Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

brokenbomb

|

Jan 9 2021, 10:28 AM Jan 9 2021, 10:28 AM

|

|

QUOTE(xander83 @ Jan 9 2021, 10:20 AM) Yes because DXY bounce back at 90 for awhile Timing is subjective because of your risk appetite. Unit Trust better off not buying it because the charges bloody ridiculous when you can get better returns on ETF RHB AI fund will be one off only for 2020 gains will be started slowing down soon 3months all depends on the market events and catalyst for growth very difficult to tell and it depend on your risk appetite But if time deposit right when the FX rate is low in USD and right portfolio already can gain 5% on Money Weighted Average easily With such big amount never look short term but on long term on consistent gains because you will need time to redeem when the USD strong then you will gain in terms of extra RMs You win you lose some  Yeah it’s just a short play. Since I’m switched from Big cap China to global AI. Bought on December and sold AI this Monday for a 6% gain. The big cap China already untung since 2019. So why not give it a try haha Sorry lari a bit from Stashaway. Haha. |

|

|

|

|

|

brokenbomb

|

Jan 9 2021, 11:40 AM Jan 9 2021, 11:40 AM

|

|

QUOTE(xander83 @ Jan 9 2021, 10:40 AM) Big Cap China will be in focus in the next 2quarters in StashAway KWEB gains should outperform the others Btw does RHB Global AI fund is it a feeder or wholesale fund? Feeder Ah ok. Might increase my monthly top up there 👍🏻 |

|

|

|

|

|

brokenbomb

|

Jan 25 2021, 10:57 PM Jan 25 2021, 10:57 PM

|

|

If not gulung tikar maybe kena absorbed or bought over by rival companies or banks

My biggest allocation is still in unit trusts, ASB then wahed and SA.

|

|

|

|

|

|

brokenbomb

|

Jan 27 2021, 01:17 PM Jan 27 2021, 01:17 PM

|

|

QUOTE(Silfer @ Jan 27 2021, 01:03 PM) I started around April 2019. DCA monthly rm50. Now got around 900 deposit. Return around rm150. Quite ok right? Risk at 22% Ok. More than 10% returns. Asalkan can beat the benchmark |

|

|

|

|

|

brokenbomb

|

Feb 13 2021, 10:44 AM Feb 13 2021, 10:44 AM

|

|

Or just use jompay

|

|

|

|

|

|

brokenbomb

|

Mar 7 2021, 01:48 PM Mar 7 2021, 01:48 PM

|

|

QUOTE(stormseeker92 @ Mar 7 2021, 01:44 PM) Stonks going up? https://www.bbc.com/news/world-us-canada-56307889Coronavirus: US Senate passes major $1.9tn relief plan Stonks going sideway until April 🤪 |

|

|

|

|

|

brokenbomb

|

Jun 22 2022, 07:24 PM Jun 22 2022, 07:24 PM

|

|

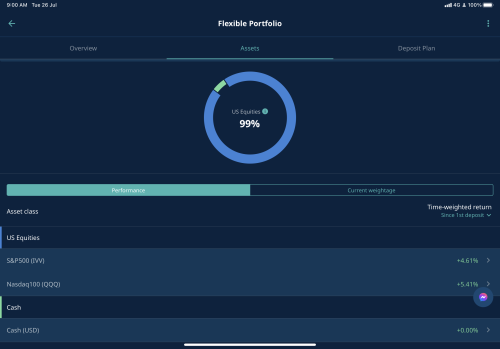

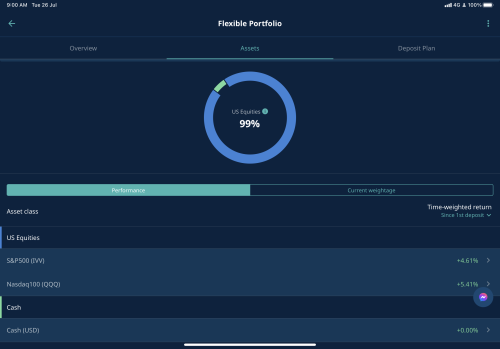

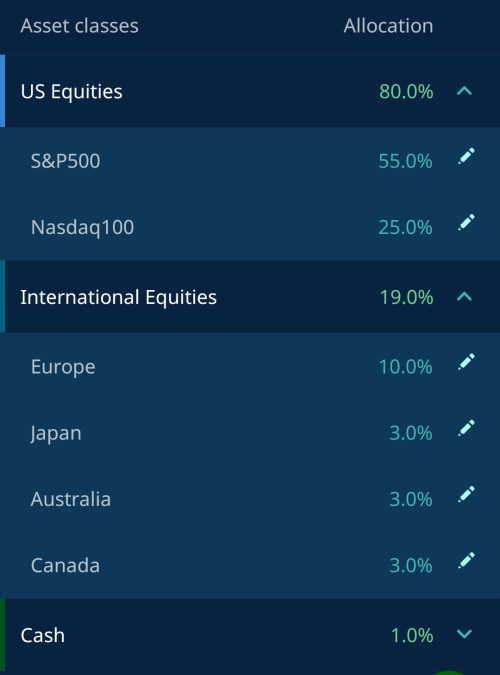

haha i terus go and make a new 60/40 sp500 nasdaq portfolio. lol

|

|

|

|

|

|

brokenbomb

|

Jul 26 2022, 09:02 AM Jul 26 2022, 09:02 AM

|

|

YOLO portfolio. There might be one final sell off but who cares. |

|

|

|

|

|

brokenbomb

|

Jul 31 2022, 06:50 PM Jul 31 2022, 06:50 PM

|

|

QUOTE(yshiuan @ Jul 30 2022, 08:59 PM) Mine almost like yours, 80% US equities How u set your percentage? I forgot. Haha. I just slide until it become 60/39 Try tinker a bit? Maybe there’s something u missed out |

|

|

|

|

|

brokenbomb

|

Aug 1 2022, 06:17 PM Aug 1 2022, 06:17 PM

|

|

QUOTE(yshiuan @ Aug 1 2022, 08:45 AM) Mine is 55/25 Should i put more in QQQ? » Click to show Spoiler - click again to hide... « Mmm depends on ur risk appetite i guess. I have a few DCA savings and this is only a small portion of it. That’s why i can take more risk. Haha. But if i were u. Max out on SP500 would be better. |

|

|

|

|

|

brokenbomb

|

Aug 5 2022, 09:55 AM Aug 5 2022, 09:55 AM

|

|

QUOTE(yshiuan @ Aug 4 2022, 06:45 PM) Should i just withdraw all from 22% risk portfolio? The performance is really disappointing U can do recurring transfer. Maybe 10% every month(or 5% every 2 weeks) to a new portfolio ka. |

|

|

|

|

|

brokenbomb

|

Aug 5 2022, 05:02 PM Aug 5 2022, 05:02 PM

|

|

QUOTE(yshiuan @ Aug 5 2022, 10:35 AM) Left rm250 inside  Oh ceh. Haha. Even the phone or laptop u use to reply my comment pun already worth more than your 22% risk portfolio  Edit : what im trying to say is losing rm250 will not make u lose sleep. Or even gaining x2. Just use SA to build up a DCA habit. Yes IBKR is better and yes DIY portfolio investing is 100x better. But who cares. In the end when crash happen, the IBKR and DIY pun both lose money too. This post has been edited by brokenbomb: Aug 5 2022, 05:08 PM |

|

|

|

|

|

brokenbomb

|

Aug 14 2022, 09:52 AM Aug 14 2022, 09:52 AM

|

|

QUOTE(zstan @ Aug 14 2022, 12:40 AM) which button do you press to hide your investment amount? on top left corner at home page. tekan the all seeing eye icon 👀 |

|

|

|

|

|

brokenbomb

|

Jan 23 2024, 08:02 AM Jan 23 2024, 08:02 AM

|

|

Thanks for the memories SA. Started investing with them since 2019. Went through 2020 lows and 2021 market high with them

2024 close my account. Move all my funds to ETF. Nasdaq aggressive risk is just QQQM or SPY.

A good learning experience with stashaway

|

|

|

|

|

Jan 9 2021, 10:28 AM

Jan 9 2021, 10:28 AM

Quote

Quote

0.4496sec

0.4496sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled