Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

yeeck

|

Nov 6 2020, 10:50 AM Nov 6 2020, 10:50 AM

|

|

QUOTE(Ancient-XinG- @ Nov 6 2020, 07:56 AM) My plan to add 2k was correct. Should have 20k lol Looks like if Biden win. Everyone in the world is happy Actually the market is happy the race is divided so that less potential impact to current tax regimes. |

|

|

|

|

|

yeeck

|

Nov 6 2020, 11:50 AM Nov 6 2020, 11:50 AM

|

|

QUOTE(WhitE LighteR @ Nov 6 2020, 11:43 AM) LOL. same here. if really kwsp allow to withdraw, will just take n dump more to investment. KWSP choices of funds too limited. Don't dream of it...if they even allow that they might allow only for the B40 group, which I'm sure you are not..lol. |

|

|

|

|

|

yeeck

|

May 9 2021, 11:37 AM May 9 2021, 11:37 AM

|

|

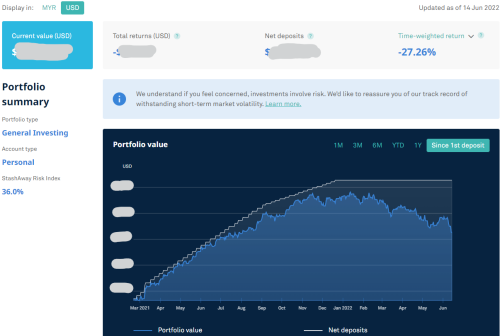

QUOTE(Kagekiyo @ May 8 2021, 11:36 AM) Checking in with you folks. Background: - I started Stashaway with an initial capital investment of RM10k in Feb 2021 and every month, i allocate RM1k to be deposited into my investment portfolio. To date, i have deposited a total of RM13k as of May 2021 - My risk setting is set to the highest at 36% Question: - I noticed that over the past 4 months since my initial capital investment, i have never break even or seen any positive returns when evaluating my portfolio every month - Are any of you folks in the same boat as i am whereby in the past 6 months or so, you have noticed negative returns month on month? When comparing Stashaway's robo advisor performance against my Public Mutual's portfolio performance, i'm quite embaressed to say that my Public Mutual porfolio out performs it by quite a large margin month on month. Aiseh man, your unrealized losses are nothing compared to mine when it was at 8% risk setting when I started at late 2018..there was a time my unrealized losses even went to more than MYR1k , but I didn't panic or withdraw and over time it grew and grew, and I even increased my risk to 22%. Now my TWR and MWR are more than 20%. This post has been edited by yeeck: May 9 2021, 11:38 AM |

|

|

|

|

|

yeeck

|

May 11 2021, 05:34 PM May 11 2021, 05:34 PM

|

|

QUOTE(Bendan520 @ May 11 2021, 02:29 PM) cause I use the 5% rule capital and cut win FREIGHT from bursa then change to SA.. Cause its too hard to trade in bursa nowadays. Other capital all bag holding right now, slowly cut batch by batch to put in SA You think exactly like me..hahaha....gain from somewhere, then put into SA. Anyway, VCA or DCA, to me it doesn't really matter much coz I only put in money into SA when I have excess money to put in. Furthermore, we are in SA not for short term gains. |

|

|

|

|

|

yeeck

|

May 14 2021, 05:54 PM May 14 2021, 05:54 PM

|

|

QUOTE(zstan @ May 14 2021, 03:50 PM) Happy anniversary to KWEB! still sitting at +30%  KWEB used to be +80% or more while those X** ETFs only in the single digits, now all the X** ETFs are also +30%, so it's fine for me  |

|

|

|

|

|

yeeck

|

Feb 24 2022, 03:46 PM Feb 24 2022, 03:46 PM

|

|

Russian invasion of Ukraine begins. Gold and energy prices going up but others will be dropping...

|

|

|

|

|

|

yeeck

|

Mar 14 2022, 12:06 PM Mar 14 2022, 12:06 PM

|

|

QUOTE(Leo the Lion @ Mar 12 2022, 09:24 AM) Hope what you guys say is true, this is the first time my portfolio reach -11%  No big deal, I've experienced more than -20% before. Currently still positive. |

|

|

|

|

|

yeeck

|

Jun 15 2022, 01:17 AM Jun 15 2022, 01:17 AM

|

|

QUOTE(jacksonpang @ Jun 14 2022, 09:23 PM) Still ok considering that your SRI is 36% lol....  My SRI is 22%, TWR (MYR) is +7.39% but MWR is -2.60%. I don't do DCA, just deposit whenever I have the extra cash and feel like depositing. This post has been edited by yeeck: Jun 15 2022, 01:21 AM |

|

|

|

|

Nov 6 2020, 10:50 AM

Nov 6 2020, 10:50 AM

Quote

Quote

0.4420sec

0.4420sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled