QUOTE(sgh @ Dec 4 2021, 10:50 PM)

First off I get to know SA from another thread. Once I get to know how SA works and it is not my cup of tea I did not invest. For those who are existing SA customer you invest based on knowing how SA works.

Criticize them when they fail to make monies for you is normal only human emotion. You also have the right not to patronise SA and leave. Instead of criticize SA non-stop why not channel that energy to find alternative investment platform to try to recoup monies you lost in SA?

Speaking from my experience I hit such case many years ago. Criticize that platform is not going to get my lost monies back unless the platform is a fraud or provide deceiving advice which maybe you can lodge a report with the relevant govt authority? This route is time consuming and maybe cannot even get any monies back.

So what I did is source other investment platform and channel my energy in this task instead. Finally I found about 2 platform which suit my strategy.

My humble opinion.

Nice. You skipped step 1 and straight step 2, by the way I said this is more for starters and therefore for experienced investors (in control of their emotions lol), I will always suggest DIY instead.

QUOTE(pendekartauhu @ Dec 5 2021, 12:08 AM)

this is why people said investing is for the rich. If you are poor, you need to increase your earning power, not relying investment to get you rich.

I humbly beg to differ. Nothing ventured nothing gained. No pain no gain etc etc etc.

For the not yet rich enough, all the more you have to invest. Without this disciplined saving, you will NEVER break out of rat race. Don’t believe for now that in Malaysia any amount of “earning power” salaryship can truly lead you to financial freedom.

My own experience tells me so and I’ve seen too many of my peers on the losing side ie depend on salary. The times when I ikat perut eat kembung, the times when I holiday in my kampung, buy rm800 androids, still driving rm30k clunker fixer upper but have my own financial destiny mapped out. Now these same peers of mine, asking me how to invest. So then how would I advise them :-

The other day I was saying the most important thing in investing is your own stomach and gut, now the most important friend you must have is TIME. If you make him your friend, time will bring you wonderful returns. If you don’t make him your friend then eventually he is your enemy. Fight against time and you will rely on luck, make mistakes, take unnecessary risks.

So for those impatient ones, what is a year or two? What have you really lost, in the bigger picture?

Then, if you know what better to do, why not do it?

Perhaps let me venture first and humbly lay my equity portfolio:

I have 30% in the company I work.

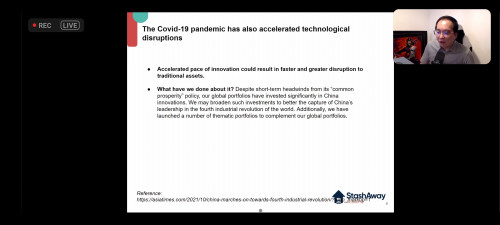

30% in growth stocks that will scare the bejesus out of any regular folk, like adobe nvda and tsla, aapl, and smaller names like docusign (ouchhhh!!!)

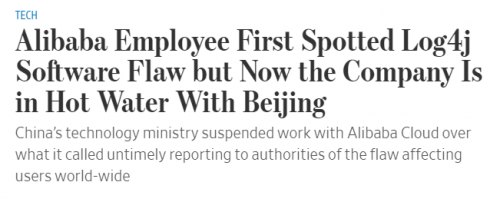

30% in ETFs that mimic StashAway minus kweb. I had a lot at some point and i mentioned in July I sold it all.

10% or so in cash. (This is why I kepoh here)

I’m looking at moving a portion to reits and value stocks but I’m still formulating that.

I have every bit of interest in the success of passive indexing which I think StashAway is the prime example for Malaysians.

Do know that if you start selling the whole deck of cards come tumbling down, OR someone else buys your stock at lower price. This basic understanding is very powerful. You need to know your price and value of the thing in your hands. Simply sell and it will be other’s treasure.

Edit :

SEE YOU AT END GAMEThis post has been edited by lee82gx: Dec 5 2021, 09:44 AM

Dec 4 2021, 10:37 PM

Dec 4 2021, 10:37 PM

Quote

Quote

0.4891sec

0.4891sec

1.32

1.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled