Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

GrumpyNooby

|

Feb 17 2021, 07:18 AM Feb 17 2021, 07:18 AM

|

|

QUOTE(ironman16 @ Feb 17 2021, 06:06 AM) Boss, wanna ask about this etf. Got sales charge for this etf? Or platform fee?I go flip2 but still dun under stand the fee involved. Only know the fee involve in mutual fund. I do purchase mutual fund that invest in this etf, by affin oso with sales charge 1% (but now is 0% sales charge) Fee to buy this ETF directly from Bursa Malaysia depends on your trading account that you opened with investment house/platform. There is min fee for each buy and sell order. And also liquidity of local ETFs (volume) is not as inspiring as those listed at NYSE. |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 07:40 AM Feb 17 2021, 07:40 AM

|

|

QUOTE(ironman16 @ Feb 17 2021, 07:21 AM) I know it under affin, but makin tengok makin blur, totally not same with mutual fund. No sales charge? If oledi add into the NAV it's OK. https://tradeplus.com.my/new_china-trackerAt first wanna go with this etf but last just use allocate plus buy mutual fund that invest in this etf. ETF is exchanged traded fund which is not exactly similarly to unit trust fund. ETF is usually be bought directly via trading platform unless there's a feed fund by mutual/unit fund manager. Each matched buy and sell order placed in the trading platform will be incurred with fee. There's also stamp duty and clearing fee which is not as significant as the brokerage fee. Also it has annual management fee like unit trust but it won't be as high as unit trust fund. This post has been edited by GrumpyNooby: Feb 17 2021, 07:49 AM |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 08:26 AM Feb 17 2021, 08:26 AM

|

|

QUOTE(prophetjul @ Feb 17 2021, 08:03 AM) KraneShares CSI China Internet ETF |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 10:18 AM Feb 17 2021, 10:18 AM

|

|

QUOTE(prophetjul @ Feb 17 2021, 10:17 AM) i just joined SA. And today i received a message that says that i authorised my bacnk to pay Pacific Trustees Berhad , limit MYR30,000.00 is successful. IS THIS NORMAL? You subscribed to periodical direct debit? |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 11:56 AM Feb 17 2021, 11:56 AM

|

|

QUOTE(Hoshiyuu @ Feb 17 2021, 11:54 AM) Huh. That's weird. The nature of ETF ( Exchange-Traded-Fund) is to be traded on stock exchange, the hell is Affin doing putting ETF on their Allocate Plus (i assume this is the platform you are referring to) lmao Kenanga bought ValueCap. Maybe Kenanga will be selling ETFs on their platform soon. ValueCap has several ETFs in Bursa Malaysia. |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 12:13 PM Feb 17 2021, 12:13 PM

|

|

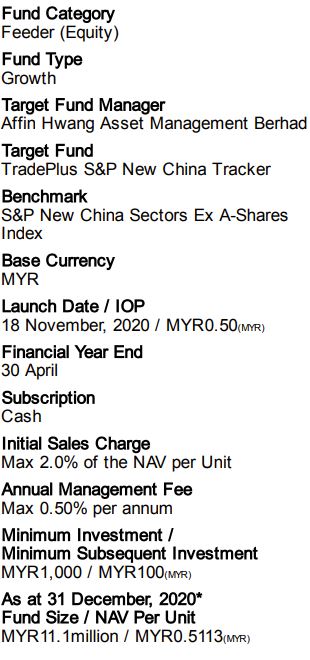

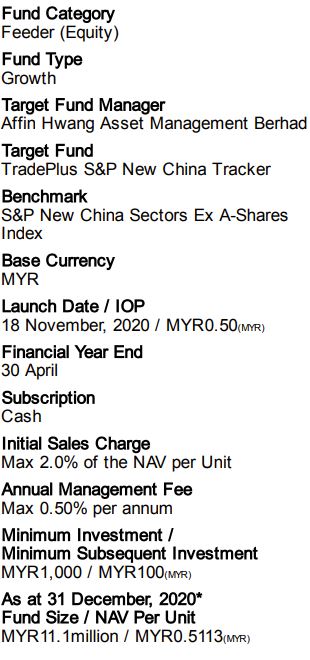

QUOTE(ironman16 @ Feb 17 2021, 12:11 PM) Ya, the name is affin hwang new China tracker fund. Its on allocate plus n almost all in this etf. Sementara wait I kaji this etf, I just stick to this mutual fund first. 👍👍 It is a feeder fund feeding into that ETF. Affin Hwang New China Tracker Fund: https://nadiablob.blob.core.windows.net/fun...FFS_NCTFHCF.pdf This post has been edited by GrumpyNooby: Feb 17 2021, 12:16 PM This post has been edited by GrumpyNooby: Feb 17 2021, 12:16 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 17 2021, 01:09 PM Feb 17 2021, 01:09 PM

|

|

QUOTE(ironman16 @ Feb 17 2021, 01:06 PM) ya , i know but seen like i not familiar with etf, so stick to this mutual fund first....  i think may b not berbaloi sikit seen it charge 2 times in affin , but nvm, now is promo period, 0% sales charge....in dulu...  If your holding are substantial, to be cost effective is buy the ETF directly. Same discussion have be done over and over between ARKK ETF and Affin Hwang WS - Global Disruptive Innovation Fund - MYR Hedged |

|

|

|

|

|

GrumpyNooby

|

Feb 18 2021, 02:00 PM Feb 18 2021, 02:00 PM

|

|

QUOTE(no6 @ Feb 18 2021, 01:58 PM) may i know any reason why the total amount for currency conversion (usd) is not tally with the total amount for buy order (usd) ? Citibank charges 0.1% as fee |

|

|

|

|

|

GrumpyNooby

|

Feb 18 2021, 05:10 PM Feb 18 2021, 05:10 PM

|

|

App update for Android

//Have you heard? We're now managing more than $1 billion USD. Thanks to everyone who was part of this milestone. We can't wait to celebrate your financial milestones, too!

While we do like celebrating, we also love working (seriously, we do). With this release, we've added a new Academy course. Check out 'A Deep Dive into StashAway's Asset Allocation Investment Framework', and hear our CIO, Freddy, explain everything you need to know about our investment framework. It pairs nicely with popcorn.

|

|

|

|

|

|

GrumpyNooby

|

Feb 19 2021, 01:48 PM Feb 19 2021, 01:48 PM

|

|

QUOTE(prophetjul @ Feb 19 2021, 01:44 PM) Do they show what they actually invest in details and not just general sectors for each portfolio? If you want details of each ETF, go dig into respective ETF factsheet. https://www.etf.com/ |

|

|

|

|

|

GrumpyNooby

|

Feb 19 2021, 01:49 PM Feb 19 2021, 01:49 PM

|

|

QUOTE(prophetjul @ Feb 19 2021, 01:49 PM) Right now i have not actually invested yet. And i cannot see the ETFs that they are in. Has your buy order completed? |

