How to know if I am entitled for free fund managing ya. Didn’t see it in the refer a friend section

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jan 29 2020, 09:12 PM Jan 29 2020, 09:12 PM

Return to original view | Post

#1

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

How to know if I am entitled for free fund managing ya. Didn’t see it in the refer a friend section

|

|

|

|

|

|

Feb 19 2020, 12:45 PM Feb 19 2020, 12:45 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Syncing @ Feb 19 2020, 11:33 AM) I have never invested in UT before but I'm planning to, however I don't quite understand the impact of sales charge if you put a lump sum vs DCA. The only reason to lump sum is for the discounted sales charge, else is the same as DCAScenario 1 : Putting in 10k lump sum with 1.75% sales charge. Total sales charge paid = RM175 Scenario 2 : DCA 10k in 10 months with 1.75% sales charge. One month sales charge paid = 1.75% of 1k = 17.50 After ten months, total sales charges paid = RM175 Hence, it doesn't matter whether you lump sum or DCA, in the end the sales charges paid are the same. Of course, annual management fees would be different in two of those scenarios. Can someone tell me if I'm wrong or right? |

|

|

Mar 31 2020, 12:52 AM Mar 31 2020, 12:52 AM

Return to original view | IPv6 | Post

#3

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

I DCA RM300 monthly, just started two months ago, not sure if I should increase the amount since the market is in the red now. But I think more importantly I should have the bullet to hold for long.

|

|

|

Apr 2 2020, 01:17 PM Apr 2 2020, 01:17 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(GrumpyNooby @ Apr 2 2020, 01:13 PM) But then DCAing your DCA would not make more sense right? The purpose of DCA is to split the risk over the long run, which you have already did by investing monthly. By splitting that to weekly, you are not any better off in the long run. What you are trying to do is to time the market, and no one can do that. |

|

|

Apr 2 2020, 01:49 PM Apr 2 2020, 01:49 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(GrumpyNooby @ Apr 2 2020, 01:18 PM) Now is the time for accumulation even though the market is not really bottom yet. If he entered lump sum at the beginning of the month at a lower price, he would’ve ended up with more units than he would, if he split it into weekly. Vice versa, if the beginning of the month is expensive, he wouldve ended up with less unit. You would want to accumulate more during down time. So at the end of the day, are you trying to time the market? |

|

|

Apr 2 2020, 01:57 PM Apr 2 2020, 01:57 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

|

|

|

Apr 2 2020, 02:09 PM Apr 2 2020, 02:09 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(John91 @ Apr 2 2020, 02:02 PM) Sorry, I don't understand how this would be considered timing the market. Its still considered DCA innit, just on different timeframes? DCA itself has its good and bad. If the price is high, you’ll end up buying less unit and when the price is low, you’ll end up with more unit. So what DCA does is it actually averages out your profit/loss.So let’s say you already have one layer of DCA, which is investing monthly. Should you split it into weekly Because the market is volatile? That’s entirely up to you, but at the end of the day, you cannot time the market and no one knows if you are better of buying beginning of the month or split it to four times. |

|

|

Apr 3 2020, 11:52 AM Apr 3 2020, 11:52 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

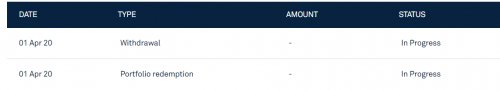

QUOTE(furious and fast @ Apr 3 2020, 09:20 AM) with the benefit of hindsight, anyone who had been doing DCA over the past few months or past few years would be in a LOSS position now. If everyone can time the market we would be rich already, how would you know when is the low to enter when is the high to exit? let me give example of doing the opposite of DCA 1. i had been saving money in FD since 2019. guarantee 4% per annum. zero risk 2. i deposit 10k in stashaway on 18 march 3. i exit on 1 April. REALIZED quick n easy profit 6%.  . .  . .  Quick and easy profit of 6% will also mean equal degree of losses to stomach. |

|

|

Apr 14 2020, 09:59 AM Apr 14 2020, 09:59 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

While there’s no reason to not split your DCA to few intervals, I think that it will be hard to manage your portfolio if you have too many DCA. At the end of the day, you are only minimizing your loss/gain.

But since SA does not incur a fixed fee on each transaction, I think a weekly DCA is good enough for most of us. |

|

|

May 26 2020, 09:32 PM May 26 2020, 09:32 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(iamwilliamcwl @ May 26 2020, 08:22 PM) Do you guys think worth paying them 5%? It's pretty simple actually, if you are paying 5% for sales charge, that is already 5% of book loss, compared to 1.75% on other platforms. I have invest a little money in PM for more than 2 years, don't see any return and still negative Thinking to move all my money to Stashaway... You have not even started, and you are already losing 5%. It will be hard to recover from there. |

|

|

Jun 12 2020, 02:20 PM Jun 12 2020, 02:20 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(walnut6363 @ Jun 12 2020, 12:49 PM) Then i think you are wrong about "tiny bit of funds we put in, not gonna chanhe your portfolio entirely" phrase. If one is able to enter and buy at low at the right timing, the portfolio earnings is gonna have big difference. Why do you even try to time the market with Stashaway? Even if you did enter at a lower price, will you sell it after it rise? No right. In the long run that “low” price that you enter at will not look low in the grand scheme of thing.I expected it will drop yesterday due to FED announcement and so i deposited 3x my normal DCA amount on Tuesday so that my buy order will be executed yesterday midnight. And i am correct and able to buy at low price yesterday. If today or next Monday DJ back to green, our returns will be alot difference. Not only buta-buta DCA, but at the same time try to time the market right to maximize our return. So yea DCA is for the long term and not for short term profit. |

|

|

Jun 15 2020, 12:47 AM Jun 15 2020, 12:47 AM

Return to original view | IPv6 | Post

#12

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

Wow

How does it compare to FSM Cash Management Fund 2 This post has been edited by victorian: Jun 15 2020, 12:47 AM encikbuta and Leo the Lion liked this post

|

|

|

Jun 15 2020, 09:57 AM Jun 15 2020, 09:57 AM

Return to original view | IPv6 | Post

#13

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

|

|

|

Jun 15 2020, 04:22 PM Jun 15 2020, 04:22 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

Dropped rm500 to simple just for fun as well.

Shouldn’t have any difference with CMF2 |

|

|

Jun 17 2020, 07:03 PM Jun 17 2020, 07:03 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

Different people different strategy and exit plan.

For me I just continue to DCA and I only withdraw if the return is positive and I really need the cash |

|

|

Jun 29 2020, 12:49 AM Jun 29 2020, 12:49 AM

Return to original view | IPv6 | Post

#16

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(iamshf @ Jun 28 2020, 11:07 PM) Anyone is Shopee voucher before? How RM15 annual fee is calculated ya? Not clear about clause 1, it means limited to 3 redemption per stashaway account? Assume I have RM1,000 in their account. Annual fee rate is RM8 per year. Will the annual fee be calculated daily and deducted from the RM15 every day? If I have RM10k, RM15 annual fee can last around 3 months right ? |

|

|

Jul 10 2020, 01:13 PM Jul 10 2020, 01:13 PM

Return to original view | Post

#17

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(nguminhuang @ Jul 10 2020, 11:45 AM) QUOTE(woonsc @ Jul 10 2020, 12:58 PM) Yea lol, the only reason your portfolio is good is because of the March crash. Normal days you won’t see this kind of returns |

|

|

Jul 20 2020, 09:01 PM Jul 20 2020, 09:01 PM

Return to original view | Post

#18

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

Anyone of your changed from direct debit to debit from Simple?

Will there be any delay compared to direct debit ? |

|

|

Jul 20 2020, 09:14 PM Jul 20 2020, 09:14 PM

Return to original view | Post

#19

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(ironman16 @ Jul 20 2020, 09:09 PM) Me Slower is okay for me, as long as the conversion rate is the same compared to normal direct debit.using simple to top up sure slower than jompay/ direct debit. Because plus one process >>> redeem from eastspring + the money appear in your account >> baru start invest compare to jompay >>> direct invest but many ppl tell me since its DCA, so we not timing the market ma.....just let it auto i tengah fikir mahu tukar or not The reason I want to switch to simple is because it’s a bit messy seeing my bank account getting debited frequently for StashAway DCA. My FSM DCA stays in FSM, so I would like to do the same to StashAway as well |

|

|

Jul 27 2020, 10:46 AM Jul 27 2020, 10:46 AM

Return to original view | IPv6 | Post

#20

|

Senior Member

5,587 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(alpha001 @ Jul 27 2020, 10:39 AM) Noted. I just created SA account 2 month ago. Confused with multiple portfolio. 12% and 14% will not have any difference. For me the 2% difference i risk index is negligible. I am still in early "experiment stage" . Only few k is deposited. Once i am more confident, i will put more money. I will stick to single portfolio for now. Diversifying is good, but do not overdo it |

| Change to: |  0.0977sec 0.0977sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 08:54 PM |