QUOTE(Ancient-XinG- @ Mar 14 2022, 03:07 PM)

QUOTE(DragonReine @ Mar 14 2022, 04:12 PM)

KEKW always hindsight eh?

when gold price tanked "SA should reduce gold"

when KWEB moon "why not enough KWEB"

when KWEB tanked "why keep KWEB"

IMO, SA if anything is proving that their version of diversification is in fact doing decent enough to weather the back-to-back storms in stock markets for the past 3 years without significant drops in value, as they claimed in their product marketing. Which is good enough for some but for others who have different expectations is not enough. And that's fair, some people would rather pursue other avenues for investment profit.

My only unker two sen to others reading is that you should be careful that you're not constantly hopping from investment to investment because you're always feeling "not good enough", it's a mental trap that can lead to buying things at hype price if you don't read and understand the market fundementals of where you're putting your money into.

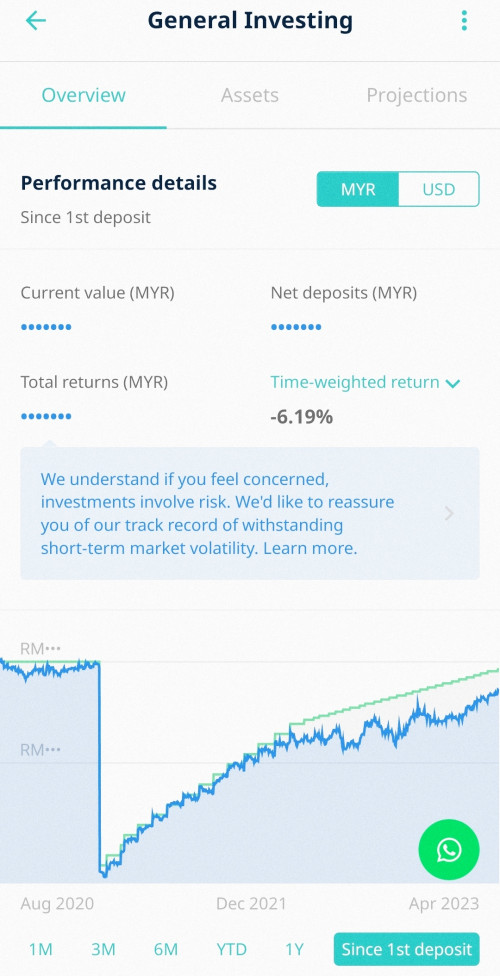

Admittedly I was one of the haters, because I entered SA at Aug 2020 (right before gold started tanking) lol. Actually thankful now for having some exposure to gold!when gold price tanked "SA should reduce gold"

when KWEB moon "why not enough KWEB"

when KWEB tanked "why keep KWEB"

IMO, SA if anything is proving that their version of diversification is in fact doing decent enough to weather the back-to-back storms in stock markets for the past 3 years without significant drops in value, as they claimed in their product marketing. Which is good enough for some but for others who have different expectations is not enough. And that's fair, some people would rather pursue other avenues for investment profit.

My only unker two sen to others reading is that you should be careful that you're not constantly hopping from investment to investment because you're always feeling "not good enough", it's a mental trap that can lead to buying things at hype price if you don't read and understand the market fundementals of where you're putting your money into.

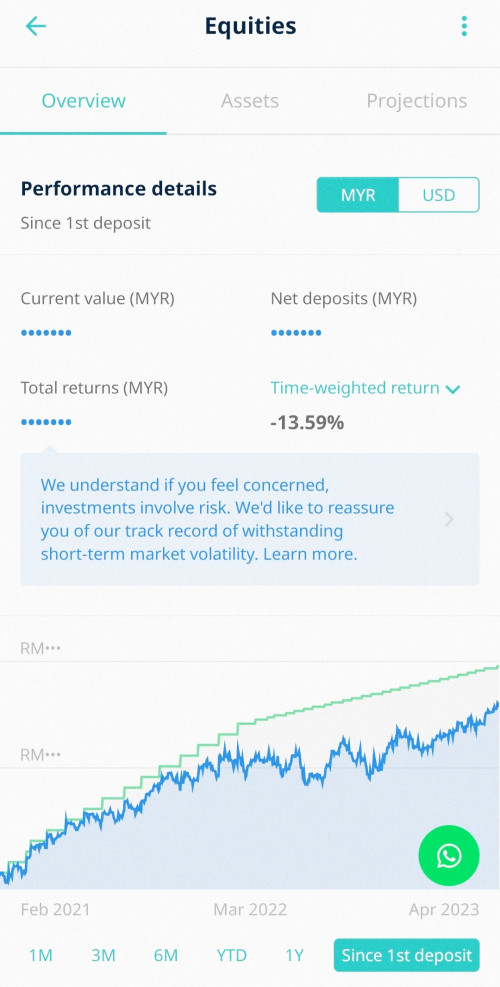

Few months down the road, I was salty that everyone was earning a lot while I was suffering losses from gold ATH entry. So on Feb 2021, I split 50% portfolio into 36%... Few days after my buy/sell orders locked in, KWEB tanked from its ATH

SO YEAH, I'm one of the idiots who hopped "from investment to investment because you're always feeling "not good enough"", and immediately suffered the consequences. My only saving grace was keeping my other half in the lower risk profile for diversification.

It does make me wonder however, whether SA might be repeating the very same mistake? I'm still banking on KWEB bouncing back eventually in a long term (3+ years) horizon, mainly because I believe the big tech companies will still be around serving 1.4 billions of Chinese even without the rest of the world. I'm not happy that SA is completely exiting China markets, but I'm not sure if I'm too optimistic with China companies.

Mar 14 2022, 08:04 PM

Mar 14 2022, 08:04 PM

Quote

Quote

0.4405sec

0.4405sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled