QUOTE(Level 60 Wizard @ Aug 9 2019, 11:15 AM)

Wait I go find back my excel fileCar Loan: 6 years or 9 years?, Which will you pick?

Car Loan: 6 years or 9 years?, Which will you pick?

|

|

Aug 9 2019, 11:21 AM Aug 9 2019, 11:21 AM

Return to original view | Post

#1

|

All Stars

28,156 posts Joined: Aug 2009 |

|

|

|

Aug 9 2019, 12:19 PM Aug 9 2019, 12:19 PM

Return to original view | Post

#2

|

All Stars

28,156 posts Joined: Aug 2009 |

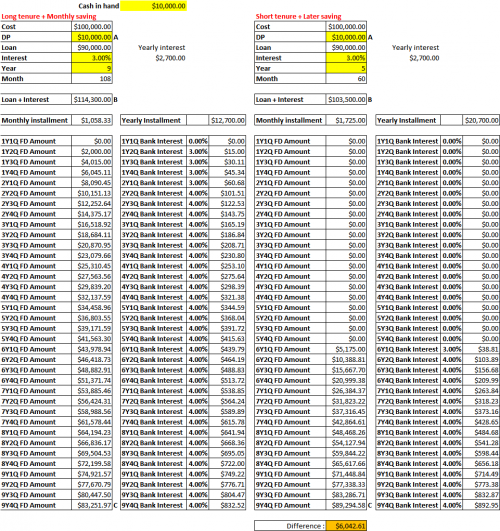

Following the link for the car price, DP, interest rate, I make a comparison between 9 years vs 5 years loan. The difference of money will be put into FD. Click the picture to see it more clearly

After 9 years the difference is you will have less six thousand ringgit if you were to take 9 years loan. Spread out by 9 years that is RM671 per year. If you put it to other type of fund/investment that give higher rate then the difference will be smaller. Usually for shorter term the interest rate is higher than longer term. The pros that I can think of for 5 years loan is you have extra 6k, if you were to trade in your car at 6th year, you will have the car value at that time as your DP + 5k cash whereas if 9 years loan after deduct all your saving you might need to top up 3k to 4k to clear your loan. The pros for 9 years loan is like you mentioned, inflation. Also as the link mention if you want to buy property. Additionally during the first 5 years you will have more extra money in your saving for emergency or opportunity use. You will less likely want to change car because still serving the loan. |

| Change to: |  0.0185sec 0.0185sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 04:38 AM |