QUOTE(polarzbearz @ Jul 20 2021, 10:59 AM)

My account delinking is completed finally. They also dropped me a message yesterday and closed the ticket that I have raised for the delinking request.

Timeline:

Saturday, 10th Jul 0100: Sent completed form to TSG, cc IBKR, with ticket lodged

Monday, 12th Jul 2200: Email received from IB on verbal verification requirement

Tuesday, 13th Jul 0030: Completed verbal verification by calling the Hong Kong number

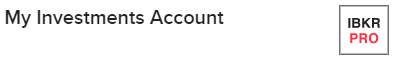

Saturday, 17th Jul 0430: IBKR "unlocked" with IBKR Pricing Tier, US Fractional Shares checkbox, and Refer a Friend functionality.

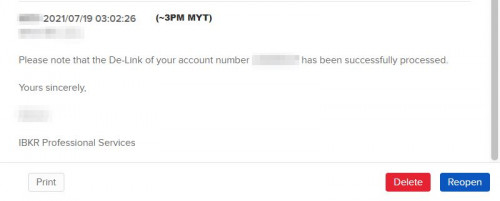

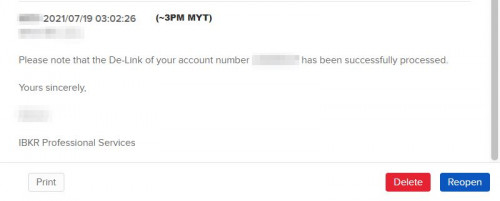

Monday, 19th Jul 1502: Received message from IBKR indicating the completion of my account de-linking process.

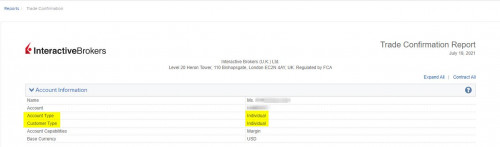

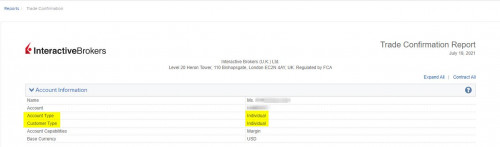

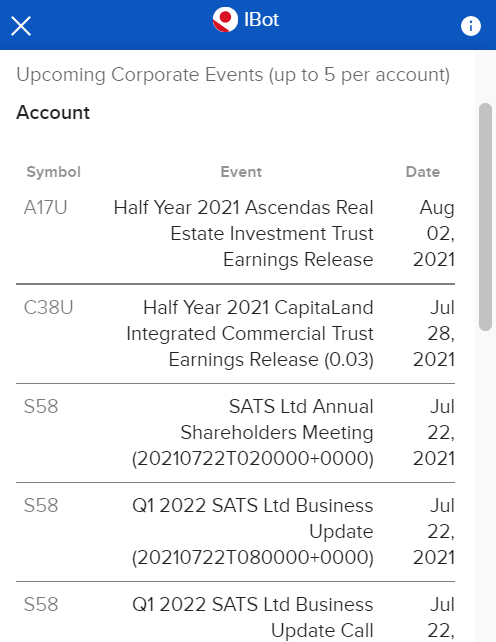

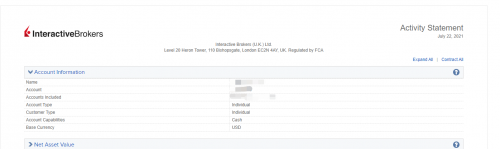

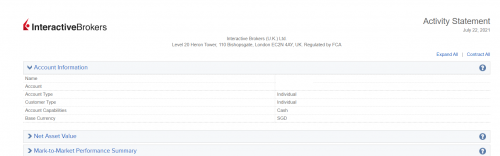

Tuesday, 20th Jul 1000: Verified Trade Confirmation Reports for 19th July and confirmed that TradeStation International Ltd is no longer reflecting in my account statements.

TradeStation International Ltd is always linked to IBKR UK. Hence after de-linking you will still be with IBKR UK. If you want, you can register in other entities (subject to their approval) and request for internal transfer. Not sure about the exact process but from FAQs these are some relevant info:this and this

So we are affiliated with IBKR UK. Need to study UK tax law now lol Timeline:

Saturday, 10th Jul 0100: Sent completed form to TSG, cc IBKR, with ticket lodged

Monday, 12th Jul 2200: Email received from IB on verbal verification requirement

Tuesday, 13th Jul 0030: Completed verbal verification by calling the Hong Kong number

Saturday, 17th Jul 0430: IBKR "unlocked" with IBKR Pricing Tier, US Fractional Shares checkbox, and Refer a Friend functionality.

Monday, 19th Jul 1502: Received message from IBKR indicating the completion of my account de-linking process.

Tuesday, 20th Jul 1000: Verified Trade Confirmation Reports for 19th July and confirmed that TradeStation International Ltd is no longer reflecting in my account statements.

TradeStation International Ltd is always linked to IBKR UK. Hence after de-linking you will still be with IBKR UK. If you want, you can register in other entities (subject to their approval) and request for internal transfer. Not sure about the exact process but from FAQs these are some relevant info:this and this

Jul 20 2021, 11:05 AM

Jul 20 2021, 11:05 AM

Quote

Quote

0.2734sec

0.2734sec

1.31

1.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled