QUOTE(hadesshadow @ Feb 2 2021, 12:57 AM)

Hi, I'm new to SA (and investment in general). Thought of kick starting with SA and some individual stocks in the US. Would like to get some some advice and have some very noob questions : l

If my target return by end 2021 is let's say 10%, does it make sense to split into 2 portfolios:

- 60% fund to 16% risk

- 40% fund to 30% risk

(will try to double up the sum if the market drops in specific months, and am keeping these 'rescue funds' in SA simple for easy transfer.)

And should I do it as a lumpsum, or monthly recurring deposit (is the interest compounded on monthly basis on SA)? How do I calculate the difference between projected returns for lumpsum vs compounded monthly?

Thanks!

On your splits it all depends on the liquidity versus return as it depends on the markets and if your split is because of liquidity If my target return by end 2021 is let's say 10%, does it make sense to split into 2 portfolios:

- 60% fund to 16% risk

- 40% fund to 30% risk

(will try to double up the sum if the market drops in specific months, and am keeping these 'rescue funds' in SA simple for easy transfer.)

And should I do it as a lumpsum, or monthly recurring deposit (is the interest compounded on monthly basis on SA)? How do I calculate the difference between projected returns for lumpsum vs compounded monthly?

Thanks!

Lump sum and DCA are subjective because it can be only calculated based on the executed buy order. There isn’t no compounded interest only unrealised gains or loss subject to market valuation. It is not fixed as markets can go down hence your portfolio is down.

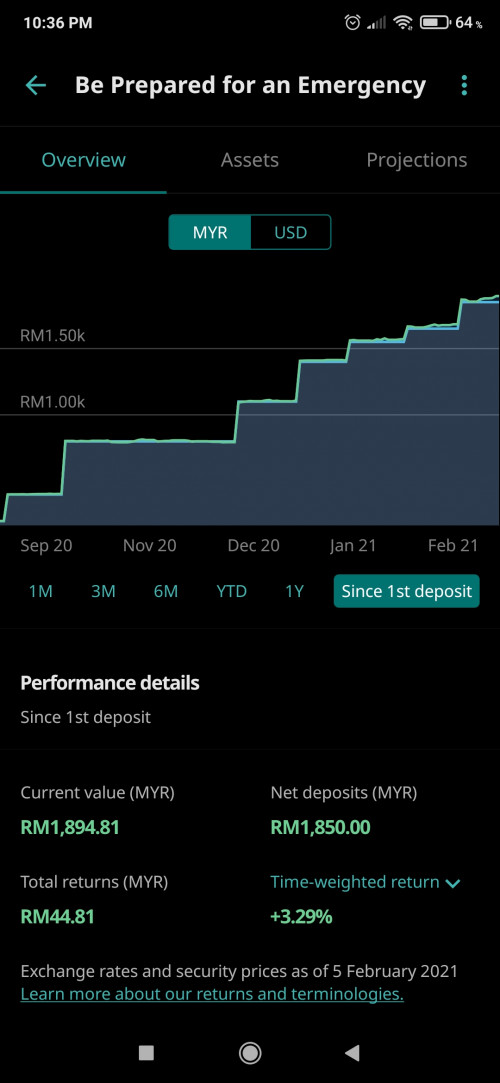

The only projected returns is to use goal based investing to set the targets

Remember Past performance doesn’t reflects future returns as it can be higher or lower all depends on markets

Feb 2 2021, 03:47 AM

Feb 2 2021, 03:47 AM

Quote

Quote

0.4976sec

0.4976sec

1.20

1.20

7 queries

7 queries

GZIP Disabled

GZIP Disabled