Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

vanitas

|

Jan 31 2021, 09:48 PM Jan 31 2021, 09:48 PM

|

|

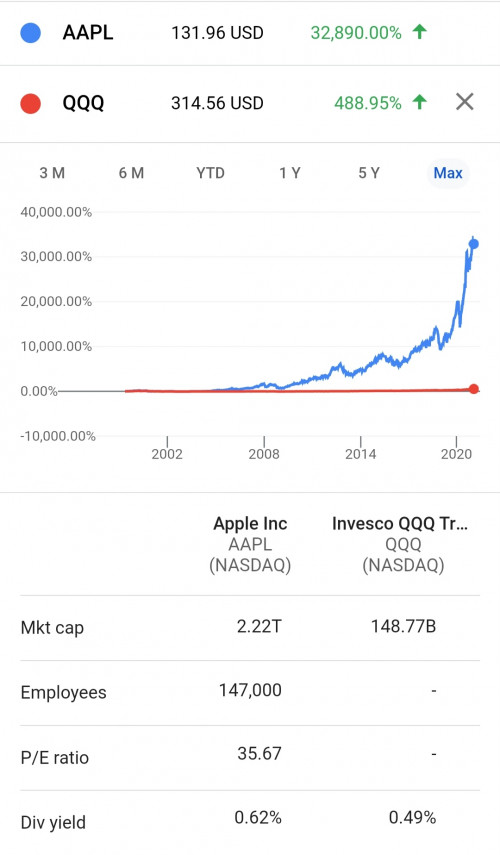

QUOTE(backspace66 @ Jan 31 2021, 09:29 PM) Dont have to preach here, everyone know s&p 500 based etf will give average return of the s&p 500 for sure it could not be as nearly as good as the best performing one or as bad as the least performing one. Yes, everyone know s&p 500 etf would be average return, but not everyone know how much different from a good one and average one over a long course of time. It is all about risk and reward, I am giving data for anyone who wish to compare, not preaching anything. Ultimately, it is just one question for forumer asking earlier, do you think AAPL will performs above average among s&p 500 for long term? |

|

|

|

|

|

vanitas

|

Jan 31 2021, 09:57 PM Jan 31 2021, 09:57 PM

|

|

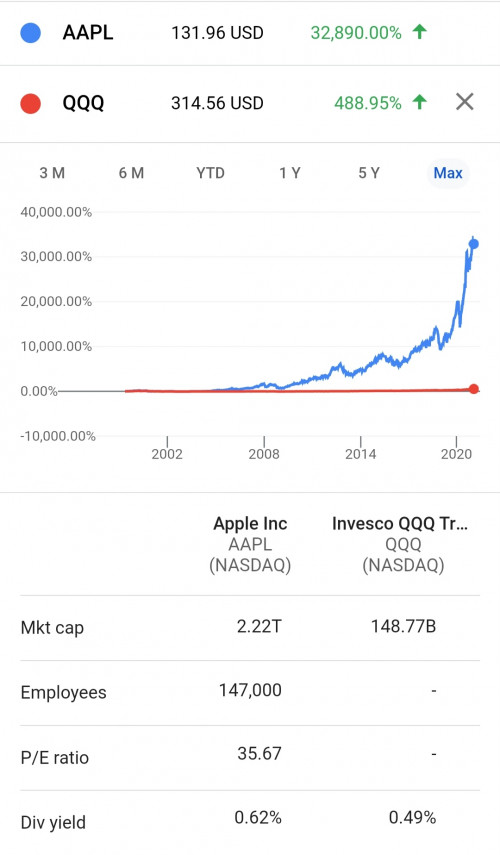

QUOTE(backspace66 @ Jan 31 2021, 09:29 PM) Dont have to preach here, everyone know s&p 500 based etf will give average return of the s&p 500 for sure it could not be as nearly as good as the performing one or as bad as the least performing one. Since so many talking about tech bubble, then it is more relevant to QQQ and you should have compared to that.   For comparison. For first image, Microsoft is 503%, QQQ is 488% return since inception. This post has been edited by vanitas: Jan 31 2021, 09:58 PM |

|

|

|

|

|

vanitas

|

Jan 31 2021, 11:44 PM Jan 31 2021, 11:44 PM

|

|

Please don't be penny wise, pound foolish.

If you think it is a good investment, go for it. Whether stock, UT, stashaway or anything else.

Imagine 10 years ago, you got a choice, but because of high fee, you missed AAPL.

For unit trust, it is higher fee, but there are still some sector/regional funds available only on UT currently. If you want concentrate on those areas, it is still a good choice.

This post has been edited by vanitas: Jan 31 2021, 11:47 PM

|

|

|

|

|

|

vanitas

|

Feb 6 2021, 06:47 PM Feb 6 2021, 06:47 PM

|

|

If having difficulty to choose lump sum or DCA, then 50% lump sum, 50% DCA.

This saves your time to think, and for sure give the average result, not best or worst which might makes you regret later.

|

|

|

|

|

|

vanitas

|

Feb 10 2021, 11:01 AM Feb 10 2021, 11:01 AM

|

|

QUOTE(halotaikor. @ Feb 10 2021, 10:53 AM) the main problem is i dont believe in Tesla. if put in SA at least can dampen the crash. compared to ARK's 10% holding. I am also very skeptical of Tesla, especially after its investment in Bitcoin. What will be your reasoning that Tesla is a bubble? |

|

|

|

|

|

vanitas

|

Feb 10 2021, 12:09 PM Feb 10 2021, 12:09 PM

|

|

QUOTE(cucumber @ Feb 10 2021, 11:14 AM) It's written by a long time Tesla bear and has a price target of $67 per stock. You gotta be kidding me. I'm not a Tesla fanboy but come on. He's expecting Tesla to crash 90% from here? I see BTC as a good thing. I am not even sure how was it a good thing. Tesla is EV company, doesn't have any relation with crypto. It was like telling Maybank (or any bank), TNB, Top Gloves, or even EPF buy crypto is a good thing. |

|

|

|

|

|

vanitas

|

Feb 10 2021, 05:41 PM Feb 10 2021, 05:41 PM

|

|

QUOTE(halotaikor. @ Feb 10 2021, 05:02 PM) nahhh even if tesla will be a 3 trillion company in 20 years, i wont pay for it now. its like you telling me one day your child will become usain bolt, so i should pay him 20 million in advance. why should i ? did he proof anything? dont talk about hedging usd, that just an excuse to cover up tesla balance sheet. you want to hedge, use gold. why bitcoin? elon musk just want publicity. Hedging USD by playing forex with leverage (if bitcoin is a currency). I hope the fanboys realised bitcoin can up 2x or drop 50% easily. This is clearly a risky investment, or speculation, but not hedging currency risk. And no asset only up up up, even land and gold which also limited. |

|

|

|

|

|

vanitas

|

Feb 10 2021, 07:18 PM Feb 10 2021, 07:18 PM

|

|

QUOTE(xander83 @ Feb 10 2021, 06:18 PM) How you know that Tesla doesn’t hedge gold? Tesla has hedge in several other commodities which are in different in their assets which are better performing than gold Companies use hedge to grow value not preserve value hence it make sense buy growth assets now like bitcoin Only a fool like you still buy gold because it is not growth asset but preserve asset  Tesla become hedge fund now. Hedging currency risk and use hedge to grow value is different. |

|

|

|

|

Jan 31 2021, 09:48 PM

Jan 31 2021, 09:48 PM

Quote

Quote

0.0483sec

0.0483sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled