Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

brokenbomb

|

May 29 2020, 11:21 PM May 29 2020, 11:21 PM

|

|

QUOTE(Oklahoma @ May 29 2020, 11:10 PM) What would you recommend if you could save RM3000 per month? Split into 3 types of investment. Maybe 1k each to stashaway, wahed, and FSM. Cuz thats what im doing now  Stashaway with 36% risk, wahed very aggressive, FSM rm500 KGF and RM500 TA global tech. But thats me, im ok with high risk because market now are low and may get lower. |

|

|

|

|

|

brokenbomb

|

May 30 2020, 01:50 PM May 30 2020, 01:50 PM

|

|

The only “robo” thing about stashaway to me is the fast transaction and the risk profile allocation. Haha.

As for portfolio reoptimization, i think they still use managers for that.

|

|

|

|

|

|

brokenbomb

|

Jun 3 2020, 11:26 PM Jun 3 2020, 11:26 PM

|

|

I guess people are still having nightmare during the march crash

No assets class survive. Not even gold. Kena dump to cover their margins

|

|

|

|

|

|

brokenbomb

|

Jun 5 2020, 11:40 PM Jun 5 2020, 11:40 PM

|

|

QUOTE(encikbuta @ Jun 5 2020, 11:31 PM) Nooo. Still waiting for the bottom 🤣🤣🤣 |

|

|

|

|

|

brokenbomb

|

Jun 11 2020, 05:40 PM Jun 11 2020, 05:40 PM

|

|

QUOTE(joshtlk1 @ Jun 11 2020, 04:58 PM) lol true. I have been DCA-ing a large amount every week. I am a little nervous about the way the market is going. In a sense, I have trained myself to think that when the market goes down its good, because I can buy stocks at a cheaper value. But now that the market is inflated, and detached from the real economy. I am thinking of cutting back the amount per DCA, but still continuing DCA. What is everyone doing with Stashaway currently? Some of us here know that sooner or later the economy is going to face a correction. (I mean just look at the chart, ijau ijau ijau for how many days straight. It is not normal) But we just have to stick to the plan. |

|

|

|

|

|

brokenbomb

|

Jun 15 2020, 10:53 PM Jun 15 2020, 10:53 PM

|

|

Just transferred a portion of my portfolio to Simple.

Profit taking while waiting for the dip

But DCA still on. No changes.

Ngam2 oh they announce. Haha

|

|

|

|

|

|

brokenbomb

|

Jun 19 2020, 02:05 PM Jun 19 2020, 02:05 PM

|

|

QUOTE(annoymous1234 @ Jun 19 2020, 11:37 AM) the concept for stashaway simple is different with the ordinary stashaway away right. Simple is more like FD, so want to ask, it is ok if I just dump one lum or do DCA better like the usual stashaway? I took profit on Monday (yes can be say panic selling. Haha). Transferred all my holdings to Simple. Left few hundreds just to keep the portfolio alive. But. I still maintained my Weekly DCA to my 36% portfolio. So what I’m going to do in the next 6 months is using the cash from simple to be ready for any dip buying opportunities. Don’t worry. Holdings is around 5k only. Haha. That’s why can experiment. |

|

|

|

|

|

brokenbomb

|

Jun 19 2020, 03:37 PM Jun 19 2020, 03:37 PM

|

|

QUOTE(honsiong @ Jun 19 2020, 02:59 PM) But I still continue my weekly DCA. QUOTE(ironman16 @ Jun 19 2020, 02:55 PM) Means the money u redeem will convert back to Myr again? When u dca again, it will convert to Usd again? @_@"" Hahaha ya. Doing a small experiment. If rugi I can just revert back to my old method. |

|

|

|

|

|

brokenbomb

|

Jul 8 2020, 07:02 PM Jul 8 2020, 07:02 PM

|

|

QUOTE(Burningsunz @ Jul 8 2020, 02:55 PM) erm for new user should i go for simple or the normal type? Depends. Haha. If you want to do lump sum, what u can do is to transfer it to simple. Then from simple do a regular DCA to any of your portfolio (if u sked the market is too high right now) Normal type pula if you say “oh i got rm100 every month to save” Then just do normal DCA to your portfolio. I just use Simple the other day to take some profit and put it there. Then when the SP500 correction to 3k ish i go and use the profit to buy the dip. Yes its a hassle but its a strategy that personally works for me   |

|

|

|

|

|

brokenbomb

|

Jul 8 2020, 07:31 PM Jul 8 2020, 07:31 PM

|

|

QUOTE(stormseeker92 @ Jul 8 2020, 07:04 PM) For me market is not too high. Cuz some of the asset prices still not as high as pre covid levels. So I guess still can join, but the profit margin is less tho..unless it went into another orbital drop of course. Just hope the new members will be wary of “Wah stashaway stonk high oh” 😅 Because some of us here stay invested during the March rout, some pula luckily bought the dip. So that’s why our gain can reach 20-30% on a 36% portfolio risk. Their margin is less of course. But we donno what the future hold. Manatau trump losing the election and second wave during fall will bring chaos back to the market. Pendek cerita yes can invest. But with caution. Haha. |

|

|

|

|

|

brokenbomb

|

Jul 10 2020, 07:42 PM Jul 10 2020, 07:42 PM

|

|

QUOTE(yklooi @ Jul 10 2020, 07:30 PM)  from that article.... "One retail investor said she made the most of Friday’s losses to load up on more shares. “It’s still just the middle of the rally,” said 30-year-old Jess Huang, who works at a state-owned enterprise in Beijing." "...........authorities appear keen to engineer a steady bull market rather than a repeat of the bubble that ended in a $5 trillion crash five years ago.".... engineer a steady bull market....thus got more to go after this pull back ??  Ride the trend. The trend is your friend. Want to buy a new phone? What’s the trend? Android or iphone? Haha https://www.marketwatch.com/story/he-had-35...=article_inlinelet’s just enjoy the ride while waiting for china’s bubbles to burst.  |

|

|

|

|

|

brokenbomb

|

Jul 27 2020, 05:00 PM Jul 27 2020, 05:00 PM

|

|

Can try jompay

|

|

|

|

|

|

brokenbomb

|

Sep 3 2020, 06:03 AM Sep 3 2020, 06:03 AM

|

|

QUOTE(backspace66 @ Sep 3 2020, 04:54 AM) It would be interesting to check when SA will finally decide to return to the previous iteration for 36% portfolio with heavy exposure to US. I miss this portfolio Every subuh before going to work check on SNP500 first. If its up stashaway also up. Haha |

|

|

|

|

|

brokenbomb

|

Oct 25 2020, 08:06 PM Oct 25 2020, 08:06 PM

|

|

QUOTE(joshtlk1 @ Oct 25 2020, 07:35 PM) anyone has started to use automated debit to stashaway now? After the crazy fiasco that happened a couple of months ago. Use jompay. Manatau win yourself x70 (I kena before. RM30 Cashback from ambank) haha |

|

|

|

|

|

brokenbomb

|

Dec 1 2020, 07:11 PM Dec 1 2020, 07:11 PM

|

|

QUOTE(lee82gx @ Dec 1 2020, 05:04 PM) relax, This is a long run. No, "Time the market" extremely useful if you think all you want to do is make 5, 10 or 20% and then cabut. But it is not repeatable. Even 1 year is too short, lah! The advise is to invest more than 3 years. But, yeah it is ok to monitor regularly and make corrections. Heck, I check my stashaway every day once or twice. Not that it changes my strategy or anything. Its just so convenient. My returns have also been eroded due to USD drop and minor corrections in the "Street". None of this changes anything, because : 1. Do you see a better thing out there? 2. Do I need to use the money?So those 2 are my criterias for exiting. My sole reason why i didn’t exit the March crash. Haha. And it’s even during the first season of MCO. Even if I exit where’s the money gonna go? |

|

|

|

|

|

brokenbomb

|

Dec 27 2020, 04:39 PM Dec 27 2020, 04:39 PM

|

|

QUOTE(ali00 @ Dec 27 2020, 03:41 PM) would you recommend me me transfer all to 36%? Yeah why not. I used to have 2 portfolio too But last2 I opt for only 1. And the other portfolio? I use it to fund wahed 🤭 |

|

|

|

|

|

brokenbomb

|

Jan 8 2021, 09:05 AM Jan 8 2021, 09:05 AM

|

|

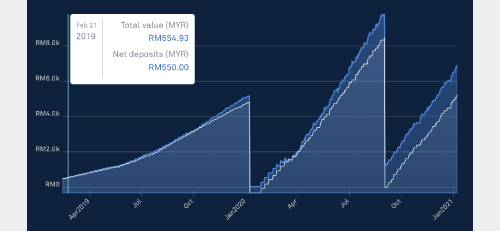

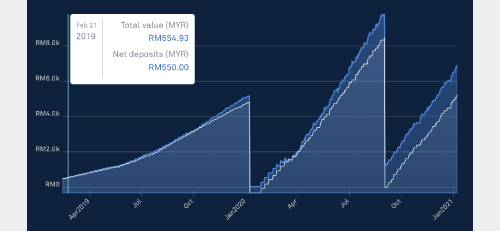

QUOTE(Oklahoma @ Jan 7 2021, 09:57 PM) lol how come your line so smooth? How do you deposit? By weeks?  Nah lagi smooth 😜 April 2019 - deposit daily RM50 January 2020 - switch to wahed. So wed Friday stash. Tues Monday Thursday wahed. Tuesday rest. Lol. Both on 36% and aggressive portfolio Took out some money to fund for tax payment etc 😅 |

|

|

|

|

|

brokenbomb

|

Jan 8 2021, 10:36 AM Jan 8 2021, 10:36 AM

|

|

QUOTE(tsutsugami86 @ Jan 8 2021, 09:49 AM) Daily RM 50    So everyday you busy to do banking transaction ?  The power of jompay. Every morning 7am deduct And sometime the banks got jompay or duitnow contest as well, Tiba2 masuk RM10 ni to my ambank account. I won some weekly prizes ka for doing jompay transaction.  So yeah, 2020 investment lesson : automate your savings  |

|

|

|

|

|

brokenbomb

|

Jan 8 2021, 10:40 AM Jan 8 2021, 10:40 AM

|

|

QUOTE(tsutsugami86 @ Jan 8 2021, 10:12 AM) I found that more frequently do DCA, the gap between portfolio value & net deposit is bigger. The return is better if we do more frequently DCA ? I guess so. Haha. 2020 january SNP500 33XX 2021 january SNP500 38XX Just follow the trend i guess  I personally cannot buy and hold. Haha. Easily disturbed by market noise  |

|

|

|

|

|

brokenbomb

|

Jan 9 2021, 08:26 AM Jan 9 2021, 08:26 AM

|

|

QUOTE(xander83 @ Jan 9 2021, 12:13 AM) With the kind of daily deposit you have loss another at least 3 to 6% gain on FX conversion Better off put in Simple and then when FX rate is favourable one shot dump in Mine this week only when deposit on Monday exactly FX rate at RM4 to 1 and already MWR is 5% to date with another at least 8 good weeks will double money for this year MWR the power of timing and exchange and we need more good weeks like this week and more to come soon for us  Yeah. Haha. If this is my only saving vehicle. I might just do that But I’m not so good in timing the exchange or even the market. So just stick whatever that works for me But if it’s unit trust. Ahh that one easier. Haha. Tesla going to listed in SNP? Ok RHB global artificial intelligence it is 😬 |

|

|

|

|

May 29 2020, 11:21 PM

May 29 2020, 11:21 PM

Quote

Quote

0.4282sec

0.4282sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled