Investing into Eastspring Investments Islamic Income Fund

https://www.fundsupermart.com.my/fsmone/fun...mic-Income-Fund

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 15 2020, 07:34 AM Jun 15 2020, 07:34 AM

Return to original view | IPv6 | Post

#301

|

All Stars

12,387 posts Joined: Feb 2020 |

Investing into Eastspring Investments Islamic Income Fund

https://www.fundsupermart.com.my/fsmone/fun...mic-Income-Fund |

|

|

|

|

|

Jun 15 2020, 08:28 AM Jun 15 2020, 08:28 AM

Return to original view | IPv6 | Post

#302

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 15 2020, 09:46 AM Jun 15 2020, 09:46 AM

Return to original view | IPv6 | Post

#303

|

All Stars

12,387 posts Joined: Feb 2020 |

We're excited to announce StashAway Simple™, our cash management portfolio that earns a projected rate of 2.4% p.a. on your cash. Unlike fixed deposit account that locks up your money or a savings account that has complicated requirements, Simple offers a flat rate for any balance in Malaysian Ringgit, and makes it, well, simple, to grow your cash. Meet StashAway Simple™ 1. No lock-up period 2. No minimum deposit requirement 3. Unlimited, free transfers 4. One flat rate for any balance 5. No cap on how much you can earn 6. No investment requirements 7. Shariah-compliant 8. No asterisks. No hoops. No catch. |

|

|

Jun 15 2020, 10:00 AM Jun 15 2020, 10:00 AM

Return to original view | IPv6 | Post

#304

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(JJ93 @ Jun 15 2020, 09:55 AM) Ayam abit new to this MMF kind of things. So for SA Simple, if I park my money for like 15 days, does it mean I get interest for that 15 days at 2.4*pa ? (pro rated to 15 days of course) It works like unit trust.It has buying and selling NAV. If the NAV is expected to behave a straight line as projected, then your assumption would be correct. It is still depending on the underlying MMF performance which is Eastspring Investments Islamic Income Fund https://www.fundsupermart.com.my/fsmone/fun...mic-Income-Fund This post has been edited by GrumpyNooby: Jun 15 2020, 10:03 AM |

|

|

Jun 15 2020, 10:02 AM Jun 15 2020, 10:02 AM

Return to original view | IPv6 | Post

#305

|

All Stars

12,387 posts Joined: Feb 2020 |

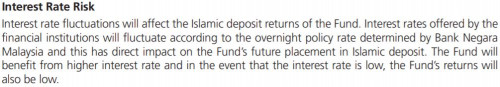

QUOTE(hiyyl @ Jun 15 2020, 10:02 AM) Yes, if OPR continues to drop.Read the risk from the Fund FactSheet & FHS: https://www.fundsupermart.com.my/fsmone/adm...anceMYESIIF.pdf https://www.fundsupermart.com.my/fsmone/fun...mic-Income-Fund This post has been edited by GrumpyNooby: Jun 15 2020, 10:03 AM |

|

|

Jun 15 2020, 10:12 AM Jun 15 2020, 10:12 AM

Return to original view | IPv6 | Post

#306

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jun 15 2020, 10:25 AM Jun 15 2020, 10:25 AM

Return to original view | IPv6 | Post

#307

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kelvinfixx @ Jun 15 2020, 10:24 AM) If next month cut OPR by 25 basis point, yes it'll be lower. https://www.fundsupermart.com.my/fsmone/adm...anceMYESIIF.pdf This post has been edited by GrumpyNooby: Jun 15 2020, 10:32 AM |

|

|

Jun 15 2020, 11:01 AM Jun 15 2020, 11:01 AM

Return to original view | IPv6 | Post

#308

|

All Stars

12,387 posts Joined: Feb 2020 |

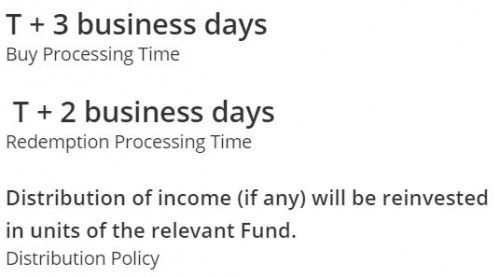

QUOTE(Eurobeater @ Jun 15 2020, 10:58 AM) Probably those annualised returns were when the OPR was higher. This year the OPR fell about 1.5% compared to last year anyway. The underlying fund doesn't belong to SAMY.The long processing time is a slight issue. Esp when this one doesn't involve buying ETFs and hence shouldn't take so long Using FSM turn around time as reference will be reasonable:  |

|

|

Jun 15 2020, 01:46 PM Jun 15 2020, 01:46 PM

Return to original view | IPv6 | Post

#309

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 15 2020, 05:23 PM Jun 15 2020, 05:23 PM

Return to original view | IPv6 | Post

#310

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Jun 15 2020, 04:39 PM) CMF2 is faster in purchase n sales but rate low a bit. CMF2 is historical pricing. You're transacting at a known price which is previous pricing.Simple = Eastspring Investment Islamic Income = rate is higher, but purchase n sales is slower (EA fund cut off is 10am from FSM website) unless they give SA a special cut off time My opinion only Eastspring Investment Islamic Income Fund is forward pricing. NAV is only known by end of the trading day. |

|

|

Jun 15 2020, 07:49 PM Jun 15 2020, 07:49 PM

Return to original view | IPv6 | Post

#311

|

All Stars

12,387 posts Joined: Feb 2020 |

Time to double DCA amount!

|

|

|

Jun 16 2020, 12:45 PM Jun 16 2020, 12:45 PM

Return to original view | IPv6 | Post

#312

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 16 2020, 02:39 PM Jun 16 2020, 02:39 PM

Return to original view | IPv6 | Post

#313

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(dinkelberg @ Jun 16 2020, 02:35 PM) It depends on the underlying ETF in your portfolio.You can search the info of each ETF details from https://www.etf.com/ or https://etfdb.com/ This post has been edited by GrumpyNooby: Jun 16 2020, 02:45 PM |

|

|

|

|

|

Jun 16 2020, 04:35 PM Jun 16 2020, 04:35 PM

Return to original view | IPv6 | Post

#314

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 17 2020, 08:46 AM Jun 17 2020, 08:46 AM

Return to original view | Post

#315

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 17 2020, 11:21 AM Jun 17 2020, 11:21 AM

Return to original view | Post

#316

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 22 2020, 01:27 PM Jun 22 2020, 01:27 PM

Return to original view | Post

#317

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 22 2020, 01:37 PM Jun 22 2020, 01:37 PM

Return to original view | Post

#318

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Blues03 @ Jun 22 2020, 01:31 PM) KWEB is not available for GBP denominated ETF listed at LSE:https://www.stashaway.my/r/stashaways-etf-selection |

|

|

Jun 22 2020, 01:48 PM Jun 22 2020, 01:48 PM

Return to original view | Post

#319

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Blues03 @ Jun 22 2020, 01:46 PM) Thank you for the info! but from the link, it shows all assets that SA invest..how to know which one available for GBP and USD? Under ticker column, there're two suffixes: US and LN US for NYSE listed ETF using USD LN for LSE listed ETF usding GBP Blues03 liked this post

|

|

|

Jun 22 2020, 01:51 PM Jun 22 2020, 01:51 PM

Return to original view | Post

#320

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Blues03 @ Jun 22 2020, 01:48 PM) too bad I just topup again this morning KWEB performance from the day of re-optimization till last Friday US time, the simple ROI is close to 22%Is KWEB performance is worth it for me to do all of these? And under 36% risk portfolio, the max allocation is up to 20% Worth of not, it's up to you to decide. |

| Change to: |  0.0509sec 0.0509sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 02:30 PM |