QUOTE(cucumber @ Aug 8 2021, 02:40 AM)

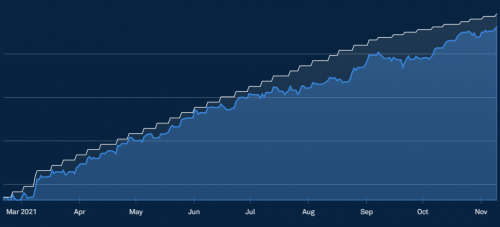

The market has gone up too high too fast. What you're seeing in the S&P500 is called a rising wedge, technically speaking, the rally is reaching its peak. Look at the distance between the current price and the moving averages... I've never seen this happened in the past 20 years. Pump and dump stocks yes, you'll find this all the time but not the S&P500.

Mean reversion is a statistical certainty, it's not a matter of if it's going to happen, it's a matter of when. We're already seeing weaknesses in the Dow Transportation & Russell 2000 Index which are the leading indicators to what's coming.

SA is doing the right thing by mitigating the risk. How do you justify buying this when the risk to reward ratio is so high? Any responsible fund manager would tell you to avoid this right now.

What SA doing is no different than a hedge fund, I'm not sure why you'd think otherwise. Their goal is not only to maximize our gains but more importantly to minimize our risk. To protect our capital. Not everyone has a 40 year investment horizon, many people only want to invest 3 to 5 years. It's very hard to balance that with a simple portfolio like what Akru is providing.

QUOTE(xander83 @ Aug 8 2021, 02:52 AM)

Great chart because we can already foresee once it hits 4400 it will be very volatile in the next 2 months

Even a few saying that SnP500 year end target would be 3900 which are waiting because it would be proper 15% correction that we would buy into because it is still not yet reflation trade as we what thought even after the jobs report and upcoming taper tantrum soon

People said the bubble is bursting since 2015 until 2020 finnaly burst. If you miss the window from that 5 years, u will have missed alot of growth. And if sell off during March, effectively back to 0 gainsEven a few saying that SnP500 year end target would be 3900 which are waiting because it would be proper 15% correction that we would buy into because it is still not yet reflation trade as we what thought even after the jobs report and upcoming taper tantrum soon

Yes we know it will drop eventually, and because sp500 track the top 500 company, in the long run it should recover. Even it drops, just keep dca. 5 years is such a short time in terms on long term investment.

Buy sell buy sell, that's what hedge fund is doing, trying to beat the market. Which Warren buffet already made a Bet, in long term it will have lesser returns.

Where SA now during May 2020, if SA didn't re opt to gold, our gains will have been higher, then kweb it happens again. My paper gains now in SA is just slightly better than FD....

I don't get the idea where SA tell us to keep long term, but every year also re opt. Last year's repot didn't even perform well, then now reopt again.

I don't know maybe I'm the idiot here. I already top up more since kweb hit its lowest 2 weeks ago, I will add more to akrunow because if really play long term, sp500 does five better return.

So far SA really has not give satisfactory returns, I just keep my money there and come back few months later.

To me, if USA have a market crash, everywhere is affected, so it dosent really matter how much we diversify, still need to hold and buy the dip regardless what etf.

Aug 8 2021, 03:16 AM

Aug 8 2021, 03:16 AM

Quote

Quote

0.4805sec

0.4805sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled