Outline ·

[ Standard ] ·

Linear+

Loans RHB raised its Base Rate/BLR, RHB

|

TSlkwah86

|

May 15 2019, 02:47 PM May 15 2019, 02:47 PM

|

|

QUOTE(BlackPen @ May 15 2019, 11:06 AM) what if i bank in rm1000 and deduct the assessment fees of RM0.50 which mean not x1000 right? (RM999.50) unless have to bank in RM1050 only entitle of x1000 Check your prepayment account balance... check in loan redrawal |

|

|

|

|

|

skl097

|

May 15 2019, 03:21 PM May 15 2019, 03:21 PM

|

Getting Started

|

QUOTE(Havoc Knightmare @ May 15 2019, 12:45 PM) still can't find any news about further adjustment This post has been edited by skl097: May 15 2019, 03:21 PM |

|

|

|

|

|

cfc

|

May 15 2019, 04:29 PM May 15 2019, 04:29 PM

|

|

|

|

|

|

|

|

katrina8080

|

May 15 2019, 05:11 PM May 15 2019, 05:11 PM

|

Getting Started

|

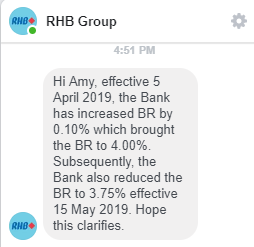

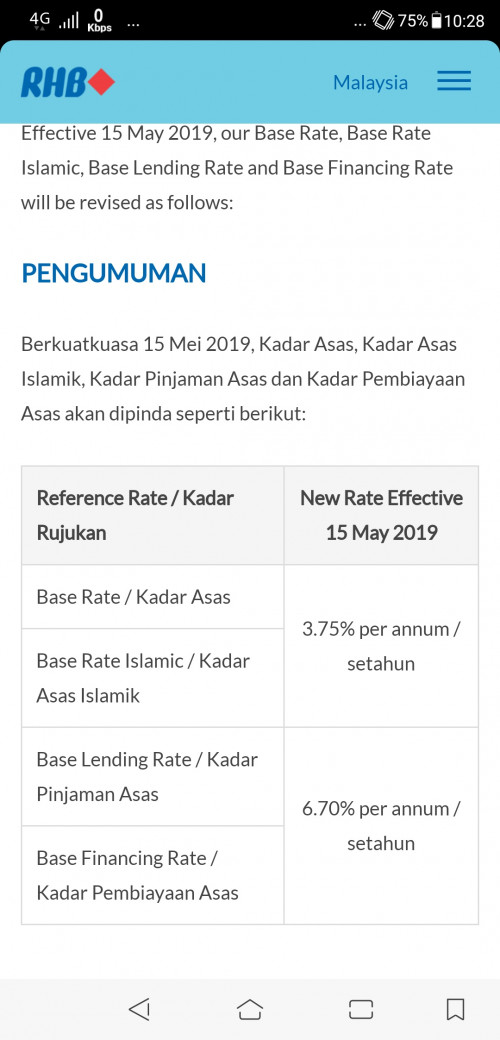

QUOTE(skl097 @ May 15 2019, 03:21 PM) still can't find any news about further adjustment Ask in RHB Group FB and was told reduction to 3.75% (reduce 0.25%). They had announced reduction of 0.2% (not 0.25%) in newspaper earlier. Lol  This post has been edited by katrina8080: May 15 2019, 08:11 PM This post has been edited by katrina8080: May 15 2019, 08:11 PM |

|

|

|

|

|

Havoc Knightmare

|

May 15 2019, 05:44 PM May 15 2019, 05:44 PM

|

|

QUOTE(skl097 @ May 15 2019, 03:21 PM) still can't find any news about further adjustment I cannot disclose, but internal sources from the bank as of this morning say that BR and BLR are lowered by another 0.05% effective today. You can verify by logging in and check your mortgage rate. This post has been edited by Havoc Knightmare: May 15 2019, 05:47 PM |

|

|

|

|

|

BlackPen

|

May 15 2019, 06:01 PM May 15 2019, 06:01 PM

|

|

QUOTE(lkwah86 @ May 15 2019, 02:47 PM) Check your prepayment account balance... check in loan redrawal loan redrawal shown rm1000..so the rm0.50 assessment fees is deducted thru my saving?  |

|

|

|

|

|

TSlkwah86

|

May 16 2019, 12:57 AM May 16 2019, 12:57 AM

|

|

QUOTE(BlackPen @ May 15 2019, 06:01 PM) loan redrawal shown rm1000..so the rm0.50 assessment fees is deducted thru my saving?  You may compose an email to RHB in the website to help you to check This post has been edited by lkwah86: May 16 2019, 12:57 AM |

|

|

|

|

|

jimbet1337

|

May 16 2019, 05:30 AM May 16 2019, 05:30 AM

|

|

Ok earlier this week my homeloan interest rate dropped from 4.5% to 4.5%. As of yesterday, went further down to 4.25%. So the further 0.05% drop is correct

|

|

|

|

|

|

cfc

|

May 16 2019, 07:31 AM May 16 2019, 07:31 AM

|

|

QUOTE(jimbet1337 @ May 16 2019, 05:30 AM) Ok earlier this week my homeloan interest rate dropped from 4.5% to 4.5%. As of yesterday, went further down to 4.25%. So the further 0.05% drop is correct tats a good rate u got from rhb mind to share what is the loan amount? |

|

|

|

|

|

skl097

|

May 16 2019, 09:26 AM May 16 2019, 09:26 AM

|

Getting Started

|

QUOTE(Havoc Knightmare @ May 15 2019, 05:44 PM) I cannot disclose, but internal sources from the bank as of this morning say that BR and BLR are lowered by another 0.05% effective today. You can verify by logging in and check your mortgage rate. yeah... today reflect in online banking further drop another 0.05%... |

|

|

|

|

|

jimbet1337

|

May 16 2019, 10:43 AM May 16 2019, 10:43 AM

|

|

QUOTE(cfc @ May 16 2019, 07:31 AM) tats a good rate u got from rhb mind to share what is the loan amount? Quite long time ago, 2014 I think. RM444k (including MRTA). BLR - 2.45%. |

|

|

|

|

|

Kaka23

|

May 16 2019, 10:03 PM May 16 2019, 10:03 PM

|

|

Log into UOB account, seems my monthly payment for the house loan still the same amount. They didn't revise lower pun...  |

|

|

|

|

|

TSlkwah86

|

May 16 2019, 10:40 PM May 16 2019, 10:40 PM

|

|

QUOTE(Kaka23 @ May 16 2019, 10:03 PM) Log into UOB account, seems my monthly payment for the house loan still the same amount. They didn't revise lower pun...  revise after due date I guess |

|

|

|

|

|

tiffneedle

|

May 18 2019, 10:29 AM May 18 2019, 10:29 AM

|

|

|

|

|

|

|

|

ableze_joepardy

|

May 21 2019, 11:18 AM May 21 2019, 11:18 AM

|

|

QUOTE(lkwah86 @ Apr 8 2019, 03:27 PM) when rhb increase BLR rates in april, any other bank increase too? usually BLR will tie to OPR. BR will be based on SRR. since no OPR raise in apr not sure why rhb decided to increase BLR. |

|

|

|

|

|

adam1190

|

May 25 2019, 11:54 PM May 25 2019, 11:54 PM

|

|

Is rhb the only bank where the installment amount will change as the loan interest rate changes?

Cause maybank installment amount doesn't change when interest rate changes..

|

|

|

|

|

|

cybpsych

|

May 26 2019, 07:50 PM May 26 2019, 07:50 PM

|

|

QUOTE(jianwei90 @ May 25 2019, 11:54 PM) Is rhb the only bank where the installment amount will change as the loan interest rate changes? Cause maybank installment amount doesn't change when interest rate changes.. depends usually no change to installment amount. my cimb home loan also no change. rate already dropped. |

|

|

|

|

|

jimbet1337

|

Jun 6 2019, 05:50 PM Jun 6 2019, 05:50 PM

|

|

My monthly installment amount haven't change although the rate went down, two times. Even the total tenure is also the same.

Unlike last time, got change even it's not that much.

Dunno what is happening now.

|

|

|

|

|

|

preducer

|

Jun 6 2019, 05:58 PM Jun 6 2019, 05:58 PM

|

|

QUOTE(jimbet1337 @ Jun 6 2019, 05:50 PM) My monthly installment amount haven't change although the rate went down, two times. Even the total tenure is also the same. Unlike last time, got change even it's not that much. Dunno what is happening now. I got 2 letters, one after they increased the rate and one after they reduced to the current rate. Both installment amount is different |

|

|

|

|

|

jimbet1337

|

Jun 6 2019, 06:29 PM Jun 6 2019, 06:29 PM

|

|

QUOTE(preducer @ Jun 6 2019, 05:58 PM) I got 2 letters, one after they increased the rate and one after they reduced to the current rate. Both installment amount is different I haven't received any letters in a longggggggg time now  My indication of installment amount, interest rate & total\remaining tenure is just on the RHBnow website. This post has been edited by jimbet1337: Jun 6 2019, 06:30 PM |

|

|

|

|

May 15 2019, 02:47 PM

May 15 2019, 02:47 PM

Quote

Quote

0.4899sec

0.4899sec

1.06

1.06

6 queries

6 queries

GZIP Disabled

GZIP Disabled