QUOTE

Most new cars nowadays got a lot of engine issues after 5 years. So its better take 5 years or lower loan. Incase u have to dump the car after the warranty period ends

QUOTE(rapple @ Aug 11 2019, 07:25 PM)

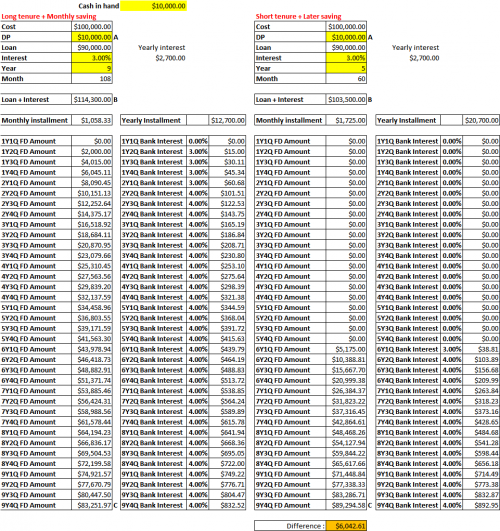

Your savings calculation is still not right. You still pay 100k over 5 years for that car vs the guy who is still paying the 9 year loan + more interest. At the end of the day, you only save the extra 4 year loan interest.

You only have more cash flow after 5 years whether you save or not is your issue. Your income will not increase in the 6th year because you have finish paying off your 5 year car loan.

The initial question is to choose shorter or longer loan tenure, in case to dump car after warranty. Not about the interest paid.

So imagine if dump the car at 5th year after warranty. I do not need to top up, but I'm getting back money for selling the car.

Imagine if you loan 9 years, dump at 5th year, what is the calculation ?

It's a trap to twist the presentation by car salesman for someone who may not be financially sound. A more proper advise is to choose a cheaper car that can pay in 5 years loan, rather than max it out for a more expensive car at 9 years loan.

My income did not increase (assuming I'm not getting increment or business profit), but my saving/spending power increases for other things in life. I'm not tied down in car loan continuously, that's an expense.

Aug 4 2019, 08:05 PM, updated 7y ago

Aug 4 2019, 08:05 PM, updated 7y ago

Quote

Quote

0.0491sec

0.0491sec

1.10

1.10

5 queries

5 queries

GZIP Disabled

GZIP Disabled