Hi all,

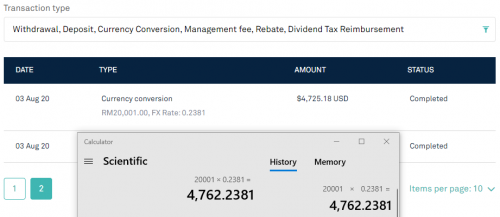

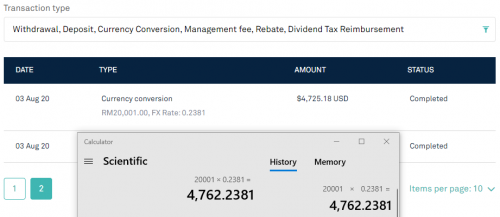

Question about SA's conversion rate - I don't like what I'm seeing but I might be wrong in this. Here's a snapshot of my SA transaction history:

The transfer fee was USD37.0581, considering SA's exchange rate displayed there, there was a hidden processing fee of 37.0581 USD.

Now to reverse engineer to find out what was the MYR>USD rate on 3 Aug 2020:

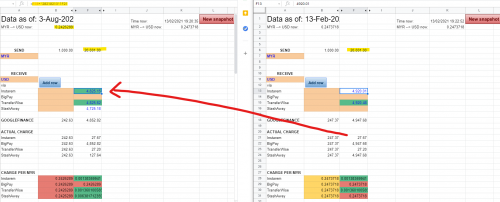

Today (13 Feb), 1MYR = 0.2473718USD

On 3 Aug, 1MYR = 0.2473718 - 0.0047429 =

0.2426289

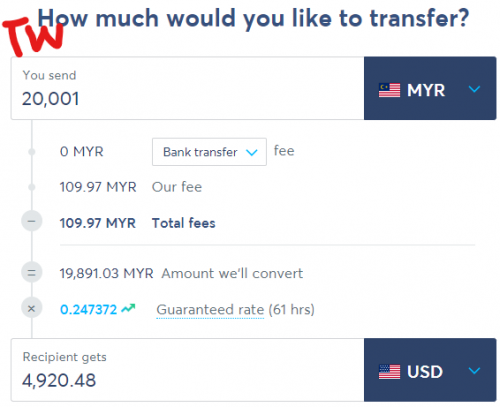

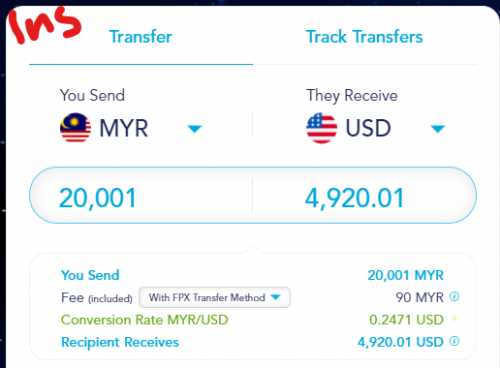

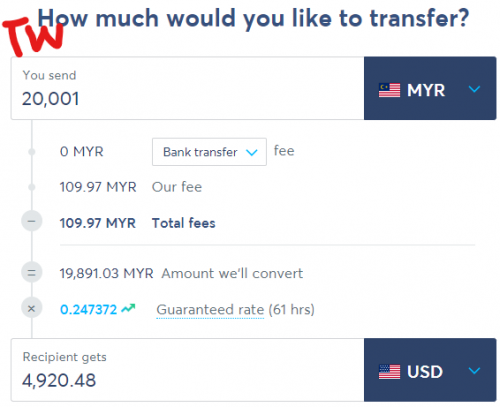

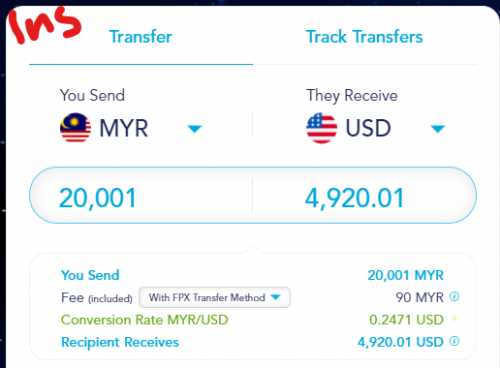

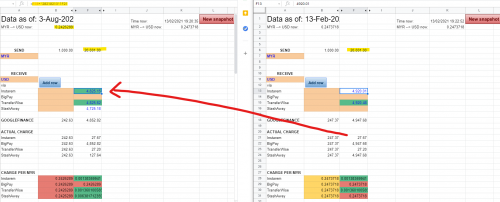

But of course, I have no way to reverse engineer fintech's or bank's offers so I went to Instarem and TransferWise to check the rates, and plotted them onto my own transfer rate calculator (Special thanks to a forumer who did a sheet like this himself, I made my own copy with some additional functions). Google finance is the benchmark, and the various fintechs are more realistic values:

TW and Instarem:

Excel comparison:

RHS: Today's exchange. I'm taking 27.67 USD as the actual charge incurred for the exchange and put that into 3 Aug sheet (LHS). Meaning, if I did the transfer on 3 Aug instead using TransferWise, I would've receive approx 4825 USD instead.

That is 100 USD spread from SA's conversion compared to other fintechs! Did I miss out something or is SA conversion rate really that bad?

inb4 "Why are you trying to reverse engineer this?"

I didn't know what I was doing back then, now I want to know if I should continue keeping my money in SA or take it out to invest manually. Frankly speaking, the performance has been disappointing, and I want to know why.

On top of that, there's a 3+USD conversion back to RM to pay the management fee every month, so shitty conversion rate would really hurt investments in SA.

OR, if anyone is going to make a deposit into SA soon, please do me a favour and compare your post-conversion amount to other fintechs? Thank you!

Did you factor in conversion rate of additional 0.1% against spot rate charged by Citibank when you deposit?

At that time your rate should be around there as you cannot compare financial instructional spot rate versus those transfer fintech specialist as the spot rate has been imposed to merchant which bear the cost/commission by them

Management fee is so minisicule 0.0125% per month which is nothing for your account base and you didn’t currency will fluctuate/appreciate on daily basis which is wrong comparison

If you wanna save better with your money go buy direct ETFs with your kinda money then you will how much charges when it comes to brokerage, conversion etc which is impossible when you factor in 0.5% versus 0.8% on yearly basis

Feb 11 2021, 02:37 AM

Feb 11 2021, 02:37 AM

Quote

Quote

0.4838sec

0.4838sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled