QUOTE(mastermindsos @ Sep 5 2020, 03:51 PM)

I am still confused.

Please bear with me.

Which currency I should look at to know my actual profit? in USD (TWR 1.5%) or MYR (TWR 0.97%)?

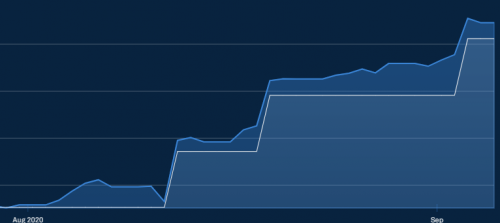

Graph USD

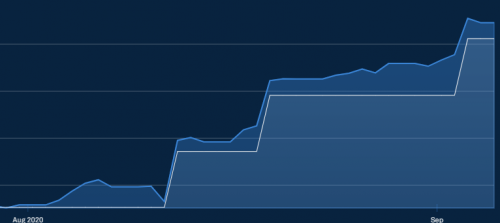

Graph MYR

U r investing in USD with MYR. If u wan to know ur estimated return, look at MYR because u can only withdraw the same currency u deposited.Please bear with me.

Which currency I should look at to know my actual profit? in USD (TWR 1.5%) or MYR (TWR 0.97%)?

Graph USD

Graph MYR

Why estimated return, that is because once u submit for withdrawal, it will take SA few more days to process ur sell request.

Sep 5 2020, 03:58 PM

Sep 5 2020, 03:58 PM

Quote

Quote

0.0488sec

0.0488sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled