[quote=Thasmita,Jul 17 2020, 07:26 AM]

[quote=MUM,Jul 16 2020, 08:04 AM]

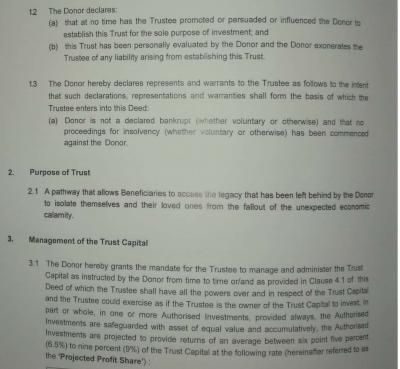

refer to GUY3288 posting above, see Management of trust capital,....there is a mention of "Authorised Investment",....

thus i think the more appropriate question would be "what are those?"

but then, as per CYCLOPES post about Trustee's ACT 8/1/d,...which reads...

(d)

to act as investing and financial agent for and on behalf

of executors, administrators and trustees or any other

persons whatsoever, and to receive money in trust for

investment and to allow interest thereon until invested;

and to undertake for and on behalf of executors,

administrators and trustees or any other persons whatsoever

the negotiation of loans of all descriptions and the procuring

and lending of money on the security of any description

of property, immovable or movable, or without taking

any security on such terms as may be arranged, and to

advance and lend moneys to protect any estate, trust or

property entrusted to the company as aforesaid and to

charge interest upon any such advances:

Provided that nothing herein contained shall be held

either to restrict or extend the powers of the company as

trustee or agent under the terms of any trust or agency

that may be conferred upon it;

.......btw,...since they are governed by this ACT....

i cannot find in the ACT that mentions that THEY MUST have a license to do that management of trust capital....

i could be wrong or missed reading it....

Please go thru and correct me if i erred in reading it

TRUST COMPANIES ACT

http://www.agc.gov.my/agcportal/uploads/fi...N/Act%20100.pdfNO wonder you cannot find more info about how they operate in their website......for as per the ACT, they are obligate / mandated to just need to submit annual statement to the Register....no mention of the need to put for public viewing too...

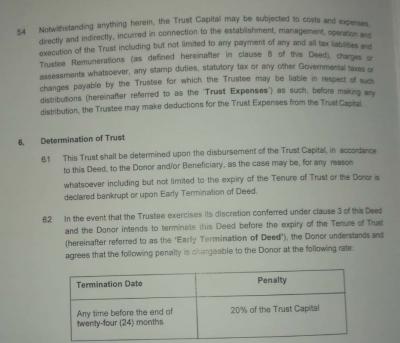

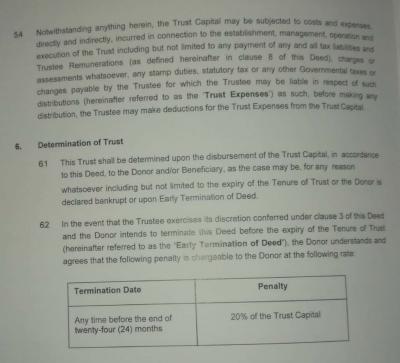

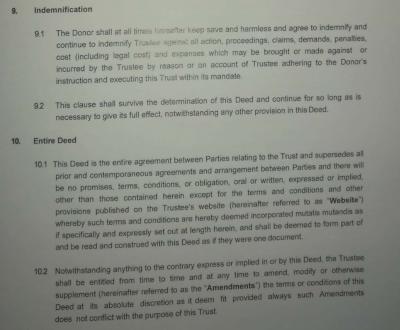

The Trust Company act must be read together with the interest schemes act and the capital market and services act.

In short anyone collecting money from the general public for investment purposes needs to be licensed to do so. The purpose for which the money is collected and how it is going to be invested needs to be made clear in a document which is called a Prospectus.

[/quote]

If I may offer my interpretation.

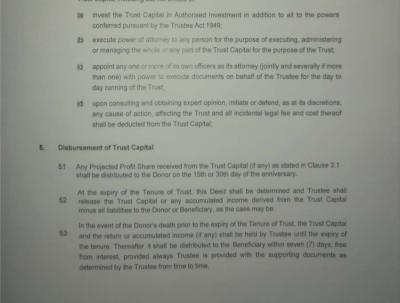

You put your money in a trust, not solely for investment, but to ' protect' it against events/circumstances that are provided in relevant Acts.

The Act also provides/mandates that the money is to be invested as per the trust deed. That gives the company leeway how it wants to invest provided you sign the trust deed with all the relevant provisions.

Jun 15 2020, 12:45 PM

Jun 15 2020, 12:45 PM

Quote

Quote

0.0294sec

0.0294sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled