QUOTE(honsiong @ Mar 31 2019, 04:03 PM)

A bit off topic from this thread, still believing crypto is the future or sell them all already?Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 31 2019, 04:21 PM Mar 31 2019, 04:21 PM

Return to original view | Post

#1

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

|

|

|

Mar 31 2019, 10:18 PM Mar 31 2019, 10:18 PM

Return to original view | Post

#2

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Apr 6 2019, 12:42 PM Apr 6 2019, 12:42 PM

Return to original view | Post

#3

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Jun 28 2019, 10:15 PM Jun 28 2019, 10:15 PM

Return to original view | Post

#4

|

Senior Member

785 posts Joined: Mar 2012 |

Second robo advisor coming to Malaysia,

https://fintechnews.my/20967/wealthtech-mal...o-robo-advisor/ Official website and pricing structure, https://mytheo.my/mytheo/hello-from-mytheo/price-structure Edit: Not sure was it an old news for you all, just sharing as I seeing the above article today. This post has been edited by vanitas: Jun 28 2019, 10:20 PM |

|

|

Jul 25 2019, 07:59 PM Jul 25 2019, 07:59 PM

Return to original view | Post

#5

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(kelvinfixx @ Jul 25 2019, 01:17 PM) My question is, since there is no dividend or interest given every year, so there is no compound interest? 1. There will be dividends for reinvestment.So it depends on the performance of the etfs when we are ready to cash out. It purely bet on the future market. 2. It depends how you interpret compound interest. Is reinvestment considered as compound interest for you? Or you only consider something like e.g. FD 4% compound interest per year? 3. And yes it depends on the performance of the etfs, and SA's optimization feature. You may lose money here, both short term and long term. But in long term, the probability to lose money is much lower. This post has been edited by vanitas: Jul 25 2019, 08:00 PM |

|

|

Jul 28 2020, 02:03 PM Jul 28 2020, 02:03 PM

Return to original view | Post

#6

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

|

|

|

Jul 28 2020, 02:12 PM Jul 28 2020, 02:12 PM

Return to original view | Post

#7

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Jul 28 2020, 02:53 PM Jul 28 2020, 02:53 PM

Return to original view | Post

#8

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(zstan @ Jul 28 2020, 02:48 PM) not bad enough for people to withdraw money and close account lor. Security leak, debit card kena deducted, always under maintenance for fun, cannot do bank transaction, but don't see people changing banks For CIMB, I think many people changing bank and complain in this forum alone, no? |

|

|

Jul 28 2020, 03:09 PM Jul 28 2020, 03:09 PM

Return to original view | Post

#9

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(zstan @ Jul 28 2020, 02:55 PM) based on the small sample size on people bitching on my fb, the same people still using cimb for their business and personal use Because they are not affected? I am also using CIMB, but didn't get the trouble as other users getting thus didn't intend to change bank.So I think those affected by SAMY bugs reserved the right to complain them, complain SC or even withdraw all money from them? I don't get those unaffected by the bugs keep protecting SAMY for what actually. |

|

|

Jul 28 2020, 04:39 PM Jul 28 2020, 04:39 PM

Return to original view | Post

#10

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(majorarmstrong @ Jul 28 2020, 04:31 PM) it is financial footprint that should not be modify I support uncle on this. Canceling auto-debit should be notified. It is not a trivial matter at all.they should have proactively inform me that we have cancel the auto debit which schedule on monday and will: 1. refund all the money including the 1st 1k that is suppose to be invested OR 2. refund the wrongly auto debit and the 1k will be invested soon so do you know which option are they taking? that is why they have to communicate without just changing the status |

|

|

Jul 28 2020, 09:25 PM Jul 28 2020, 09:25 PM

Return to original view | Post

#11

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(djhenry91 @ Jul 28 2020, 09:17 PM) they havent see stock market vendor trading platform down issue for 1 hours plus.. I think platform down is a much smaller issue than unauthorized debit.here all because one direct debit issue sudah got trust issue.. ahh nvm..no point i talking right now because i got see the worst nightmare |

|

|

Jul 28 2020, 09:43 PM Jul 28 2020, 09:43 PM

Return to original view | Post

#12

|

Senior Member

785 posts Joined: Mar 2012 |

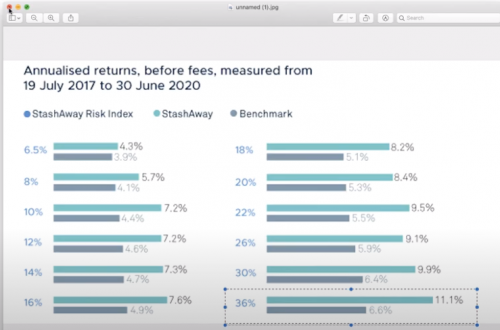

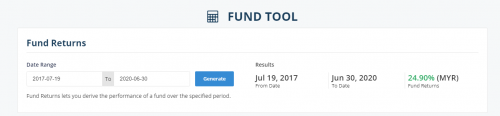

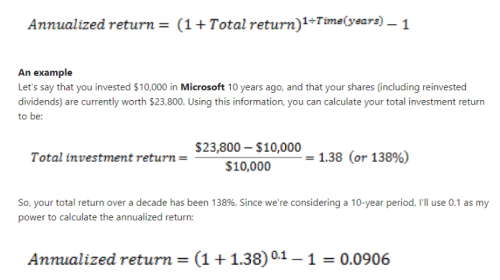

QUOTE(tadashi987 @ Jul 28 2020, 09:32 PM) i obtained annualized return rate from 19 Jul 2017 - 30 Jun 2020 benchmark SA8 from source  then i obtain the same period cumulative return rate from FSM using FSM tools  convert them to annualized return rate using  i compared with some fixed income funds from FSM SG too. here my results in performance descending. annualized return rate from 19 Jul 2017 - 30 Jun 2020 benchmark SA8 amanah syariah trust FI = 7.99% nomura i-income FI = 7.83% Eastspring Investments - US High Investment Grade Bond AS SGD = 5.98% StashAway 8 = 5.7% United High Grade Corporate Bond A Acc SGD = 5.51% Legg Mason Western Asset - Global Bond Trust A Acc SGD = 4.21% just for sharing, any input is welcome, in case my calculation is wrong or so. But certainly some funds in the same risk category would outperform it even with higher fees. In the low risk category i.e. bond / fixed income, the fee in fund isn't high at the first place, so it is even easier to outperform Stashaway. This post has been edited by vanitas: Jul 28 2020, 09:45 PM crazytaxi123 and tadashi987 liked this post

|

|

|

Jul 28 2020, 09:43 PM Jul 28 2020, 09:43 PM

Return to original view | Post

#13

|

Senior Member

785 posts Joined: Mar 2012 |

Double post

This post has been edited by vanitas: Jul 28 2020, 09:44 PM |

|

|

|

|

|

Jul 28 2020, 09:56 PM Jul 28 2020, 09:56 PM

Return to original view | Post

#14

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(djhenry91 @ Jul 28 2020, 09:51 PM) actually platform down at market open is much bigger issue thn unauthorized debit.. Yes, it is still an issue. But perhaps you can call broker to sell instead?let say share price keep drop more thn 20%..but platform cant login to sell the share..losses how? who bear? if unauthorized debit, can refund 100% ma.. so u think..which is bigger issue.. Anyway it was a big IF drop >20%. There might be also IF you are paying surgery fee in hospital but bank money got drained all? |

|

|

Jul 28 2020, 10:05 PM Jul 28 2020, 10:05 PM

Return to original view | Post

#15

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(djhenry91 @ Jul 28 2020, 10:01 PM) problem is..what if u call ur remisier, ur remisier others few hundred client also same time call him.. The IFs goes on. But public generally accepted any platform / website went down (even Google, banks), but not unauthorized transaction. Because platform down is common, but this auto debit is really first time.how ya.. and..what if broker trading platform also down due to tht vendor? how ya? |

|

|

Jul 29 2020, 12:14 AM Jul 29 2020, 12:14 AM

Return to original view | Post

#16

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(tsutsugami86 @ Jul 29 2020, 12:02 AM) If next time got one banker accidentally transfer money wrongly to my account, will I need go to jail due to I stole someone money? If next time got one banker accidentally transfer your money wrongly to my account, will you still believe the banker?If just a human error did by curlec, SA already do their best to refund all the money. Those 2nd or 3rd batch auto debit may be just because key in wrongly by curlec and the system automaticly follow the instruction to process, SA should not able to stop it. Some will forgive, some won't, as simple as that. |

|

|

Jul 29 2020, 12:24 AM Jul 29 2020, 12:24 AM

Return to original view | Post

#17

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(honsiong @ Jul 29 2020, 12:18 AM) I think I am more scared of StashAway backend making rogue trades than just accidentally debiting my bank accounts. Coz that one will give us unintended exposures to risks we didnt sign up for. Actually there is no details on the issue yet. Stashaway claimed it is Curlec problem, and everyone believes lol. I see Curlec is used by Axiata, HellloGold and more (according to their home page), but no issue on them?What if Stashaway backend got bit issue too... |

|

|

Jul 29 2020, 12:27 AM Jul 29 2020, 12:27 AM

Return to original view | Post

#18

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Jul 29 2020, 12:53 AM Jul 29 2020, 12:53 AM

Return to original view | Post

#19

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Jul 29 2020, 01:12 AM Jul 29 2020, 01:12 AM

Return to original view | Post

#20

|

Senior Member

785 posts Joined: Mar 2012 |

|

| Change to: |  0.0385sec 0.0385sec

0.23 0.23

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 25th November 2025 - 10:56 PM |