/verr...en/ausland.html (scroll towards the end)I did a quick Google and looks like it's about RM 5: https://www.pos.com.my/send/mail/international/air-mail.html Am I missing out anything? I've never done any international mailing before Malaysia does not have its own form, it seems.  The file format is QDF, not PDF, so you need some "special" software to view it. https://www.estv.admin.ch/estv/en/home/verr...orm-viewer.html As for postage fee, I found the same link too, 4.8 MYR. This post has been edited by TOS: Oct 13 2021, 09:27 AM Takudan liked this post

|

|

|

Oct 13 2021, 10:08 AM Oct 13 2021, 10:08 AM

Return to original view | Post

#179

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

With the successful trial on Swiss shares, I tried to contact Taiwanese authorities for my TSMC dividend WHT refund but my request submission was rejected and could not be sent.

You guys can try here: https://service.mof.gov.tw/Eng/ServiceEmail/Index?nodeid=338 EDIT: I have successfully contacted the National Taxation Bureau of Taipei, MOF of ROC Taiwan. Will updates you guys when the I receive replies. This post has been edited by TOS: Oct 13 2021, 10:19 AM |

|

|

Oct 13 2021, 10:22 AM Oct 13 2021, 10:22 AM

Return to original view | Post

#180

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(kart @ Oct 13 2021, 10:21 AM) I am not sure how it works. If I cannot achieve certain passing rate in the exam, IBKR may block me for trading options for unspecified duration. There is a new "options" thread for you guys: https://forum.lowyat.net/topic/5204911I think that it is best for me to read more about options, and make a small amount of trade in options. Do not be greedy. |

| Change to: |  0.2152sec 0.2152sec

0.60 0.60

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 04:27 PM |