QUOTE(annoymous1234 @ Aug 3 2021, 04:52 PM)

Something careful something greedy something something.Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Aug 3 2021, 05:25 PM Aug 3 2021, 05:25 PM

Return to original view | IPv6 | Post

#341

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Aug 5 2021, 09:35 PM Aug 5 2021, 09:35 PM

Return to original view | Post

#342

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Kadaj @ Aug 5 2021, 09:28 PM) Thats the nature of investment, there is always speculation involved that may result in losses.short term you can only cry but long term it usually goes up |

|

|

Aug 8 2021, 02:25 PM Aug 8 2021, 02:25 PM

Return to original view | Post

#343

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I personally don't withdraw my EPF for whatever scheme. Again, remember that Modern portfolio theory advocates a certain portion of your portfolio in low risk instruments such as bonds, even up to 50 or 70% of your entire investment. In this regard, the moment you withdraw your EPF, and do some equity heavy investment you are reducing your fixed income or low risk proportion. A regular salaryman will have a hard time exceeding that ratio.

If you and understand the gibberish I just type above then you are on the path, if not just learn to use your nett income after EPF to invest in SA...if not every 1-3% down on SA you will come here and cry father cry mother. edit-just to clarify, Im 40 years old, I have been investing for 15 years. Maybe my advise does not apply to those who are near retirement age and you have plenty in your safety nest thus you feel like taking some risk, or those who die die feel lucky and are young enough to absorb some years of losses. Either way, I am most confident in Stashaway method compared to any Active trust fund management, individual stocks, or portfolio management by FSM. (Ok la, I am also human, I also scared when dunking my touche into KWEB now). This is not investment advice. This post has been edited by lee82gx: Aug 8 2021, 02:35 PM |

|

|

Aug 10 2021, 11:13 AM Aug 10 2021, 11:13 AM

Return to original view | Post

#344

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

There is no such thing as go up all the time. Well there is and then people will say yikes too high I won’t invest now! Then now it’s down, everybody shaking and then saying it keeps going down I need to exit this boat. Here’s some conventional wisdom: 1. Always talk about your returns after 3 years consistently following a certain strategy. Better yet 5 years. 1.1 whatever you do today, how do you think it will be in 3 years? 1.2 whatever you have now should be a product of 3 years ago. How is it now? Ok? 1.3 never invest money that you know you need to use in the near term future. Another way to say is if you need the money after you invested 3 years ago, today, it is good time to sell and absorb the losses or reap the gains. 2. Never get out of the market - This I did not coin but you can ask Jack Bogle / Peter Lynch / Malkiel. 3. In long term US market has always risen and so too the Chinese market. There are a few exceptions - Japan, Malaysia. 4. Short term movements are usually random noise. Means you can ignore. If you have a better idea than StashAway, by all means go and try it. Let’s share ideas and track it for 3 years. tehoice, WhitE LighteR, and 4 others liked this post

|

|

|

Aug 10 2021, 05:33 PM Aug 10 2021, 05:33 PM

Return to original view | Post

#345

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I realize this is a the internet, but it does not need to be Wild West. Some investors are really just dipping their toes. I remember seeing red my first few times and it was scary. I did lock in my losses by selling. Even a few weeks ago I locked in my losses when I sold my Chinese etf at literally the bottom. I had plenty of chances to sell at green, at break even and even if I held it till now itd be less red. So I still keep my own head down and keep plugging away. Hoshiyuu liked this post

|

|

|

Aug 10 2021, 06:13 PM Aug 10 2021, 06:13 PM

Return to original view | IPv6 | Post

#346

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(xander83 @ Aug 10 2021, 05:44 PM) What Chinese ETF made you sold at loss? Kweb, kgrn and cxse. Remember black rock also gets money from retail and if they run black rock still has to sell. Im still heavily unconvinced by China at the moment. My posts here still reflect what I feel deeply. But I admit im swayed by sentiments either side. As long as Blackrock and gang are coming to buy a truck the moment the losses can’t go much more than early July dip Just that if you are dca ing at the moment then it’s the best. That im still doing. |

|

|

|

|

|

Aug 18 2021, 01:48 PM Aug 18 2021, 01:48 PM

Return to original view | Post

#347

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I dont really know where to share this, but my paper portfolio consisting of shorts against all things China is turning green. Bear in mind I started during 27th July 2021.

|

|

|

Aug 18 2021, 03:00 PM Aug 18 2021, 03:00 PM

Return to original view | Post

#348

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Aug 18 2021, 03:13 PM Aug 18 2021, 03:13 PM

Return to original view | Post

#349

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(MUM @ Aug 18 2021, 03:07 PM) "shorts against all things China is turning green. ....." example :-KWEB is around US$46 on 27/7 which was a bottom, but here we are now at $44.8 Baba also $181 now $173 |

|

|

Aug 18 2021, 03:28 PM Aug 18 2021, 03:28 PM

Return to original view | Post

#350

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(MUM @ Aug 18 2021, 03:24 PM) my earlier charts end on 16 Aug.... Yeah, so the question on everyone's mind is when, if ever it will come back. I also don't have crystal ball.i think KWEB and BABA if end on the same date is still ok.... but due to the the bigger drops in the last 2 days......REsults varied greatly Short term anything +/- 5% daily and medium term +/-20% should not be surprising. But bull run ain't happening. |

|

|

Aug 19 2021, 12:30 PM Aug 19 2021, 12:30 PM

Return to original view | IPv6 | Post

#351

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

If you do experience the 1% worst case then you are going to experience the 1% best case scenario too which is 36% (assuming symmetrical distribution) haha WhitE LighteR liked this post

|

|

|

Sep 19 2021, 09:58 PM Sep 19 2021, 09:58 PM

Return to original view | Post

#352

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

So, I take a few week breather and this becomes a toxic thread?

Haiya. Guys and girls. Grow up. You’d be all happily gay abandon if kweb was 100+ Now is red tide, u either get in and wait or stay out and laugh at “fools”. No need to fight la. |

|

|

Sep 20 2021, 12:19 PM Sep 20 2021, 12:19 PM

Return to original view | Post

#353

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(prophetjul @ Sep 20 2021, 09:30 AM) Sir, at 60, you are still actively investing and you have my respect. I only wish that at 60 I can tell them punks to behave and eat my compounding. anyway, internet is wild wild west. People have lost a lot of common sense here. Quazacolt and wongmunkeong liked this post

|

|

|

|

|

|

Sep 23 2021, 06:02 PM Sep 23 2021, 06:02 PM

Return to original view | Post

#354

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Their prime strange product would kweb 🙄.

It’s good that they hold themselves accountable by benchmarking msci awi index. Which this year will definitely outperform their 36 RI. Not only in terms of outright returns but also in terms of volatility / sharpe ratio. Buying arkk right now seems as weird as buying kweb though. |

|

|

Sep 23 2021, 09:06 PM Sep 23 2021, 09:06 PM

Return to original view | Post

#355

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

no mention of fees in the app for the thematic based?

|

|

|

Sep 30 2021, 01:39 PM Sep 30 2021, 01:39 PM

Return to original view | Post

#356

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Medufsaid @ Sep 30 2021, 12:32 AM) doesn't seem like it. i "created" 3 portfolios in yahoo finance at $10,000 each, on the day it was open to SA users, currently healthcare dropped the most I used to love doing this back tests. But as you pointed out a few hundred posts back past performance is not a guarantee of future results, I dare to go 1 further and say almost guarantee goes the other way.I have quite a few “portfolios” with that middle hump. They are all driven by the tech craze during Jan 2021, just before GME exploded. If I cashed out then…..I can already say 2021’s investing objective achieved. Alas…. |

|

|

Nov 9 2021, 11:48 AM Nov 9 2021, 11:48 AM

Return to original view | Post

#357

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(MUM @ Nov 9 2021, 11:31 AM) No right or wrong, perhaps its not nett worth, but more like investing portfolio. In that case it is more "safe" and another thing is crypto is up 100% so perhaps the capital injected was only 7.5% which is not unheard of.But just my "chicken" thought,... Abt 85% of your net worth is in equity markets n 15% in crypto... Just not sure how crypto rs corelated to equity mkts, if equities mkts crashes.. Yr net worth will ne crashing with in too. Not my style of betting... May the force be with you n your winning streaks continue for years to come Its really depend on your risk tolerance and cup of tea / coffee / milo. I've been staring at this crypto thing for years and the bus has come and gone countless times. I'm still probably gonna stare at it a few more times. Personally I would've bought some crypto if there was much "safer / more renowned" system in Malaysia, like coinbase, greyscale etc. |

|

|

Nov 9 2021, 01:16 PM Nov 9 2021, 01:16 PM

Return to original view | Post

#358

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Medufsaid @ Nov 9 2021, 12:18 PM) to stay sane, must only invest with money you really truly can afford to lose, else will "pay" with mental health which is not good also I take a slightly different view. I can afford to lose but not all of it. And none of it is owed to anyone else.And the part about sleep level can actually train one. Or easier still just don’t look at it so often. Haha |

|

|

Nov 9 2021, 01:23 PM Nov 9 2021, 01:23 PM

Return to original view | Post

#359

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

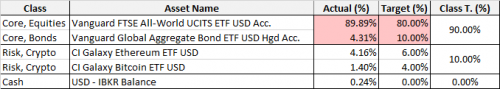

QUOTE(Hoshiyuu @ Nov 9 2021, 01:11 PM) I've been staring at it for a few years too, still not convinced it isn't a massive ponzi scheme built on top of proper future looking technology. When the bubble burst and the tech matures into what it's suppose to be, I'll put my full weight behind it. You have quite the allocation towards crypto, for a person not so convinced by it 😅. My max allocation for any one single particular ticker except index etf, would be 10%. For my not so convincing stuff I allocate around 0.2%. In the meantime, I just put 5-10% of my total port into it for suppressing my FOMO - if it goes beyond 15%, then I rebalance it into my core portfolio and secure my earnings ( I bought ETHX/BTCX via Toronto Stock Exchange, trade commission only around 0.1 USD per trade, if you don't own too much and is less strict about "not your wallet, not your coin" maybe can look into it. Maximum TER 1% for these two fund managed by CI Galaxy. Way cheaper than whatever exchange fee/gas fee you might pay. Only downside is if a massive crash happens outside trading hours, you will be a very sad man. I don't mind because I don't own much, and even if it does crash, chances are the DEX will be down from all the traffic and gas fee will skyrocket to a point you cant even cash out anyway - in that sense, a traditional brokerage will probably fare better, LOL!) This is what my current allocation looks like after exiting Bursa, Stashaway, Wahed, MyTheo and LUNO.  Recently with greyscale gbtc attempting to disguise itself as a etf, I’m thinking of DCAing a bit. |

|

|

Nov 9 2021, 01:46 PM Nov 9 2021, 01:46 PM

Return to original view | Post

#360

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Hoshiyuu @ Nov 9 2021, 01:32 PM) My networth is 🤏 so I really don't have much to lose. Your 0.2% might feed me for a year, but my 10% might be your afternoon tea ^^ What do you use to buy $ETC? I tried for a few minutes can’t find it on IBKRJokes aside, you probably do have a point. I'd rather not fill up the 10% of my port with fully crypto either - thing is, I adopt a 90:10 barbell style investment, and I recently dropped everything else that seems risky or funny in my portfolio, so I just let my crypto balloon bigger without depositing or withdrawing. If I do find something new that I want to try, I would probably cut BTC+ETH down to 5%. On the bright side, BTC and ETH are probably the least likely to lose its full value overnight. BTC is speculative digital gold to me, but ETH I can see myself believing it without needing to wait 20 years. Here's to PoS. Re: Greyscale - there's also https://evolveetfs.com/product/etc/$ETC, an ETF that hold BTC/ETH by market cap. Can't vouch for it but you might be interested. |

| Change to: |  0.6189sec 0.6189sec

0.79 0.79

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 04:30 AM |