|

|

|

|

|

GrumpyNooby

|

Feb 19 2021, 01:51 PM Feb 19 2021, 01:51 PM

|

|

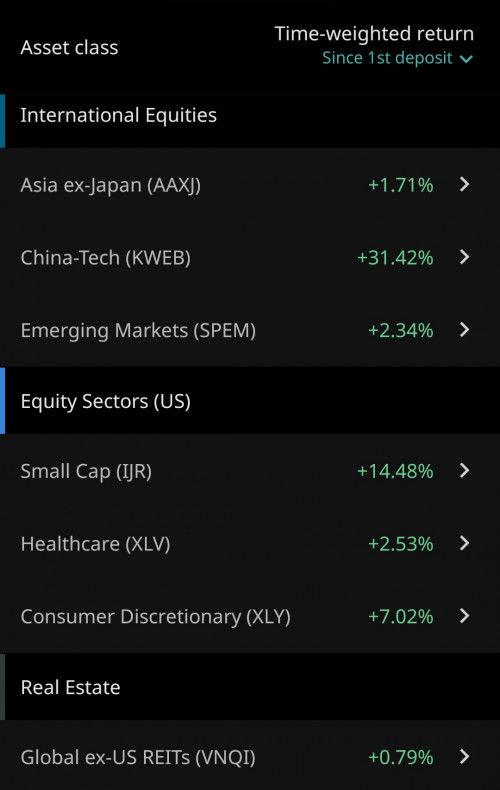

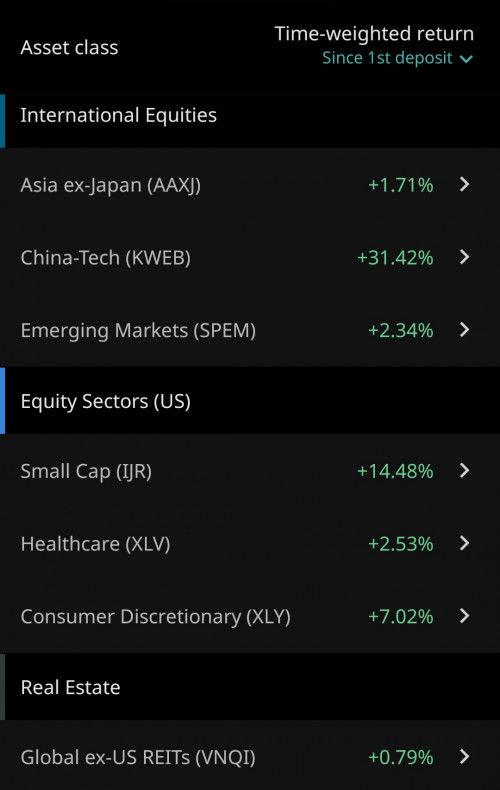

QUOTE(prophetjul @ Feb 19 2021, 01:50 PM) No. i just received my approval. Then wait till it gets completed and you'll be able to see the screen like shared earlier:  |

|

|

|

|

|

GrumpyNooby

|

Feb 19 2021, 01:54 PM Feb 19 2021, 01:54 PM

|

|

QUOTE(prophetjul @ Feb 19 2021, 01:51 PM) Thank You very much.  Here's list of all ETFs available in SAMY: https://www.stashaway.my/r/stashaways-etf-selectionBased on your risk %, the ETF may or may not available to your portfolio. |

|

|

|

|

|

GrumpyNooby

|

Feb 19 2021, 06:07 PM Feb 19 2021, 06:07 PM

|

|

QUOTE(skyvisionz @ Feb 19 2021, 06:06 PM) Do the transfer duration from simple to risk portfolio same as direct deposit from bank to risk portfolio? Slower. |

|

|

|

|

|

GrumpyNooby

|

Feb 22 2021, 09:18 AM Feb 22 2021, 09:18 AM

|

|

QUOTE(xander83 @ Feb 22 2021, 05:38 AM) Your Virgin buy will be happening on Wed  What is Virgin? New product from SAMY? I know Vagina only. This post has been edited by GrumpyNooby: Feb 22 2021, 09:18 AM |

|

|

|

|

|

GrumpyNooby

|

Feb 22 2021, 09:15 PM Feb 22 2021, 09:15 PM

|

|

QUOTE(lee82gx @ Feb 22 2021, 09:15 PM) with your high frequency trades + oracle abilities I doubt you need bucks from me. Totally agreed with you!  |

|

|

|

|

|

GrumpyNooby

|

Feb 23 2021, 12:13 PM Feb 23 2021, 12:13 PM

|

|

QUOTE(lee82gx @ Feb 23 2021, 12:12 PM) Buy the dip! Except you won't know the depth and width of the valley. Don't worry, we have a prophet in there who does high frequency trades with oracle ability. This post has been edited by GrumpyNooby: Feb 23 2021, 12:13 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 23 2021, 02:06 PM Feb 23 2021, 02:06 PM

|

|

QUOTE(DragonReine @ Feb 23 2021, 02:02 PM) Market correction and response to rising commodities + recent storm disaster in US. Don't worry too hard about it, pump in if you have cash but otherwise just hold steady  SA is a gold mine which attracts a lot of new comers. There's a school of DCA-ers that shows the beauty of DCA. This post has been edited by GrumpyNooby: Feb 23 2021, 02:06 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 23 2021, 02:39 PM Feb 23 2021, 02:39 PM

|

|

QUOTE(prophetjul @ Feb 23 2021, 02:36 PM) Sorry for this noob question: If i have 2 portfolios and i deposit one time Rm10,000. How i will they split the deposit or i have to do it manually? Set the amount under manual deposit.  This post has been edited by GrumpyNooby: Feb 23 2021, 02:42 PM This post has been edited by GrumpyNooby: Feb 23 2021, 02:42 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 23 2021, 02:56 PM Feb 23 2021, 02:56 PM

|

|

QUOTE(Oklahoma @ Feb 23 2021, 02:53 PM) hmm yea am trying to create alerts on my phone to any of the news relating to the ETFs in SA. e.g. Any KWEB news, will instantly be notified on my phone, without the need to google it. So far I failed. Do you use any software / app to do this? Try Seeking Alpha |

|

|

|

|

Feb 17 2021, 07:18 AM

Feb 17 2021, 07:18 AM

Quote

Quote

0.5052sec

0.5052sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled