Guys,

I have switched/de-linked from Tradestation to IBKR since about a month ago and have been using IBKR and its rates daily.

Recently I've sent an inquiry regarding options futures trading. They have replied and added something about my IBKR account.

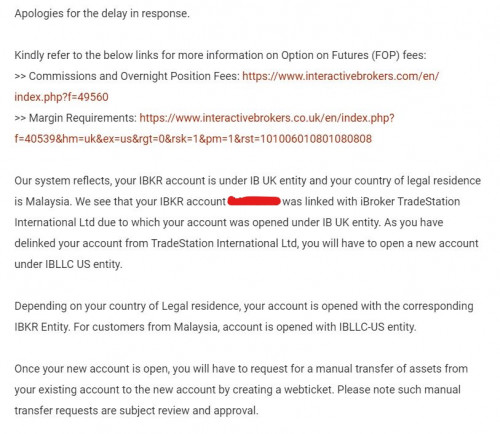

Their exact words (copied paste):

==================================================

Apologies for the delay in response.

Kindly refer to the below links for more information on Option on Futures (FOP) fees:

>> Commissions and Overnight Position Fees:

https://www.interactivebrokers.com/en/index.php?f=49560>> Margin Requirements:

https://www.interactivebrokers.co.uk/en/ind...006010801080808Our system reflects, your IBKR account is under IB UK entity and your country of legal residence is Malaysia. We see that your IBKR account UXXXXXX was linked with iBroker TradeStation International Ltd due to which your account was opened under IB UK entity. As you have delinked your account from TradeStation International Ltd, you will have to open a new account under IBLLC US entity.

Depending on your country of Legal residence, your account is opened with the corresponding IBKR Entity. For customers from Malaysia, account is opened with IBLLC-US entity.

Once your new account is open, you will have to request for a manual transfer of assets from your existing account to the new account by creating a webticket. Please note such manual transfer requests are subject review and approval.

If you need further assistance, please let me know.

===================================================

Is it just me or anyone encountered anything similar?

Time to do a Skype toll-free call.

Jul 25 2021, 08:35 PM

Jul 25 2021, 08:35 PM

Quote

Quote

0.2905sec

0.2905sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled