QUOTE(pinksapphire @ May 27 2021, 02:22 PM)

Thanks for sharing your views.

Btw, when you said little spare cash...did you mean that you don't keep any in FDs? Reason for asking is I see more people are conserving cash. I see FDs in some ways, as cash, since returns are low, but at least still something than zero.

These days, I highly doubt anyone who says "cash" means literal bank notes and/or coins. So yes you're right - FD is in fact "cash", added with the fact that you can easily do them online, so it's not like the past where you had to go to bank counters queue to place/withdraw. It's almost as liquid as your regular saving account, but with higher interest.

QUOTE(blackchides @ May 26 2021, 12:13 AM)

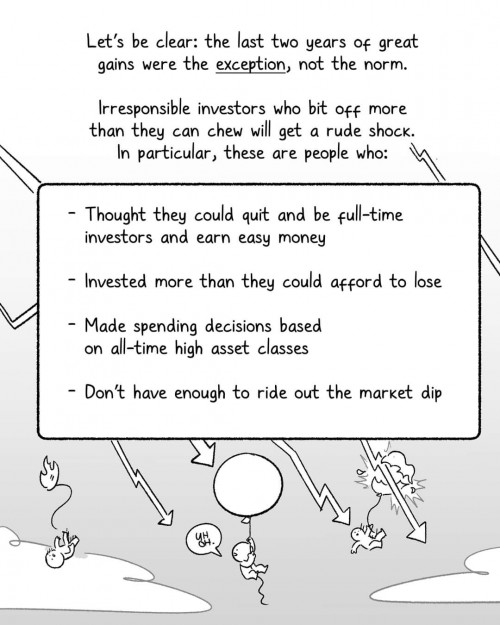

It's been talked to death in this thread but just want to point out for transparency that generally speaking, (1) DCA itself is a form of timing the market because you're deliberately choosing not to invest now on the fear that the market may dip in the future, (2) history favours lump sum investing over DCA approximately 2/3 of the time.

You can check out a couple of links here on the subject:

https://www.forbes.com/sites/robertberger/2...sh=6fb5351e7c50https://ofdollarsanddata.com/dollar-cost-av...ng-vs-lump-sum/However, it comes down to an individual's risk tolerance - if DCA is psychologically more comforting and helps you sleep better at night, then absolutely go for DCA.

I am personally a bit impatient and don't like waiting for my money to start working for me, so knowing the historical data and that my investment horizon is long term, I am very comfortable just investing lump sum.

Go with the strategy that you're most comfortable with and that will allow you to stay invested during the downturn without being tempted to pull out your funds.

QUOTE(lee82gx @ May 27 2021, 09:40 AM)

No luck involved. I am not talking about accidentally lump suming during the dips.

Now if you do your homework right, as in select the right investments such as stashaway or a good stock or a good ETF, history has already proven that it rises over time. End of story.

Anytime you think it is all time high, get scared, fall back to DCA, only to prove yourself right in the first place(yes this is a good investment), yes it is rising, but then you maintain your DCA pace, you just buy less and less.

The only time DCA works better is when the market is actually going down, not up. In that case yes you get more, but it helps me not much to see that it is still actually going down. Again by the case of maths and probability of a good instrument which should generally be going up, this scenario should be way less in occurrence than the going up scenario, which you will profit more by lump sum and forget.

I dont beat myself up, I have almost not much in spare cash lying around.

But I will not shame anybody who stick to DCA.

My take on DCA vs lump sum (high5 if anyone said the same in this sea of 10k+ replies!):

- Why/How is DCA better for your mental/emotional state? It is because you're no longer making a decision on when to put in, so you're no longer "directly accountable" to your action.

- On the other hand with lump sum, your time of entry is in your hands. If you happened to enter at a certain peak, then the next days/weeks it dips, it's very easy to think, "damn, if only I did this a bit later", then you feel bad every time you look at this red portfolio. I'm not talking about paper hands pulling out immediately, but the psychological damage that your decision has a direct impact and it reflects on your profile.

- for SA, I am more inclined to advise to DCA for a few reasons:

1) you're here because you want someone else to manage your money, probably because you can't (knowledge, time, effort, whatever).

2) SA processing is not instantaneous (a few business days); timing the market is less effective and you have less control

3) SA has a vast portfolio that you need to track: multiple ETF, gold price, global market etc. It's a lot more difficult than focusing on a single option as compared to your DIY

- Instead, I strongly recommend lump sum approach on DIY - to actually have your own account on a brokerage and do your trading

1) each trade has a fee; you want to minimise the fee by trading as much as possible in one go

2) the opposite of points 2) and 3) for SA.

3) sure you'll feel the same pain if you lump sum at a bad timing, but what I'm saying is - feel the pain on where you have more control on so you can learn easier.

Anyway, definitely try out both and reflect on it -- that's when you'll learn what you really prefer for yourself (just be warned of the potential "lesson fee" that you may lose to market

)

May 23 2021, 05:50 PM

May 23 2021, 05:50 PM

Quote

Quote

0.4547sec

0.4547sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled